Introduction

2025 was dominated by a few powerful narratives. Meme coins, ETFs, US strategic reserves, perpetual DEXs, RWAs, tokenised stocks, and more recently, stablecoins and prediction markets.

Institutions such as BlackRock, Grayscale, Fidelity, Goldman Sachs, Deutsche Bank, JPMorgan, DATCOs, Mastercard, Nasdaq, Visa, and others entered the space. Regulatory clarity improved, the US moved toward a more pro-crypto stance, ETFs gained traction, and onchain finance moved closer to the mainstream.

As the year approaches its end, attention naturally shifts forward.

Instead of focusing on short term price action, the more important question is which narratives will shape crypto in 2026.

Stablecoins

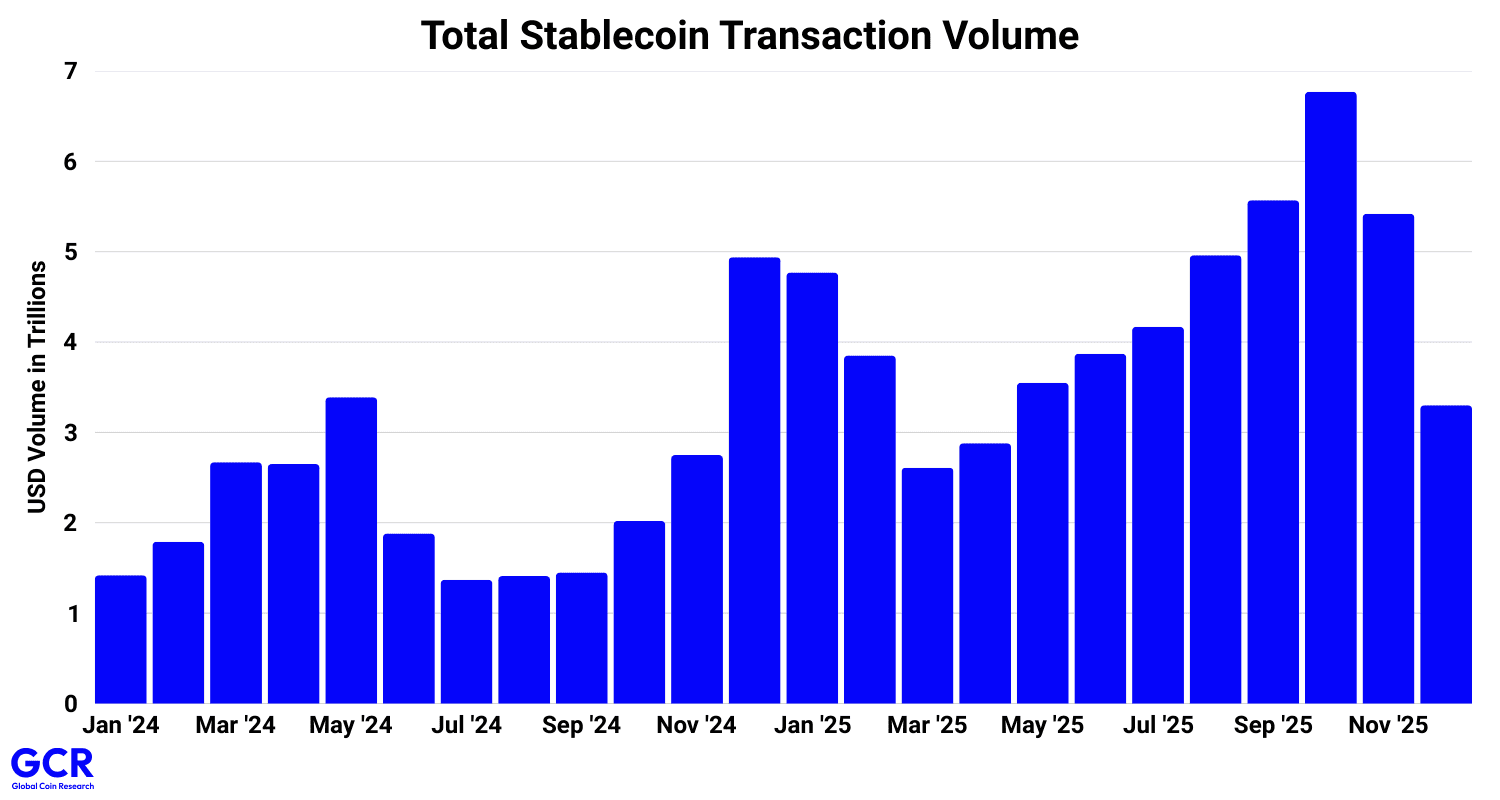

Stablecoins are arguably the strongest product market fit in crypto today.Over the last 12 months, stablecoin transaction volume reached $51.7 trillion, representing roughly a 180 percent increase year over year. What started as a niche crypto use case has quietly become one of the largest payment rails in the world.

