dYdX- 5 Key Facts About Its Trading Capabilities

Hi there, I am going to help you lovely readers understand what exactly dYdX is. If you are a fan of decentralized finance (DeFi), then you have probably come across the project “dYdX“.

Let’s get started!

Key Points

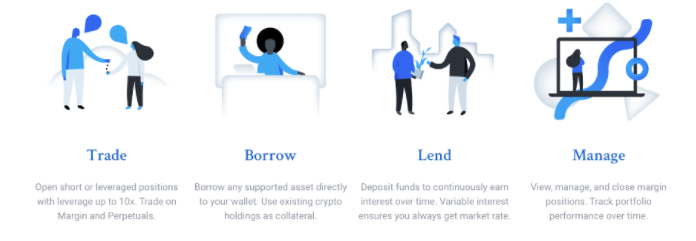

- dYdX allows users to borrow lend and trade popular cryptocurrencies.

- dYdX is a decentralised margin trading platform based on Ethereum.

- dYdX wants to bring trading tools normally found in fiat markets to the world of blockchain.

What is dY/dX and what is it used for ?

dY/dX is a sophisticated decentralised exchange (DEX) that supports margin, spot, and perpetual trading. It is a platform that is permissionless, powered by smart contracts on Ethereum that supports margin trading, borrowing, and lending.

The great thing about dYdX is that anyone can use it without signing up or handing over their assets to a central party.

Why is it necessary?

When it comes to centralised exchanges, the main problem is fund security. The crypto market has suffered from large-scale exchange hacks where thousands and millions of user funds have been stolen.

Decentralized exchanges (DEX), on the other hand, leverage non-custodial fund storage and smart contracts to reduce the risk of funds being stolen by hackers. In simple words, DEX does not hold the funds of users, which means they cannot be stolen from the exchange. This key attribute of decentralized trading platforms, such as dYdX, is what makes it appealing to traders.

How does dYdX work?

dYdX ensures that traders get the same execution speeds traders are familiar with on centralized exchanges by settling trades on the blockchain but uses an off-chain matching engine to do so. This comes with the added security of holding funds in a non-custodial manner.

Each asset on the dYdX platform has a lending pool that borrowers and lenders interact with. Each asset is managed by Smart contracts which enable transactions to occur instantaneously.

dYdX is focused on building advanced trading tools as borrowing and lending services already exist on many popular DeFi exchanges. The platform wants to bring trading tools from traditional finance to the world of blockchain.

How do you use dYdX?

dYdX requires only an Ethereum wallet like MetaMask and ETH to get started. There are currently no trading fees and no special tokens needed to use dYdX. The interaction between borrowers and lenders determines the interest rates of each asset.

For further instructions, is best to have a look at the platforms FAQs or Help Centre page.

The future of dYdX

Options, derivatives, and margin trading are some of the advanced trading features dYdX has on its platform. Recently, dYdX has added stop-loss options to allow traders to limit potential losses and are also looking to add more crypto assets to their platform. dYdX plans to continue developing its platform, to make it more robust and unique. This will simultaneously contribute to the growth and development of the DeFi ecosystem.

Questions, comments, share them below!

-

Good read ??

-

Wow this is fantastic!