Is the Stimulus Check Pouring into the Crypto Market in Japan?

This is a contributing article from Yuya Hasegawa, a Crypto Market Analyst at bitbank, inc..

Join the Global Coin Research Network now and contribute your thoughts on Asia!

This past April, the Japanese government began distributing ¥100k stimulus check to households through local municipalities as a part of the COVID-19 relief programs. By June 16th, it was reported that all the local municipalities have started the distribution process, and towards the end of the month, a little less than 60% of the households had received the check. As you may already know, stimulus checks, or ‘helicopter money’, have grabbed the industry attention as the US stock market rally coincided with its distribution in the states, and mainstream media have repeatedly pointed out those ‘mom-and-pop investors’ are using the stimulus check to speculate on the stock market. The effect of helicopter money in the US was even recorded on US-based crypto exchanges like Coinbase.

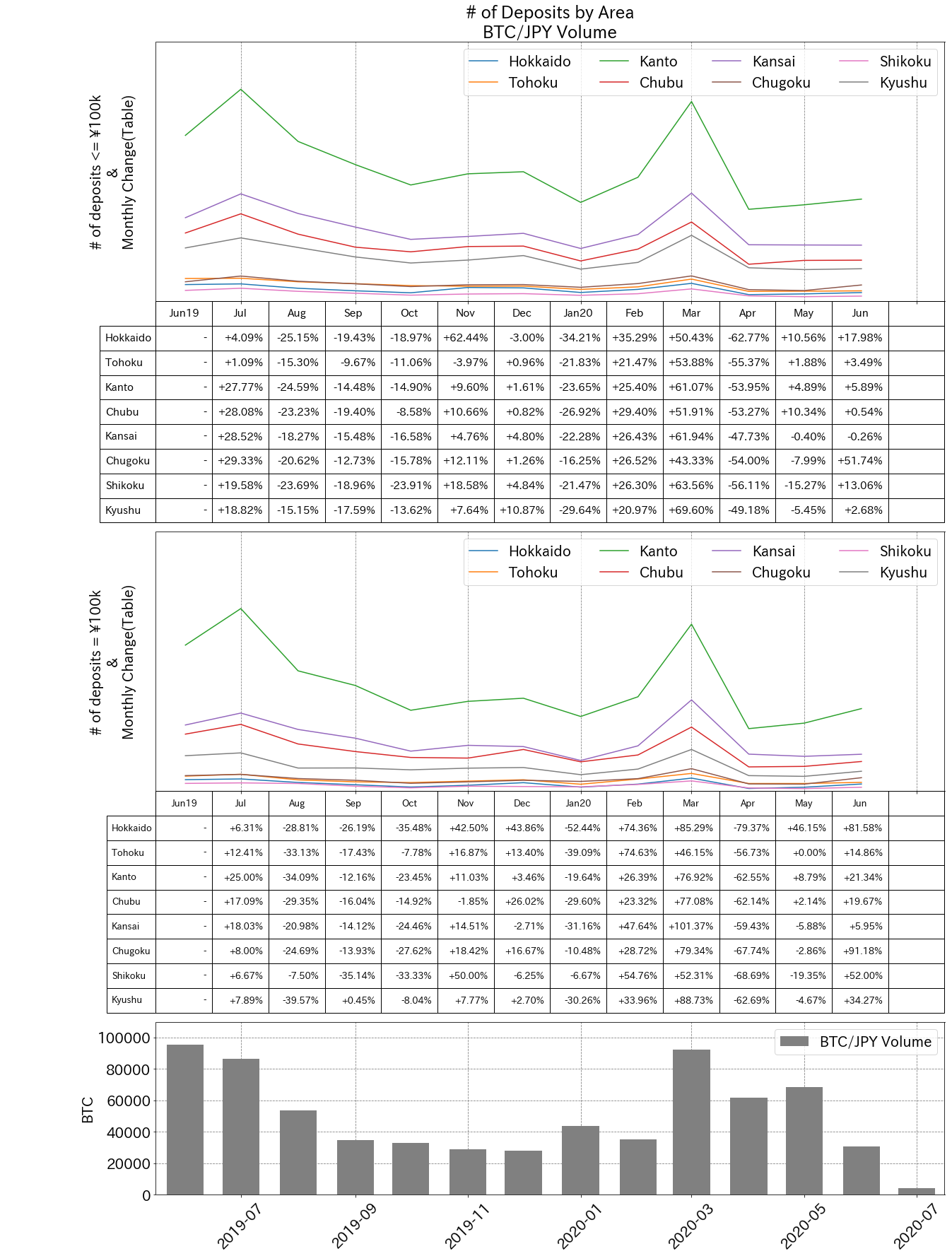

So, in the wake of the March market crash, we were expecting some changes in investor behavior and started monitoring deposit patterns across age groups and areas to see if the stimulus check is encouraging Japanese investors to take more stake in the crypto market. In this article, we will go over the number of deposits made on our platform that were <= ¥100k and = ¥100k on a monthly basis by age groups (Fig. 1) and areas (Fig. 2) and see if there has been any unusual activities during the 2Q of this year.

First and foremost, we can see yet another evidence that the Japanese retail investors were buying the dip back in March as the number of deposits increased dramatically across age groups and areas. However, interestingly, the number of deposits decreased sharply across generations and areas in the following month, while the market was maintaining relatively high monthly volume. Bear in mind that by then, the Japanese government had already decided to distribute stimulus checks for households.

It was not until June that we saw a bit of irregularities in the number of deposits. As can be seen in Fig.1 and Fig. 2, there was a slight increase in the number of deposits that was exactly at ¥100k in younger generations and in Kanto area. Notably, the number of deposits that was exactly ¥100k from investors in their 40s surpassed that from investors in their 20s in June. Also, taking lower volume level during this month into consideration, the increase in the number of deposits that were exactly ¥100k may have something to do with the stimulus check.

However, when we compare the number of deposits in June with previous months that recorded roughly the same amount of monthly BTC volume in the past (ie. Sep 19?Dec 19), the number of deposits and the degree of increase is a little too small to conclude, with confidence, that a number of Japanese investors are using their stimulus checks to buy crypto (emphasis on ‘a number of’). In other words, we believe that if Japan’s helicopter money had any noticeable or significant effect on investor behavior in Japan, the number of deposits that are <= ¥100k or = ¥100k could have increased more.

Source: bitbank.cc

Source: bitbank.cc

So, yes, we observed some small irregularities in the number of deposits that were exactly ¥100k, but the number itself was just not that surprising. We attribute the small impact of the helicopter money on our platform to Japanese consumer’s tendential characteristic towards investment. In Japan, average households allocate only about 15% of their funds to financial products (excluding insurance, pension, and standardized guarantee scheme) and a little over 50% to savings, whereas the average US and EU households allocate more to financial products and less to their savings (Fig. 3). So, the Japanese consumers have a strong tendency to save money rather than to invest. This tendency is also salient in numerous questionnaires asking Japanese consumers how they will use their stimulus checks. Typically, the highest use for it is for ‘living expenses’ followed by ‘saving’, and ‘investment’ is often one of the least common ways to spend their stimulus checks (in some cases, ‘investment’ did not even make it to the list).

So, to conclude, there is a good chance that the effect of Japan’s stimulus check on crypto market is too minuscule to alter overall investor behavior in any significant way and there has not been any sign that the stimulus check is ‘pouring into’ our platform. The vast majority of Japanese consumers are likely to spend the stimulus check on living expenses or save it for the future, and spending it on alternative assets like crypto may be one of the last choice they make.

Source: Bank of Japan