Source: Visa

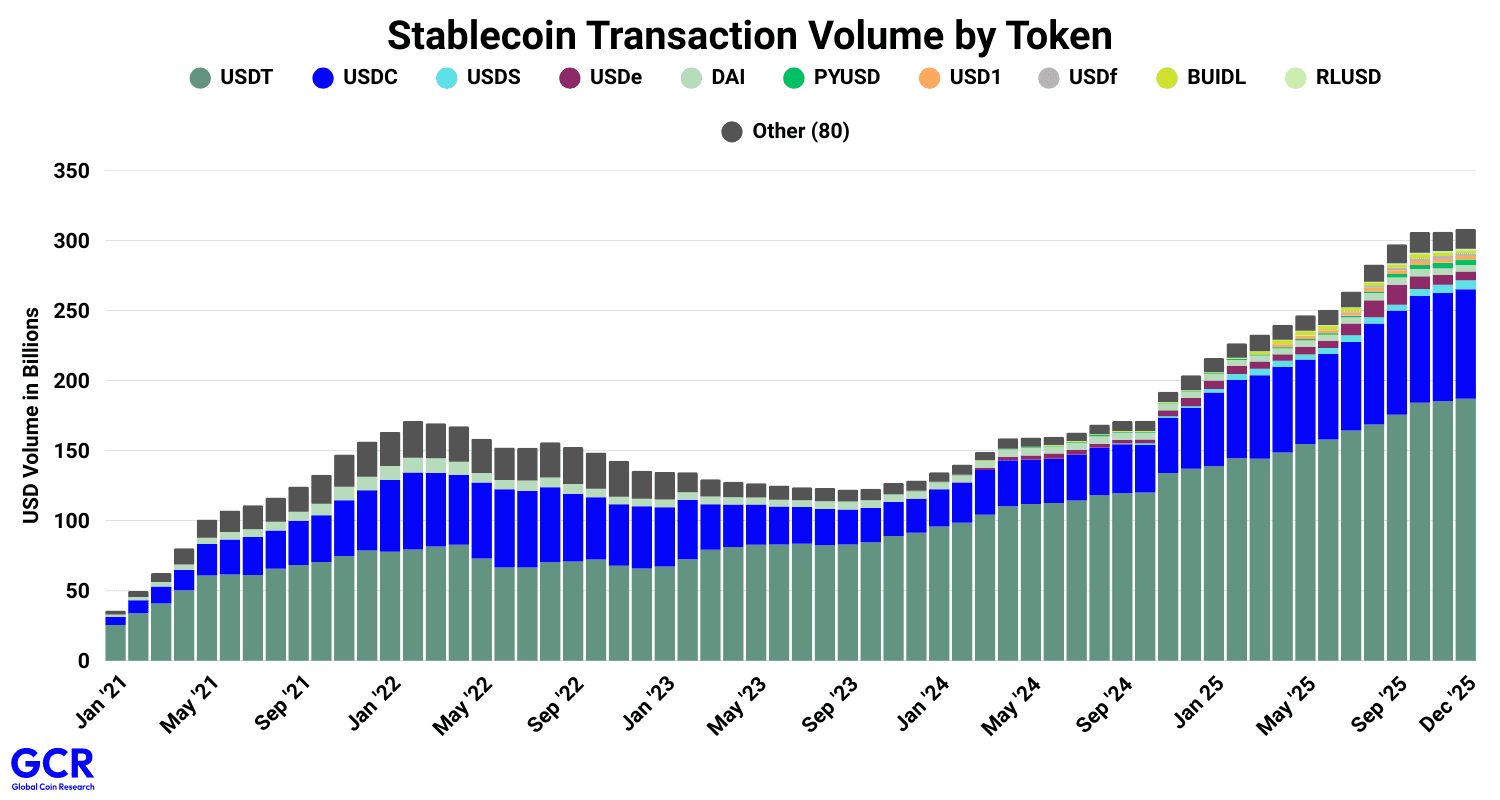

The stablecoin market is still dominated by two players by a wide margin: Tether (USDT) and Circle (USDC), which together account for over 80 percent of total stablecoin market share.

