Kujira – Decentralising DeFi

The risk in crypto is in the people as opposed to products.

The one thing that sets the crypto-verse apart from centralized institutions like the banking system is its transparency. Cryptocurrency and blockchain technology are completely transparent from the transactions to the code. Individuals do not have access to alter any of the fundamental characteristics of a currency. Everything is public and open source. When required, pre-set protocols enable adaptations for upgrades or other reasons.

Free from centralized control and devoid of institutional checkpoints the crypto world or more specifically DeFi is taking over the world by democratizing finance, removing intermediaries, and facilitating peer-to-peer interactions. This has caught the attention of several regulatory authorities with the area of concern being whether certain offerings should be classified as securities or not. The role of regulatory authorities is protection against market risks, systemic risks but primarily malicious activities and actors. In the case of crypto, the risk associated with the product is insignificant owing to its transparent and secure nature. What you buy is what you get, however, the risk is the volatile nature of the product.

What does that mean?

Well at any moment, the prices can crash wiping out billions in a jiffy without any reason or warning.

And who exactly is responsible for this?

Collectively, they’re referred to as the whales of the crypto-verse. And just like the mighty mammals they share their name with, crypto whales are sometimes admired but mostly feared. This fear is a result of the whales’ power to manipulate the valuation of a specific cryptocurrency. Whales include individuals, institutions, etc. who own enormous quantities of digital currencies. Whales not only possess the power to turn waves and create huge market swings but they have access to better information that enables them to multiply their gains (more on this later).

Borrowings and lendings on blockchains are thriving and at the time of writing this article, DeFi has close to $243 billion total value locked (TVL). However, leveraging or margin trading as it is called is a risky endeavor in the highly fluctuating crypto markets. Let me explain how loans work on a blockchain.

Individuals/Institutions (lenders) with surplus money provide crypto assets to a lending smart contract. Borrowers provide collateral as a security deposit to obtain cryptocurrency. Now, a rather interesting feature of borrowing on blockchains is over-collateralized loans. In the crypto world, the amount of debt that borrowers can obtain is inferior in value to the pledged cryptocurrency’s price. This is because while the decentralized world respects anonymity, in such instances, this very anonymity can work against it. The high volatility intrinsic to digital tokens makes it rather risky for lenders to not work with plenty of buffer. Over-collateralized loans enable borrowers to take on leverage.

Now, if the value of the collateral falls below a specific threshold (pre-defined on the protocol) the associated debt is triggered for liquidation. On the Anchor Protocol, these loans are given at a loan-to-value (LTV) ratio of 60% of the security deposit. As previously mentioned, the high volatility that plagues the crypto markets means liquidations are a common occurrence.

What is Liquidation? Who’re liquidators and what does this have to do with Whales and Kujira?

Liquidation occurs when a borrower is unable to fulfill the margin requirement for the leveraged position. Thus, a negative price fluctuation of the pledged collateral triggers the liquidation of the leveraged position. Since blockchains are permissionless, anyone can take the opportunity to repay the debt and claim the collateral. These lurkers are referred to as liquidators, they’re essentially the whales with fat wallets, better information, and technical know-how compared to others. Liquidators typically operate bots to observe blockchains for unhealthy positions so they can snap up the collateral at big fat discounts. Their majestic and powerful nature literally helps them identify these positions faster than the drifting planktons like us.

ENTER KUJIRA’s ORCA?—? Give Power to Less Privileged

Recognizing the need for dApps where gains aren’t skewed in favor of the elite aka crypto whales, Kujira is a team of finance, blockchain & software development experts whose purpose is to level the playing field with the launch of dApps that will cater to individuals who normally otherwise wouldn’t have the means or access.

To deliver on its manifesto of “Everyone deserves to be a whale”, Kujira introduced its first product ORCA that means a killer whale (in case you wondering).

“Envisioning a truly revolutionary strategy of generating profits when the market is up and down, Kujira is committed to its stance of going beyond Exchanges, Staking and ICOs to open up opportunities once reserved for whales, elites, and insiders”.

The vision of Kuijra is to make DeFi truly revolutionary by creating an opportunity in both Up and Down markets while empowering the retail investors. The long term mission is to build an entire ecosystem of tools that are easy and cost-effective for everyone to use (special emphasis on the novice crypto enthusiast).

