InsurAce becomes the first DeFi insurance protocol to launch on both ETH and BSC

Following two successful months since the launch of our Ethereum Mainnet, and one month since our multi-chain V1 launch, InsurAce is extremely proud to announce the launch of our BSC-Ethereum INSUR token bridge and insurance services on BSC mainnet as the start of our multi-chain V2 expansion.

InsurAce is the first insurance protocol to be able to offer BSC and ETH options to users, providing more flexibility and lower fees for insurance customers.

Users are now able to EARN BEP-20 INSUR tokens for mining, INSURE their assets with BSC tokens through the InsurAce app, SWAP their ERC-20 INSUR tokens for BEP-20 INSUR tokens, and TRADE INSUR tokens on Pancake Swap. Read on for all the details.

Why BSC & Multi-chain insurance?

Ethereum has been long established as the leader in DeFi development, but despite this dominance, transactions on Ethereum have run into hundreds of dollars, and often face issues at peak hours. Binance Smart Chain addresses these issues directly with lower costs and faster transactions. This is made possible primarily by BSC’s current PoS (Proof of Stake) model rather than Ethereum V1’s PoW (Proof of Work).

As of writing, BSC has attracted over $28.03B TVL, over 78M unique addresses, and more than 11.83M of transactions per day at its peak. Without any doubt, BSC has grown to be one of the most influential blockchain ecosystems.

Developing on multiple chains, and using token bridges is gaining adoption very fast, as it promotes interoperability and flexibility that end-users are looking for. As the leading insurance service provider for DeFi, InsurAce is proud to announce the launch of its BSC chain token, mainnet and token-bridge with the INSUR ERC-20 token. In doing so, InsurAce is the first insurance protocol to offer both Ethereum and Binance Smart Chain functionality.

We have already listed several high-profile DeFi protocols that have been built on BSC including 1inch, Alpha Homora V1, MDEX, Autofarm, Pancake Swap V1, and Venus. Many more are due to be listed in the coming months.

Protocols wishing to sign up for insurance services can click here to find out more information and fill out a listing request.

Launching Schedule

This launch will be rolled out in a phased approach, the key timelines are:

- 20:00 SGT (08:00 EST) : BSC launch annoucement

- 21:00 SGT (09:00 EST): Cross-chain bridge open

- 22:00 SGT (10:00 EST): Start of trading on Pancakeswap and Staking on InsurAce dApp

- Once the TVL hits $1M, the insurance services will be enabled.

ETH-BSC bridge info

The cross-chain bridge is a critical component in building multi-chain applications, by which assets will be able to migrate and transfer among the different chains. There are a few cross-chain bridges in the industry, however, we eventually decide to build our own bridge due to security concerns as well as scalability. This bridge will work as a gateway to securely transfer the $INSUR tokens between Ethereum and BSC. Once we expand to more chains, this bridge will be enhanced to support the transfer of $INSUR tokens among all supported ecosystems.

To find out how to use the bridge, please refer to this user guide.

To check the proof of assets among different chains, please check this page.

Mining (staking) Info

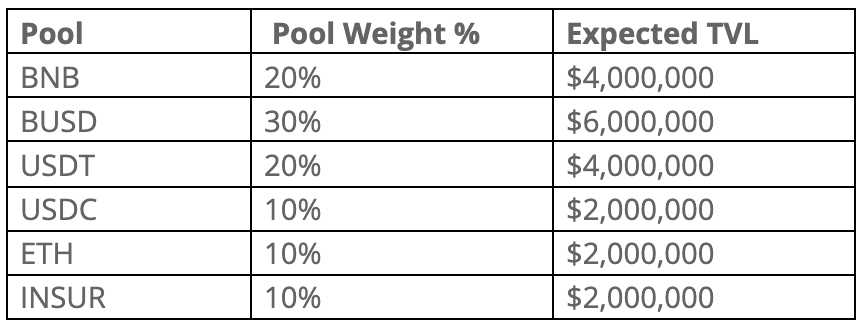

Similar to our staking programs on Ethereum, there will be an array of staking pools created for insurance underwriting with BSC. The pools include BNB, BUSD, USDT, USDC, ETH and INSUR.

The details of the staking pools are as follows:

- Staking Pools

There will be 6 pools created, including BNB, BUSD, USDT, USDC, ETH and INSUR with different weights for each pool.

- Staking Cap

As a start, we plan to accept an initial TVL of $20,000,000 as a staking limit, and the cap for each pool can be calculated according to the weightage above.

- Reward and APY

The rewards for the staking will be INSUR tokens calculated at a per-block level according to the per-block reward configured. The rewards can be unlocked any time, but subject to per-block linear vesting over 15 days.

Subsequently, when the insurance service is bootstrapped, we will add premium sharing into the reward system to provide higher yields in a more sustainable way. The APY has been set at 30% when the pools are full, but of course, the early stakers will always enjoy a much higher APY. This APY will be subject to the change of the INSUR token prices and may be adjusted accordingly.