Source: Artemis

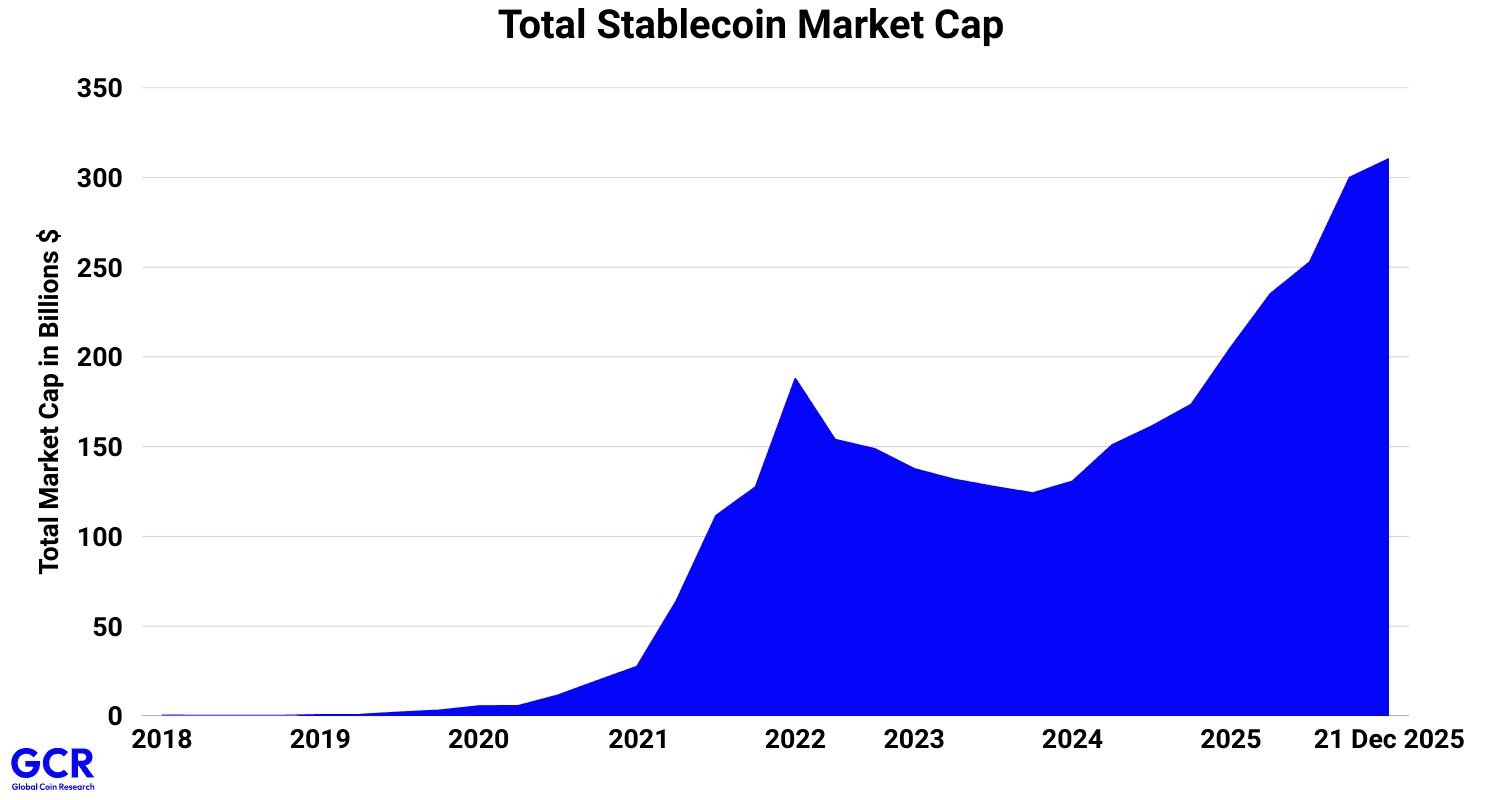

Thanks to cheap, fast, and 24/7 transactions, stablecoins are now attracting major traditional finance players. Institutions such as Visa, Stripe, PayPal, Mastercard, JPMorgan, Goldman Sachs, Bank of America, Deutsche Bank, and Interactive Brokers are actively exploring stablecoin based settlement and infrastructure. Despite recent bearish sentiment across crypto markets, total stablecoin market capitalization is at an all time high, currently standing at $310 billion as of 21 December 2025.