ORCA Explained

Now that we know how loans typically operate on blockchains, let’s focus on one particular protocol- Anchor.

To be able to understand ORCA, it is essential to understand Anchor Protocol’s collateralized loaning.

Terra presents a host of opportunities to LUNAtics and with the DeFi sector booming, borrowing and lending on the Anchor Protocol is thriving, to say the least. Anchor enables individuals to borrow money (UST) by locking bAssets as collateral (at 60% LTV ratio). Anchor ensures the protection of the principal through a liquidation protocol. It ensures deposit protection through over-collateralization of all the borrowings. The liquidation protocol maintains deposit safety by paying off debts that are at risk of violating collateral requirements using a liquidation contract. If you want to read more on this, click here.

As mentioned, a loan is at risk and in danger of liquidation in the event of a negative fluctuation in the value of the pledged collateral changing the dynamics of your loan terms subjecting the lender to forced liquidation. When the LTV ratio exceeds the 60% threshold, the loan is deemed risky resulting in a third party (liquidator) stepping up to pay the difference. In the case of Anchor Protocol, ORCA is the third party.

Normally, the sale of at-risk loans is a game of fastest finger first. Whales have a plethora of advantages (from their fat wallets, well-programmed bots, etc.) at their disposal making them the fastest bidders to secure these loans but the average user finds it challenging to even access these opportunities. In comes Orca, with its well-crafted strategy of leveling the playing field and bridging the gap with a simple and fluid interface.

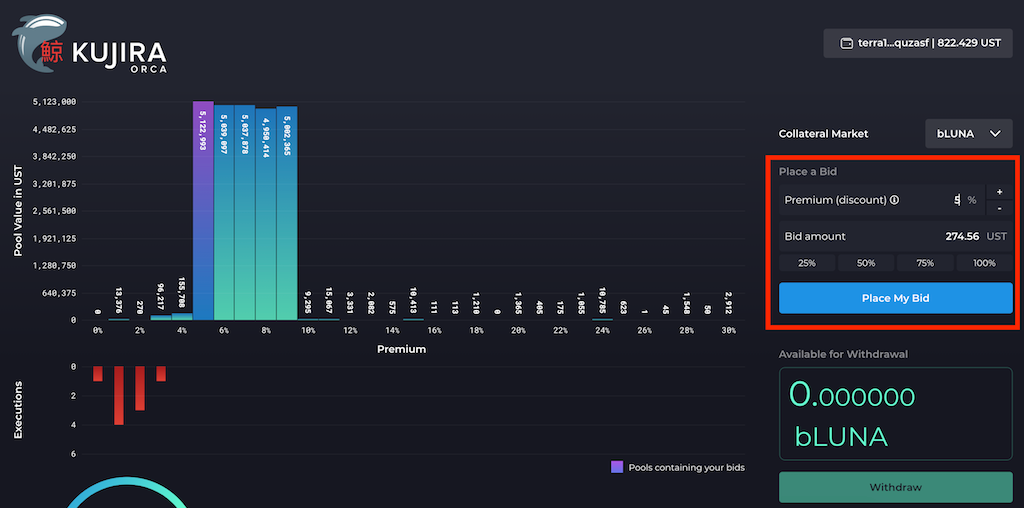

Essentially a liquidator’s role is to ensure lender solvency, by paying up the difference. Liquidators are handsomely rewarded through the sale of collateral by the lender, at a discounted price compared to the going market value. The size of the discount is referred to as the premium, and ORCA, lets the user choose a premium from 1% to 30%.

Example?—?Let us understand this process through an example to make things more coherent. For the sake of this example, suppose you have 1000 UST to invest and imagine bLUNA is worth 50 UST. So you trade your UST to LUNA and then to bLUNA for an exact 20 bLUNA (all other fees are on top of that 1000 UST). You then use the bLUNA as collateral and borrow 500 UST against it. So that’s an LTV (loan-to-value) ratio of 50 percent. A loan gets liquidated if it reaches 60 percent LTV on Anchor which means you only have a margin of 100 UST. The price of LUNA drops and bLUNA trades at 40 UST which means your LTV went up from 50 percent to 500/800 or 62.5 percent, above the liquidation limit of 60 percent. The moment this happens, your loan becomes available at a premium for the liquidators to pounce in.

The only people to benefit were the fastest fingers leaving us way behind in the game. Not anymore with ORCA.

