Covalent Data- Analyzing the Performance of Crypto Liquidity Pools

Liquidity pools (LPs) are funds collected and piled as a pool and are locked by smart contracts. Liquidity pools enable you to facilitate decentralized trading in automated market maker systems wherein users can directly interact with smart contracts for investing in the pool, buy or sell crypto coins without interacting with counterparties on a transaction. They are an efficient replacement for an order book. Yield farming and liquidity mining are key benefits of Liquidity pools.

Liquidity pools are rapidly growing in recent times. According to Defi Pulse, a total of $62.76 billion funds are locked in Defi Apps, as of June 15, 2021. Aave leads the race with $13.11 billion locked funds followed by UniSwap with $6.29 billion and SushiSwap accounts for $3.37 billion locked funds.

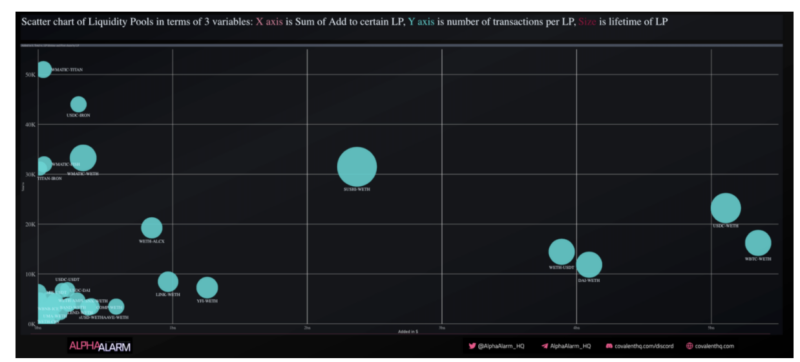

Scatter Chart of Liquidity Pools powered by Covalent

The above chart is a scatter chart of Liquidity Pools. The X-axis shows the total liquidity added to the pool, the Y-axis shows the number of transactions per liquidity pool. The lifetime of the liquidity pool is represented by its size.

The WBTC-WETH LP

Looking at the chart, you can see that only two liquidity pools have crossed the $5 billion mark. Being the first two crypto coins, it is no surprise that WBTC-WETH LP is in this zone with $5.34 billion in funds and 16,215 transactions done on the Ethereum chain. The other LP that crossed the $5 billion mark is the USDC-WETH LP. While the locked funds are $5.10 billion, the transactions are more standing at 23,202 done on the Ethereum chain.

WMATIC and TITAN are a Great Pair

When it comes to total transactions, WMATIC-TITAN LP is leading the race with a total of 50978 transactions with the first chain being Polygon. Though the locked funds haven’t touched $1B yet, transactions are rapidly increasing owing to the growing popularity of the Polygon chain. Polygon offers high scalability, high transaction per second with low gas fees. In addition, the recent collaborations with Infosys, Google BigQuery and investments from venture capitalist Mark Cuban has instantly raised its popularity.

Similarly, TITAN coin comes with its own blockchain technology with hybrid PoW/PoS and dual algorithm system in the form of SHA 256+ Groestl that enables instant and secure verification of transactions facilitating the instant transfer of funds across the world. With a highly secure system, power-efficient mining and fast money transfer facility, TITAN is quickly earning a reputation. As such, WMATIC-TITAN LP is seeing more transactions.

The Steady Rise of Sushi

Sushi-WETH LP strikes the right balance. It crossed the $2 B mark and 30K transactions and has the largest lifetime as well. The locked funds value $2.36 billion while the total transactions come up to 31,484 with Ethereum being the first chain. SushiSwap only charges a 0.03% fee and most of this fee is rewarded back to the user. This low fee and dividend-like passive income are some of the important reasons for the steady growth of the Sushi coin and the Sushi-WETH LP. Considering the 600% growth of Sushi coin in 2021, it is a good choice for investors as well.