Source: DefiLlama

Today, most stablecoins are USD denominated. That is not surprising, given the US dollar’s role as the world’s reserve currency. However, this also highlights a clear opportunity. Non USD stablecoins could play a critical role in serving local markets, cross border trade, and regions underserved by the dollar centric system.

The next major challenge for stablecoins is usability. UI and distribution need to improve to support everyday payments and onboard not only web3 natives, but also mainstream web2 users.

Stablecoins already enable instant, low cost transactions for both retail users and institutions, often without the need for a traditional bank account. What was once just another crypto category is now on track to fundamentally reshape how money moves and settles globally.

Privacy

Privacy is becoming a central topic not only in crypto, but in society at large. Social media restrictions, the rise of CBDCs, and increasing control over financial assets have pushed privacy back into the spotlight.

For institutions, privacy is a competitive advantage.

For individuals, it is a basic human right.

In crypto, privacy was sidelined for years in favor of radical transparency. That trade off made sense in the early days, but it no longer holds. As more value moves on chain, full transparency shifts from an advantage to a liability. Broadcasting positions, counterparties, execution prices, or treasury movements in real time is simply not viable for large market participants.

Privacy is also closely tied to the user lifecycle. New users rarely prioritise privacy at the start. Convenience and access matter more. But as users hold more value, interact with more protocols, and build financial history on chain, privacy becomes increasingly important.