How Orca Works?

The answer is smooth like butter. Jokes aside, the old realities are now a thing of the past- THANKS TO ORCA, a platform that ensures liquidations on Anchor enter a queue and are prioritized based on the rate of premium as opposed to the size of wallet and bidding speed. A user places a bid based on the chosen premium into the liquidation queue. The bids get activated based on the premium starting from the lowest to the highest, sequentially in an order book style.

With its user-friendly interface and a crispy clean dashboard, Orca takes care of the bidding for the user. What do I mean by this? Orca simplifies the user experience by letting the average investor place bids at a premium level of choice, irrespective of the amount of capital.

Orca’s design proves the Kujira team has put a lot of thought into removing ambiguities and streamlining the bidding process. As a matter of fact, it is designed to cater to novice investors so that they do not get overwhelmed by the complexities associated with bidding for loans at the brink of liquidation.

The premium can vary from 1 percent till 30 percent. In the example above, let’s suppose your liquidated loan gets fulfilled at a 5 percent premium. The 500 UST loan gets bought at 475 UST.

A Walk-Through the Platform

1. Go to Kujira.app and then click on Go to Orca or read the Litepaper.

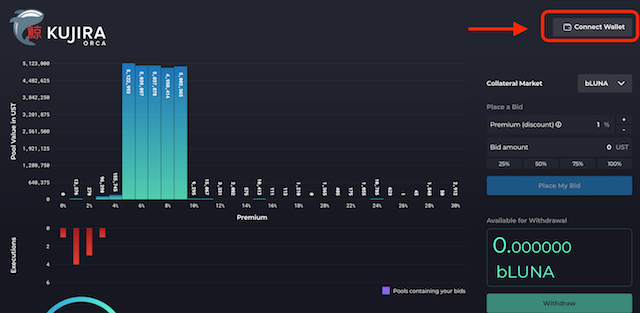

2. Connect your Terra Station wallet.

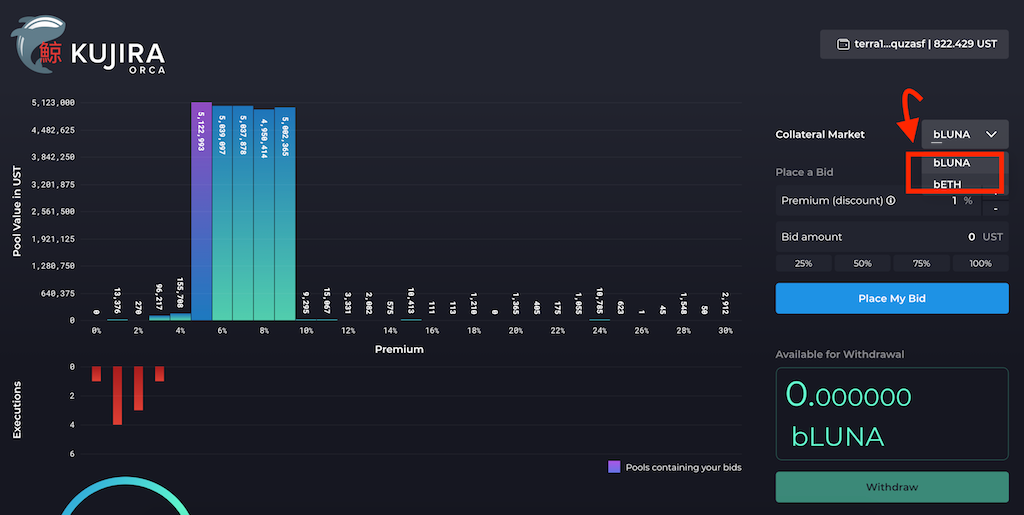

3. Select the Collateral Market?—?bLUNA or bETH

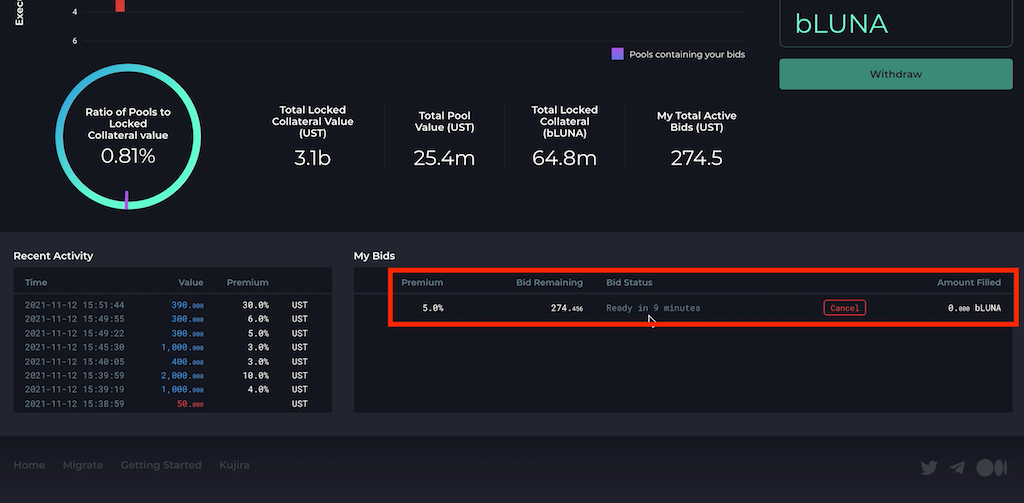

4. Place your bid?—?Select your Premium (your profit) and the bid amount and place the bid. The purple bar indicates your bid allocation pool. (For this one 5 percent pool)

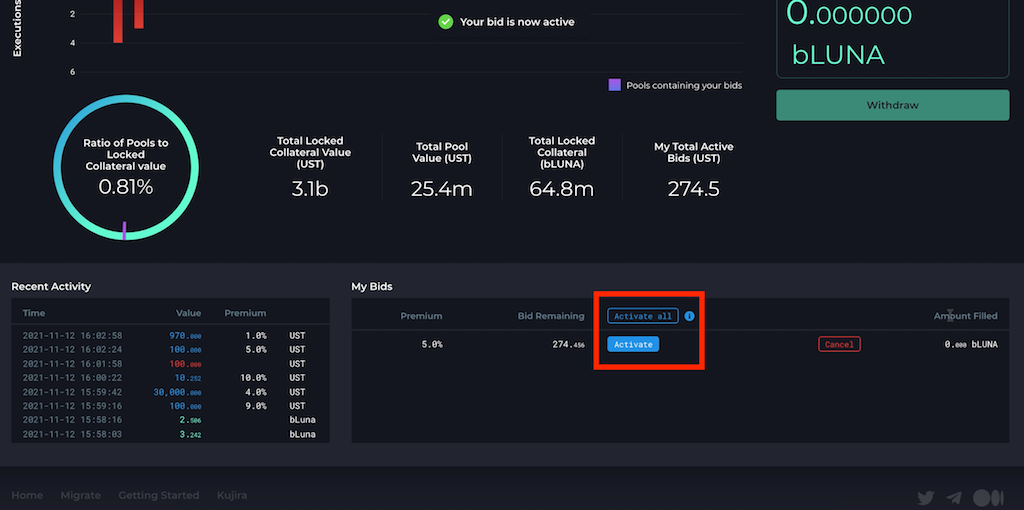

5. Activate your bid?—?Wait for 10 minutes to activate your bid and then let ORCA work finding that premium for you. You also have the option of activating multiple bids, all at once. This helps to save the activation transaction fee.

