Japan Crypto Snapshot — Everything has a ‘First Time’

This is a contributing article from Yuya Hasegawa, a Market Analyst at bitbank, inc..

Join the Global Coin Research Network now and contribute your thoughts on Asia!

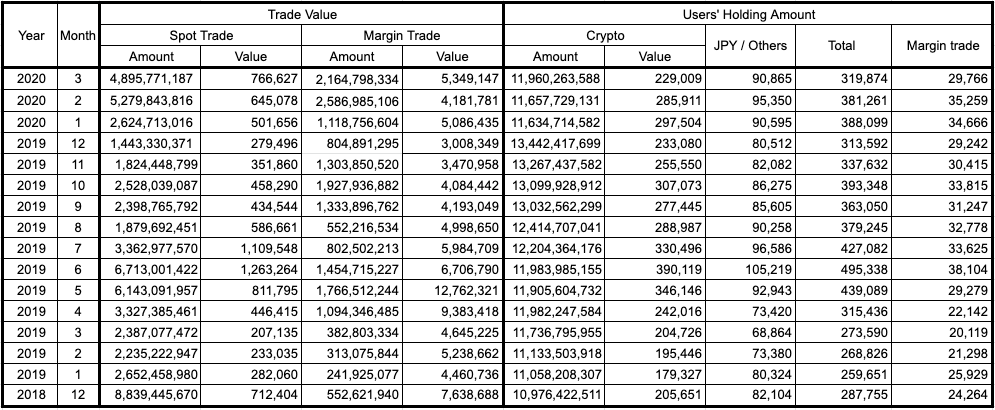

This article is based on official information of Cryptocurrency Monthly Trade Data published by JVCEA (Japan Virtual and Crypto assets Exchange Association), which is a Self-Regulatory Organization named by Financial Services Agency in Japan. Formerly known as the Japan Virtual Currencies Exchange Association, the organization has revised its name to its current one due to changes in Japan’s regulatory rules.

*Value = 1 million JPY

Source: Japan Virtual Currencies Exchange Association

*Value = 1 million JPY

Source: Japan Virtual Currencies Exchange Association

*Value = 1 million JPY

Source: Japan Virtual Currencies Exchange Association

*Value = 1 million JPY

Source: Japan Virtual Currencies Exchange Association

Quick Take

- Monthly active accounts decreases for the first time despite the spike in fiat deposit and volume

- Market turmoil may have generated demands for cash, forcing users to withdraw funds from crypto exchanges

This past March was quite a month for crypto investors and exchanges alike, as the market crashed and started to jump back up, resulting in high volume, high volatility, and high account activity, or so we thought. As we covered in one of the previous articles, during the market turmoil back in March, we experienced a higher-than-average registration and a spike in JPY deposits. Furthermore, the flagship crypto, bitcoin, recorded an impressive comeback in the following two months, completely recovering the March loss. So, following the pattern so far, we made a prediction that the number of active accounts will continue to increase.

However, according to the data from the JVCEA, the number of monthly active accounts in March had, for the first time since the statistics started, decreased. This means that the number of accounts that did not trade any crypto for the month or accounts with no outstanding balance had increased. There seems to be only little chance that the former case was contributing to the decrease given the heightened volatility during this month (you’ve got to be a hardcore hodler to be unflinched by that drop, or you may have missed the greatest buying opportunity of the year so far). Rather, the latter is somewhat more an imaginable factor.

It is often said that a number of investors who allocate their funds to crypto and other asset classes are allocating only a small share of their cash cushion to crypto. So, when the Corona Shock hit the wider financial market and generated demand for margin calls, a good chunk of investors may have withdrawn all their funds from crypto exchanges to scrape up some cash. Or, some investors may have done so to prepare for potential risks, such as reduced income and unemployment, that could be caused by a state of emergency.

Source: Japan Virtual Currencies Exchange Association

On the flip side, this is unlikely to have a lasting impact on the Japanese crypto market since the stock market had stopped plummeting and bitcoin sustained relatively high volume during April and May. Also, it was quite surprising to see the decrease in the number of active accounts since it kept growing regardless of market trends or price actions, we believe this does not necessarily mean that the Japanese users are losing interest in cryptocurrencies.

Notes

On Table .1 and Table .2

“Trade Value ‘’ includes a numerical value by trade agencies to the other cryptocurrency exchanges. “Amount” and “Value” of open interest of margin trade don’t include a numerical value by trade agencies to the other cryptocurrency exchanges. “Base Accounts” includes the accounts for the purpose of agency trade to the other cryptocurrency exchanges. “Total Accounts” includes the series of accounts for the purpose of compatible use of spot trade and margin trade. “Active Accounts” means the accounts by which users trade at least once in each month, or by which there remain some amount of cryptocurrencies or JPY. “Trade Value ‘’ and ”Open Interest of Margin Trade ‘’ were aggregated apart from one member company of JVCEA. Lastly, “Trade value” is a numerical value calculated from the first day to the last day of each month. “Users’ Holding Amount”, “Open Interest of Margin Trade”, and “Users’ Crypto Accounts” are as of the last day of each month.

On Table .3

This table is a series of data of users’ monthly BTC holding of each month. “Spot” is the amount of BTC deposited by users and its evaluated value. “Open Interest of Margin Trade ‘’ is the amount of open interest held by users and its evaluated value. This table excludes the result of trade agency to the other cryptocurrency exchanges. Each numerical datum is as of the last day of each month. ”Open Interest of Margin Trade ‘’ was aggregated apart from one member company of JVCEA.

On Table .4

“Value” of each cryptocurrency is the aggregation of the valuations reported by each JVCEA member company. Each JVCEA member company calculates the valuation on the deposited amount by users multiplied by each companies’ final valuation rate. This table is based on the types of cryptocurrencies, which three or more JVCEA member companies list. The types of cryptocurrencies will be reviewed once a year. This table excludes the result of trade agency to the other cryptocurrency exchanges. Each numerical datum is as of the last day of each month.