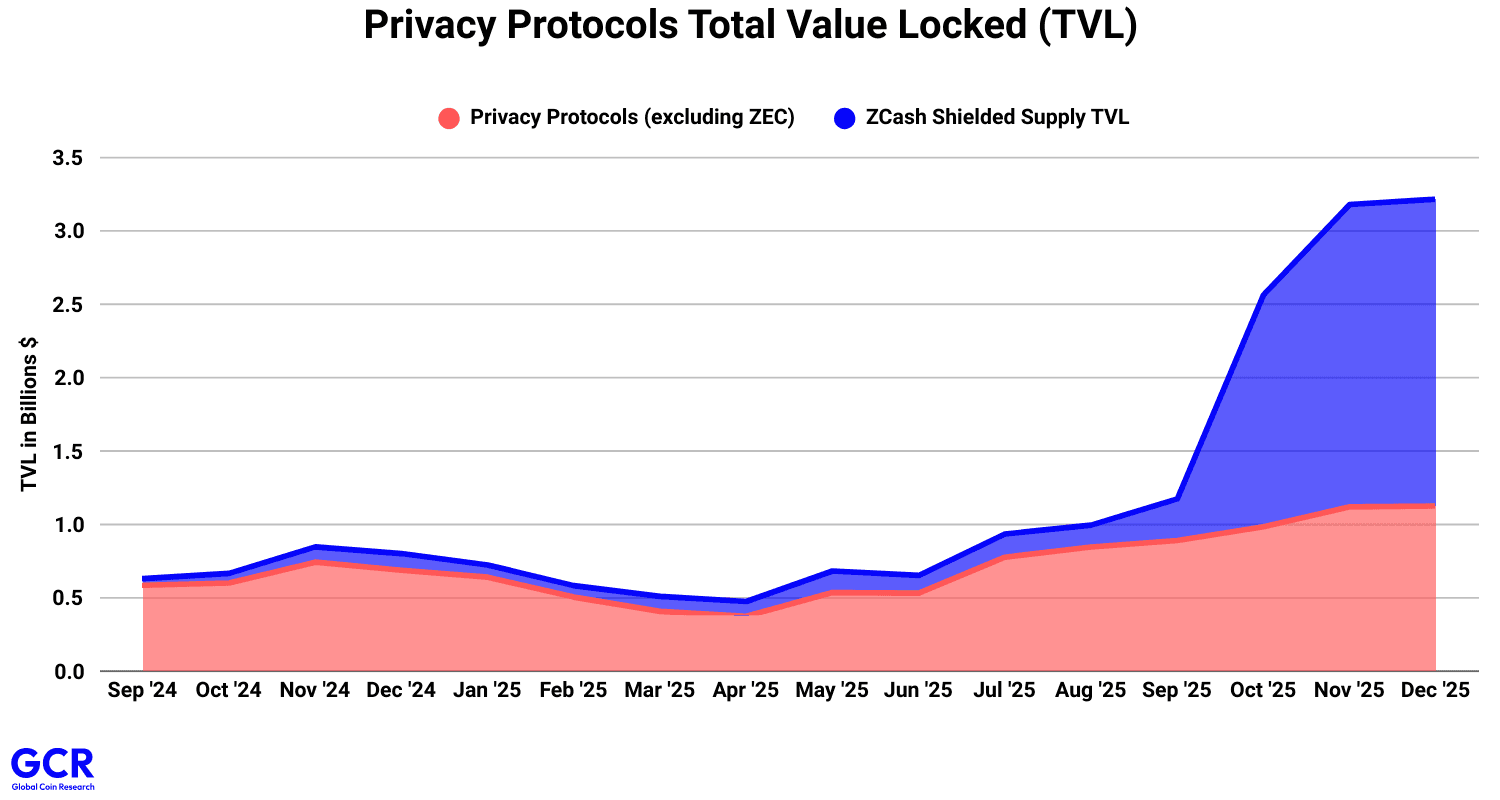

Zcash has reemerged as one of the most notable privacy focused assets, with shielded ZEC accounting for a growing share of activity across the privacy sector. Shielded ZEC now represents roughly 65 percent of total TVL across privacy protocols, highlighting a clear preference for private execution as adoption matures.

Institutions are also betting on privacy. Circle partnered with Aleo to explore a private version of USDC, often referred to as USDCx. Ethereum is also pushing privacy forward through Kohaku, a new initiative planned for 2026. Championed by Vitalik Buterin, Kohaku aims to integrate privacy directly into Ethereum wallets and developer tooling. This includes shielding transactions, isolating dApp specific addresses, and enabling stealth or one time addresses by default.

Privacy is no longer a feature to be added later. It is becoming a core pillar of crypto infrastructure.

The remaining challenges are significant. Policy alignment, regulatory clarity, and user experience all need to evolve. Privacy solutions must be seamless for users while remaining compliant at the infrastructure level. Projects that manage to strike this balance will likely have one of the strongest moats in the next phase of crypto adoption.

