GCR Market and Investment Trends Review – Q1 2023

By Cosmo Jiang, Jin Kang, Junney Kang

Highlights

GCR is a research and investment DAO. As a community, we source investments, conduct research and diligence, and make investments together.

This piece lays out some highlights from the past quarter:

- The GCR Community saw over 70 investment opportunities in Q1, of which ~40% was brought directly from the community.

- The top category the community deployed the most capital to during Q1 was Infrastructure (same as in 2H 2022).

- GCR Core Team’s macro review and outlook.

Community-Driven Investing in Q1

The GCR Community continues to make strides by staying disciplined in meticulously curating top-notch deal flow and partnering with high-conviction companies.

- The GCR Community saw over 70 deals in our Q1 pipeline, of which ~40% came directly from the community members. Despite the diminished investment appetite across both crypto and traditional asset classes, the GCR Community sourced and reviewed more deals than in Q4 2022.

- Amongst the opportunities the community saw by category: Infrastructure remains most prevalent at ~40%, followed by Social at ~23%, and Gaming at ~10%.

- In line with the current market sentiment and the high level of scrutiny by the GCR Community, GCR did not participate in any deals during Q1.

Every quarter, we share our progress to highlight the aptitude of GCR’s community-led investment platform. The GCR Community continues to grow stronger with members educating each other about their specific niches of expertise. If you would like to learn more about how you can be involved with the GCR Community, join our Discord.

Venture Investing in Hibernation

Q1 2023 was a rather muted time for the Web3 space, with economic pressures and the hawkish policy of the Federal Reserve massively suppressing liquidity and institutional investment appetite (more background on the challenging macro landscape in the following section). Looking at data from DefiLlama, deal activity compressed from 224 funded rounds in Q4 2022 to 204 funded rounds in Q1 2023. The total capital deployment also decreased from ~$3bn to ~$2.24bn. This is reflected in smaller ticket sizes, down from an average of ~$14.8m to ~$10m in the past quarter.

It is worthwhile noting that many of these deals had been out in the market for many months and they are manifesting in the numbers now. As such, we need to account for some time lag that likely reflects even lower effective activity. Despite the mini rallies, we are neck-deep in a bear market with incessant regulatory headwinds, particularly in the US with the latest being a Wells Notice against Coinbase. This is adding further uncertainty to the already sensitive climate.

Another trend the community has been noticing is that the small pool of high-profile startups is still able to command relatively higher valuations as many investors are competing for highly coveted deals. On the other hand, most startups continue to feel the pain of the bear market.

Continued Dominance of Infrastructure

There is a surplus of capital on the sidelines ready to be deployed, thanks to robust capital-raising efforts in the past few years. Fundraising has been difficult for most crypto projects, but new L1 infrastructure projects have been able to command high valuations.

Tokens associated with these new infrastructure projects are unsurprisingly attractive to investors, as tokens remain an easy way to access liquidity. The playbook to attract the right institutional capital and traders (or generally users with trading appetite) has been in play for some time, creating a large floor valuation. It is too early to tell the future of these new infrastructure projects, but investor sentiment is clear: there is a large whitespace.

Consumer applications will be the ultimate drivers behind mass adoption, and these new infrastructure layers can hopefully provide the right environment to support these players. This can be viewed as a “trickle-down effect” of capital, where capital infusion from investors occurs at the infrastructure layer and flows down to applications and projects that will be built on top, thereby creating a robust ecosystem.

GCR Portfolio Companies Continue to Ship

We have previously focused our quarterly reviews on highlighting our deal pipeline and funded investments, but GCR now has grown to nearly 70 portfolio companies that are relentlessly building. In these times when our conviction in Web3 is being tested, we want to take this opportunity to showcase what some of our awesome portfolio companies have been up to lately.

Mysten Labs

Mysten Labs is a Web3 infrastructure company and the initial developer of the Sui Layer 1 blockchain.

- Mysten just announced that Sui will be launching its mainnet on May 3, 2023.

- Mysten has entered into a MOU with Alibaba Cloud, an arm of Chinese tech conglomerate Alibaba Group (BABA), which has a $235 billion market cap. Alibaba Cloud will provide archival node services and secure cloud infrastructure for validators for Sui’s testnet to help create more user-friendly experiences.

- Mysten announced their partnership with BlueJay Games, a leading gaming studio. Through this partnership, BlueJay Games will launch Arcade Champion, a mobile Web3 arcade game on Sui.

Utopia Labs

Utopia Labs is building crypto payments, payroll, and treasury management for companies and DAOs, built right on top of Safe.

- Utopia announced their new Bookkeeping product, which enables enterprises and DAOs to seamlessly manage their crypto transactions, derive insights around their Safe treasury, and create shareable transparency dashboards for their communities.