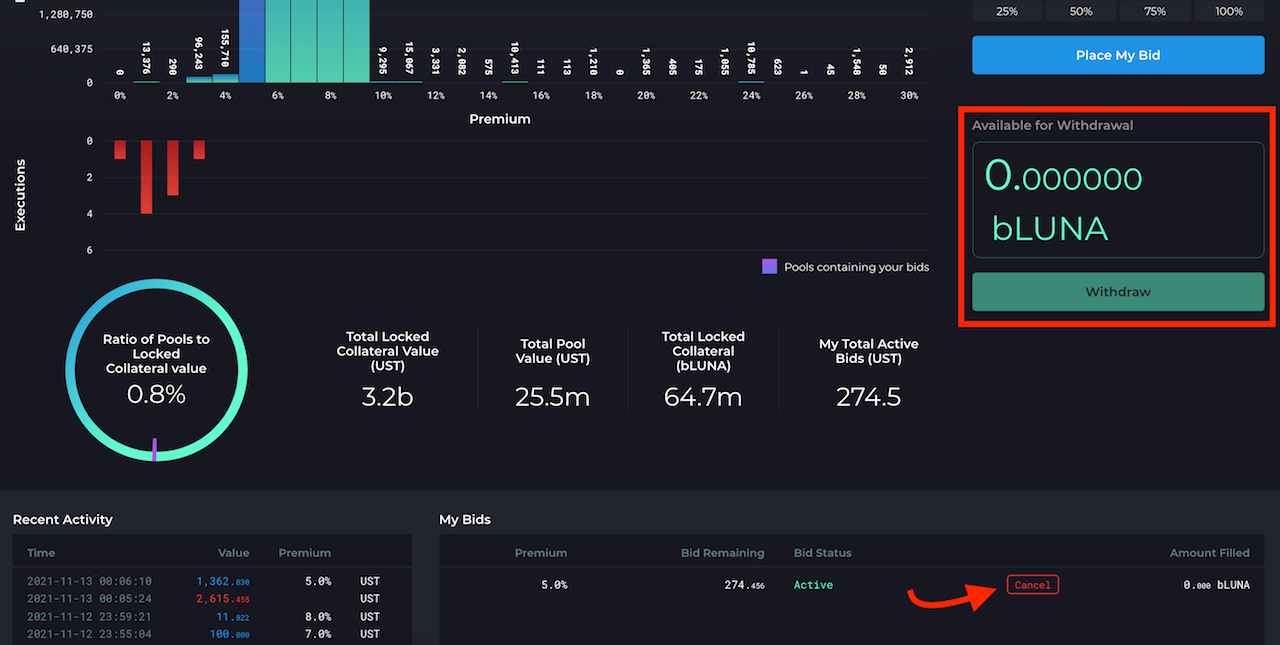

6. Withdraw your bLUNA/bETH once it gets fulfilled. You can also cancel the bid at any point before it gets fulfilled.

The recent activity shows the record of the latest bids, retracted bids, and claimed bids with the time, date, bid value, and premium percentage.

For a guided tutorial, check out the video.