Prediction Markets

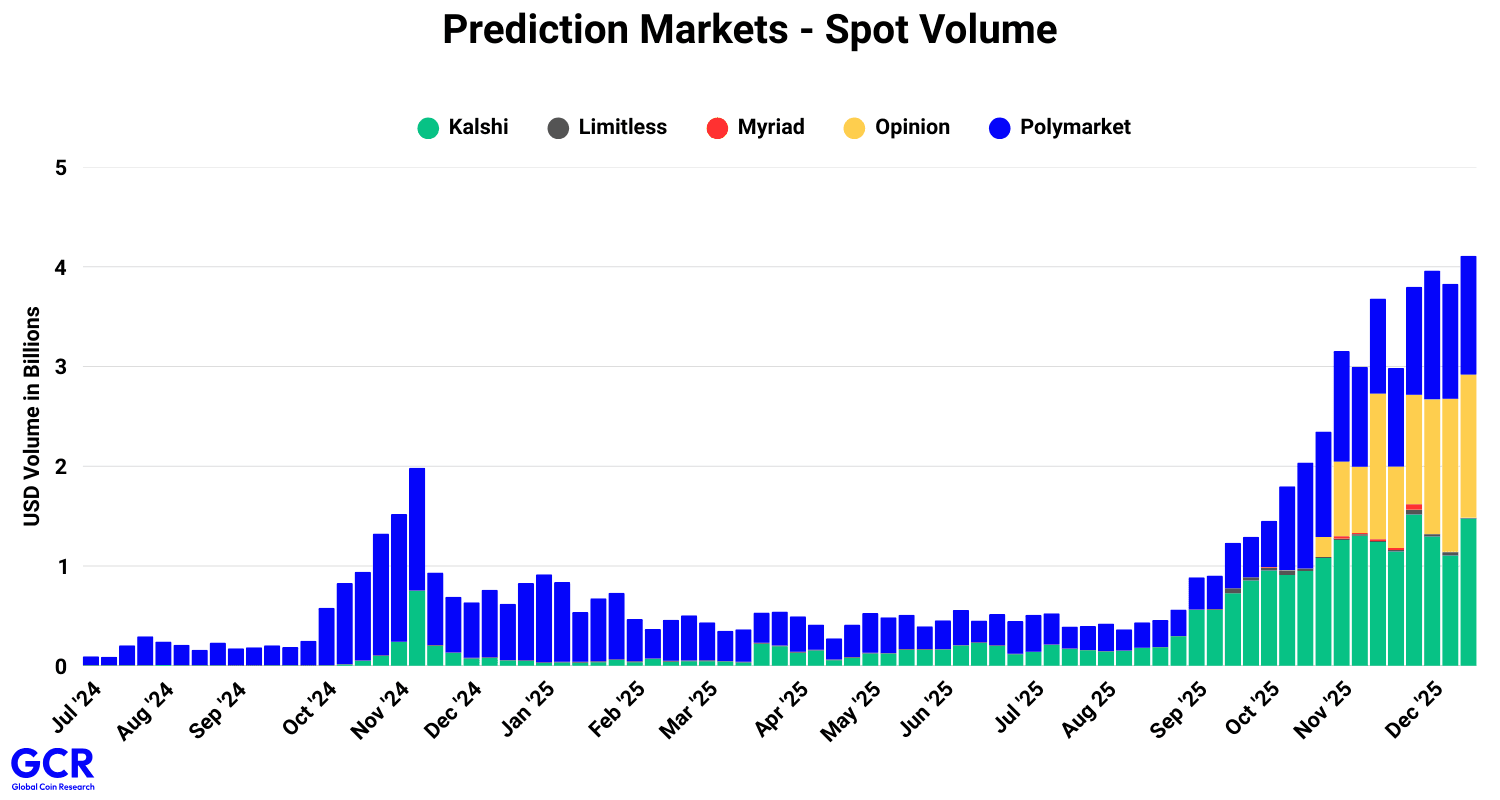

Prediction markets moved into the mainstream during the 2024 U.S. election. In 2025, volumes accelerated sharply as new markets and use cases were introduced.

Prediction markets show rare product market fit across both web2 and web3, and for both retail and institutional users. Retail participants speculate on public events ranging from sports and elections to economic data, geopolitics, and even highly unconventional outcomes. For institutions, prediction markets offer something more valuable: an alternative data source. They aggregate real time expectations and probabilities, which can be used as analytical inputs or even as hedging tools. For example, in June 2025, Goldman Sachs referenced Polymarket odds as a metric in its commodities research.

According to Keyrock, monthly trading volume grew from roughly $100 million in early 2024 to over $13 billion by November 2025, a 130x increase. That pace puts prediction markets among the fastest scaling financial platforms globally. Market composition differs by platform. Kalshi remains heavily sports driven, with sports accounting for around 85 percent of notional volume. Polymarket shows a more diversified mix, with sports at 39 percent, politics at 34 percent, and crypto at 18 percent, together representing over 90 percent of activity.

Source: Artemis

The comparison to betting is unavoidable, but there is an important distinction. Prediction markets aim to reflect objective probabilities, not just wagers. In the U.S., this difference matters. While sports betting remains restricted in many states, prediction markets operate under financial market frameworks and are regulated at the federal level by the Commodity Futures Trading Commission.

Both Kalshi and Polymarket are valued above $10 billion, with Kalshi recently raising $1 billion at an $11 billion valuation. Partnerships with major organizations such as Google, X, Coinbase, CNN, CNBC, NHL, and the UFC highlight the growing legitimacy of prediction markets. At the same time, the entry of new competitors like Fanatics and Robinhood signals that prediction markets are moving from niche products to mainstream financial infrastructure.

Prediction markets will expand into new niche markets, attracting more specialized users. At the same time, AI agents are likely to transform the category entirely. By continuously aggregating global signals at machine speed, AI driven participation could push prices closer to real time collective truth.

As the number of markets grows, especially niche ones, oracle design, data integrity, and outcome resolution will become increasingly critical. These challenges intensify as markets move into more subjective or harder to verify domains.

With clear product market fit across retail and institutional users, web2 and web3 users, strong regulatory positioning, and accelerating adoption, 2026 is shaping up to be a defining year for prediction markets.

Neobanks

Neobanks are not strictly a crypto narrative, but they are uniquely positioned to disrupt both traditional finance and crypto. Sitting between web2 and web3, they act as a natural bridge for mainstream users moving toward digital finance.