C3

C3 is an automated way to interface with the Web3 carbon markets.

- C3 announced their partnership with President Voyage Jet, a prominent player in the private jet charter industry, to implement measures to compensate for its carbon footprint. As part of its commitment to environmental sustainability, the company has started using C3’s carbon offsetting tool to retire carbon credits and offset its emissions.

Market Outlook

2023 started off with a strong rebound across all risk assets and especially crypto. After the torrent of bad news that buffeted the digital assets industry, capstoned by the collapse of FTX, positioning and sentiment were as negative as possible at the end of a historically bad year. Given that backdrop, the bottom for crypto asset prices appears to be behind us.

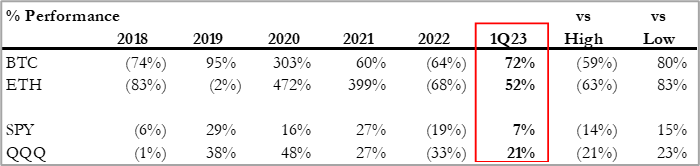

This quarter Bitcoin’s price appreciated by +72% and Ethereum’s price appreciated by +52%, which compares to the S&P Index by +7% and the more tech-heavy and growth-oriented Nasdaq 100 Index by +21%. This strong performance to start the year may seem extreme on an absolute basis, but looking back at the prior 2019-2021 cycle shows it is not out of character for the asset class and that this run may only be getting started. In fact, over the last five years, a one-standard-deviation move in price on a trailing 90-day basis was 56% for Bitcoin and 64% for Ethereum, which is not far from this last quarter’s performance.

Source: Bloomberg, CoinGecko

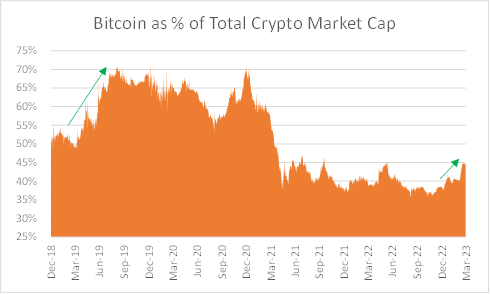

Much like in equities, for which a handful of tech giants contributed >100% of the S&P’s performance, the crypto market rally was led by Bitcoin. In prior cycles, the industry has seen Bitcoin be the initial driver of the rebound. As risk appetite and new capital come into the system this then spills over into even stronger price action in the longer tail of higher growth smaller market capitalization assets. This is best seen in what’s called the Bitcoin dominance indicator (below). The lack of breadth across multiple asset classes creates a reason for pause because it suggests not a lot of risk appetite exists yet.

Source: CoinGecko

The macro debate this year is not on whether there will be a recession but rather on the severity of it given the impact of higher rates on the economy, including tighter liquidity and credit. Regional banks became a casualty of these headwinds in March.

Accordingly, the banking contagion has been uniquely positive for crypto. It validates crypto’s original use case by elevating Bitcoin, a store of value secured by decentralization and not subject to counterparty risk, as a potentially viable alternative to traditional financial institutions (such as depositing at a regional bank). Recent supportive price action has been important in validating this thesis, especially for Bitcoin, a store of value asset with no intrinsic fundamental value and is instead judged by price performance.

The Big Picture

This recovery cycle will continue to have bumps in the road, but as the cycle turns, macro considerations will continue to move further into our rearview mirror. In the meantime, it is important to take a step back and note the continued institutional adoption of crypto. This quarter included:

- Microsoft testing a crypto wallet in its web browser Edge (link)

- Amazon staffing up a new division dedicated to blockchain-based gaming (link)

- Fox Entertainment launching token-gated fan experience for “The Masked Singer” (link)

- Toyota sponsoring a hackathon to explore blockchain use cases for in-house projects (link)

- Developer of Eve Online, one of the longest-running and largest massively multiplayer online role-playing games (MMORPGs), began working on a blockchain-based game (link)

- California DMV tokenizing vehicle title and transfer systems (link)

Join Us

We continue to be excited about what lies ahead in 2023 for GCR and the rest of the crypto community.

If you are a startup raising capital and are interested in learning more about what it is like to have the support of a community with 7,500+ members, please reach out to one of our GCR Core Team Deal Leads!

If you are a Web3 enthusiast and are interested in learning about new crypto projects, investing alongside sophisticated members, and sharing investment opportunities, hop into our Discord and join the conversation!

As part of our effort to onboard the next one billion users to crypto, we are giving away complimentary 1-month Gold memberships to people who are aligned with GCR’s core values and are seriously interested in investing with us. If you are interested, please fill out this form here.

Please reach out if you have any questions, comments or feedback! We welcome the dialogue.

[This article has been written and prepared by the GCR Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research and analysis.]

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.