- Stake and Unstake

Users can stake and unstake their asset any time, but unstaking will be subject to a 30 days (configurable) lock-up period until it will be fully withdrawable, which is to ensure the sufficiency and liquidity of the capital pool in the event of potential claim payout, a commonly adopted practice in insurance protocols. However, stakers will still be entitled to rewards during this 30-days lock-up period.

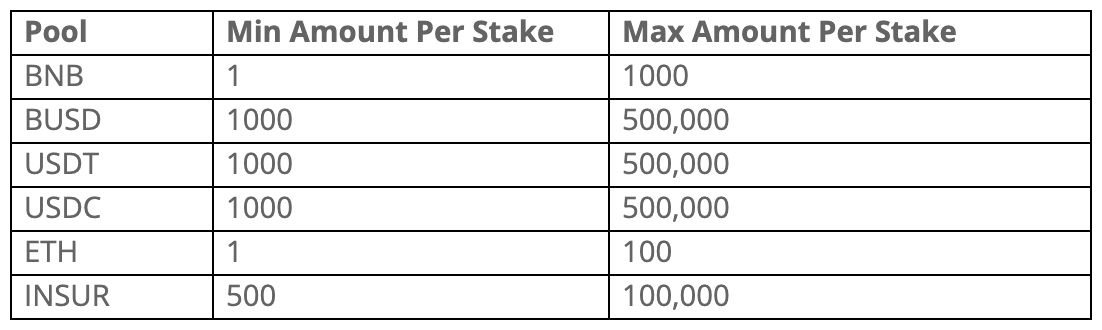

There are also minimum and maximum caps per each staking transaction to prevent the concentration risk as illustrated in the table below. This will be regularly reviewed as prices fluctuate.

- Risk Reminders

Unlike staking on other types of DeFi protocols, insurance protocol staking has more risks. Please be noted that your staking may be subject to financial loss if a claim is approved. Claim payouts will be deducted in a tiered structure, in which the total premium pool will work as the 1st tier, and the staking pools will be the 2nd tier if the premium pool is not sufficient to cover the claimed amount. The claimed amount will be deducted from the staking pool on a pro-rata basis.

To understand more about the risks of staking, kindly refer to our documentation.

Insurance Services

Staking is the initial phase to build liquidity, and insurance services will be launched once a minimum stake has been reached. For our Ethereum mainnet launch we reached the minimum in less than 12 hours.

- Start of Insurance Service

Once the TVL hits $1M, the insurance module will be enabled to accept insurance purchases, capacity for insurance purchases will increase relative to TVL.

- Initial Listed Protocols

The listed protocols will be the same as existing on Ethereum mainnet in a multi-chain insurance context. All risk types and protocols supported currently will be supported in BSC as well. Please refer to this insurance portal for details.

- Purchase of Covers

Once the insurance functions are enabled, users will be able to purchase covers, view cover records and submit claims where triggered. For more operations under the Insurance menu, please refer to this user guide.

Trading on Pancake Swap

With $INSUR tokens bridged to BSC, we have also launched the trading pairs of INSUR/BUSD on PancakeSwap, the leading DEX on BSC.

You will be able to trade $INSUR tokens in this pool with much lower gas fee compared to Uniswap on Ethereum.

We encourage our users to add more liquidity to this pool, and LP staking programs will be available shortly after this launch.

The swap will be enabled at 22:00SGT and the link will be shared once the pool is created.

User Guide

For more information on how to buy cover, stake, and claim, please click here to view our User Guides.

It’s a new dawn for DeFi insurance, and we’re glad to have you along with us.

About InsurAce

InsurAce Protocol is a Singapore based DeFi Insurance protocol that has quickly become the second-largest protocol in DeFi insurance. At the time of writing, the protocol has a $20 million market cap based on a circulating supply of 11 million INSUR tokens. There is a maximum release of 100 million INSUR Tokens which can be mined through staking on the protocol.

InsurAce is a decentralized insurance protocol, to empower the risk protection infrastructure for the DeFi community. InsurAce offers portfolio-based insurance products with optimized pricing models to substantially lower the cost; launches insurance investment functions with SCR mining programs to create sustainable returns for the participants, and provide coverage for cross-chain DeFi projects to benefit the whole ecosystem.

InsurAce is backed by DeFiance Capital, Parafi Capital, Alameda Research, Hashkey group, Huobi DeFiLabs, Hashed, IOSG, Signum Capital and a dozen of other top funds. In the three months since its first testnest was released, several high profile partnerships have been established. Information to be released in separate releases.

The project lead for InsurAce is Oliver Xie. Oliver started to work on InsurAce project since September 2020, and prior to that he worked as the CTO in one of the three largest Singapore-based licensed derivative Exchanges and Clearing Houses. Oliver entered the crypto space back in 2017 where he led a team to research crypto derivatives and blockchain technology and has gravitated towards blockchain-based Open Finance for the past few years. He identified an opportunity for a unique approach to providing insurance for DeFi smart contracts and users, and InsurAce was created.

For press enquiries and assets please contact: dan@insurace.io

Join our community:

Email: contact@insurace.io

Telegram: https://t.me/insurace_protocol

Discord: https://discord.com/invite/vCZMjuH69F

Twitter: https://twitter.com/insur_ace

Forum: http://forum.insurace.io