Over the past decade, entire industries shifted to mobile first models without owning traditional infrastructure. Airbnb scaled without hotels. Uber scaled without owning taxis. Finance, however, remained largely unchanged. Banking moved its interface to mobile apps, but the underlying systems stayed the same.

Platforms such as Nubank, Chime, Revolut, Trade Republic, and N26 allow users to open accounts without physical branches, paperwork, or legacy infrastructure. On top of basic banking, they increasingly offer instant access to investing in stocks and crypto, all from a single mobile interface. Lower infrastructure costs allow neobanks to move faster, iterate on user experience, and offer more competitive products.

Nubank addressed what legacy banks struggled to solve: access to financial services in underdeveloped markets across South America. In its latest earnings report, Nubank surpassed 127 million customers, adding 4.3 million new users in Q3 2025, a 16 percent year over year increase. Activity rates remained above 83 percent, driving over $4 billion in revenue and $783 million in net income. Customer acquisition cost stayed remarkably low at $0.90 per active customer.

Chime continues to grow rapidly in the US. In Q3, revenue reached $544 million, up 29 percent year over year. Active members increased 21 percent to 9.1 million, while acquisition cost per new active member declined by more than 10 percent year over year for the third consecutive quarter.

Revolut has evolved into a global financial platform with 65 million customers worldwide. The company reported £1.01 billion in revenue in Q3 2025, a 46 percent year over year increase, putting full year revenue on track for £4.1 billion, up from £3.1 billion in 2024. Revolut recently completed a fundraising round valuing the company at $75 billion, underlining strong investor confidence in the neobank model.

Despite this progress, traditional banks still retain a powerful moat: lending. Most consumers continue to rely on banks for loans, especially when collateral such as real estate is involved. That part of the system remains largely inaccessible through neobanks today. However, this may change over time as crypto infrastructure and RWAs enable new forms of on chain collateral and more flexible lending models.

At the same time, neobanks are unlikely to fully replace traditional banks. Instead, they are emerging as a strong alternative. A large customer segment still prefers traditional banking or is less comfortable with mobile first financial services. While younger generations are becoming increasingly tech savvy, it is unrealistic to expect neobanks to displace legacy banks in the near term. What they will do, however, is force traditional institutions to adapt. Faster innovation cycles, better accessibility, and improved user experience are becoming table stakes, and neobanks are setting that standard.