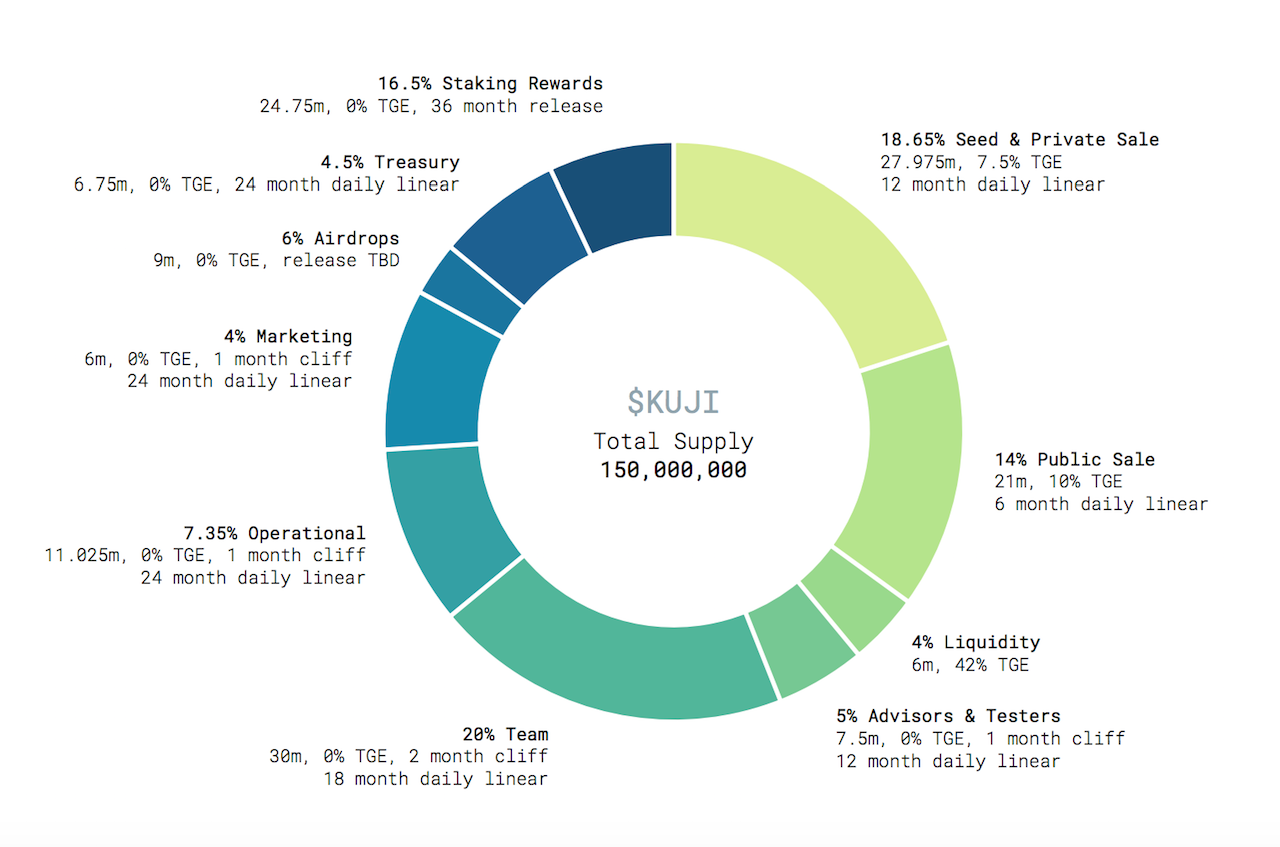

Tokenomics

$KUJI is the native token of Kujira offering benefits either through token utility or staking all across the suite of dApps in the Kujira ecosystem. The end goal is to create an ecosystem centered around the KUJI token.

Orca derives income from two main sources: UST from the transaction fees incurred when liquidations execute, and $KUJI at the time of bAsset withdrawal by the user. These funds flow into the liquidity pool to support the price stability of the token.

Check out this tokenomics depiction for detailed insight.

Utility?—?It is used as a utility token for paying fees on the network with users enjoying discounts between 50–90% of the UST value. When a user withdraws bAssets earned from bidding, a fee has to be paid that is equivalent to 1% of the value of the bAsset being withdrawn. If this fee is paid in $KUJI, the users can avail a discount on the fee.

Staking-Users can contribute to the $KUJI-$UST pool and earn staking rewards.

Funding Stability?—?The value of this fee is used to buy $KUJI from the market. These funds are directly routed into the liquidity pool to support price stability for the $KUJI token.

KUJIRA tokenomics is designed to balance utility, staking, and other future incentives that will contribute to the creation of a local economy fueled by $KUJI.

Roadmap & Future Offerings

Not only is Kujira a highly ambitious project but its team comprises highly skilled and motivated individuals driven in their goal of being truly revolutionary and making DeFi a profitable investment at all times.

Kujira will be migrating to far-off waters to breed and ensure the production of Beluga, another product that will form part of the Kujira family.

Beluga, Kujira’s next offering is developed with an extensive use case. Beluga will enable users to send CS20 tokens (CosmWasm IBC tokens) on Terra to multiple addresses simultaneously in a single transaction significantly cutting cross-chain transaction fees.

The launch of this dApp will do wonders providing an easy way for VCs to pay members, crypto companies for payroll, and retail users could use it in a multitude of ways.

Conclusion

The power of blockchain in general and DeFi, in particular, lies in its decentralization. Yet, the world is still far from experiencing its true power. We need solutions that aim to bridge the existing gaps for DeFi adoption so that the world sees it for what it truly is. The existing chains of the traditional financial systems which have captured the world need to be broken down. This is only possible when DeFi is what it truly is – Decentralized. Kujira is a step towards financial independence that eases the path for commoners like you and me by simplifying participation. It provides an opportunity to everyone alike, taking the liquidation world from the hands of a select few and living to the true belief that decentralization means everyone from the crypto sphere.

Everyone deserves to be a whale.

*This article was published in November on Publish0x.

I need your love and support. Please give it a like or follow or subscribe so that I can keep writing what I love.

Socials

Substack, Loop, Torum, Odysee, Twitter, Youtube, Read.cash, Publish0x, Presearch, Medium, Noisecash

Crypto Taps Pipeflare, GlobalHive, GetZen for some free crypto

Exchange on SwapSpace

For price updates, check Coinmarketcap or download the app on Apple/ Google

Join CMC for Airdrops, Diamonds, Learn&Earn

On Telegram(G), Telegram(EN), Twitter, Reddit, Instagram, Facebook

Create your crypto Watchlist or track your Portfolio on Coinmarketcap