Tokenised Stocks & Equities

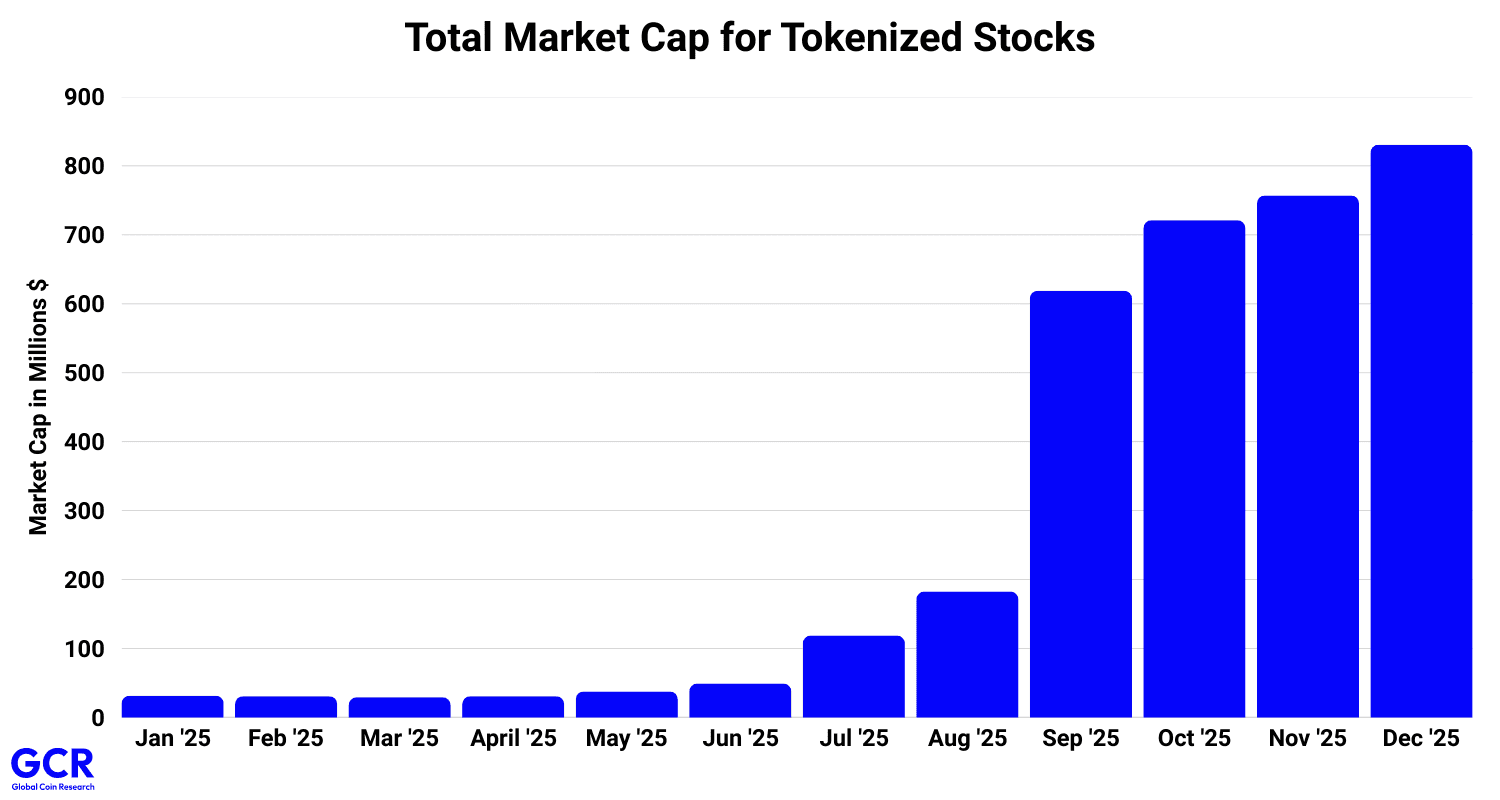

Tokenised stocks existed before 2025, but June marked a clear turning point. During ETHCC, Robinhood announced plans to bring tokenised stocks to its platform, signaling a shift from experimentation to mainstream distribution.

Since then, platforms such as Coinbase, Kraken, Gemini, and Ostium have expanded access to tokenised equities, commodities, indices, and currencies. Adoption so far has been driven primarily by web3 users who want to trade traditional financial assets on crypto rails.

The tokenised commodity market cap, including both distributed and represented assets, grew 244 percent year over year to $3.6 billion, led by products such as Tether Gold and Paxos Gold. More than 167,000 holders now use tokenised commodities as digital bullion and on chain collateral. Tokenised stocks increased from approximately $31 million at the start of the year to $836 million by mid December, representing roughly a 27x increase.

Source: Token Terminal

The main advantages of tokenised stocks are structural. Settlement is faster through smart contracts, trading is available 24/7, and assets can seamlessly integrate into DeFi. Tokenised equities can be used as collateral for lending and borrowing, contributed to liquidity pools, or combined with yield strategies, often at lower transaction costs than traditional brokerage infrastructure.

For institutions and asset managers, tokenisation offers a practical upgrade rather than a reinvention. Existing strategies can be issued as tokenised share classes and distributed through crypto infrastructure while preserving familiar portfolio construction and risk management frameworks.

Traditional finance is already adapting, as Nasdaq is exploring near 24 hour trading five days a week, and major TradFi players such as BlackRock, JPMorgan, and Citigroup have publicly expressed bullish views on tokenisation.

There are, of course, challenges, including custody and backing of the underlying assets, the risk of depegs during periods of high volatility, and ongoing regulatory uncertainty across jurisdictions.

The trajectory closely resembles the early stablecoin journey. Initial skepticism around backing and transparency gradually gave way to standardisation, disclosure, and competition. Tokenised stocks are likely to follow a similar path.

By expanding access, improving settlement, and unlocking new financial use cases, tokenised equities offer a feature set that traditional brokerage held stocks will increasingly struggle to match. Over time, competition alone may be enough to force adoption.

Conclusion

These narratives are not isolated.

Stablecoins, privacy, prediction markets, tokenised assets, and neobanks reinforce each other and form a connected shift in how financial systems are built and used. Together, they point toward a financial system that is faster, more accessible, and more programmable than what exists today.

We are likely witnessing the early stages of the biggest structural change in the financial industry in decades. How money is stored, moved, invested, and settled is being redefined. Crypto in 2026 will be less about speculation and more about becoming the next evolution step of traditional finance.