Unraveling the Complexities of Web3: InsurAce and LI.FI Unveil the Future of Cross-Chain Insurance

As the decentralized finance (DeFi) ecosystem matures, blockchain bridges have become indispensable in enabling seamless interoperability between various blockchain networks. However, these bridges also expose users to significant risks, including smart contract vulnerabilities, potential hacks or exploits, and implementation errors. In response to these challenges, industry leaders InsurAce and LI.FI Bridge Aggregator have partnered to create Bridge Cover, a groundbreaking insurance product designed to provide a safety net for users navigating the intricate world of cross-chain transactions.

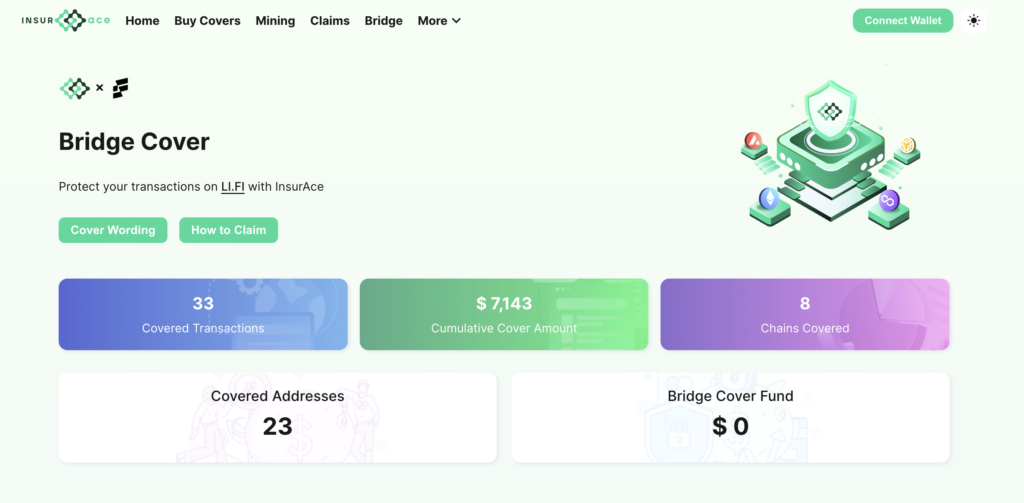

Launched on April 18, 2023, Bridge Cover is a pioneering solution, offering compensation for claimable losses during specified bridge transactions. This is achieved through a comprehensive and transparent process that involves stringent claims procedures, thorough proof of loss and ownership requirements, and an exhaustive investigation by an Advisory Board.

InsurAce, a leading decentralized insurance protocol, and LI.FI, an innovative cross-chain liquidity provider, have spent the past six months tirelessly collaborating to develop Bridge Cover. Leveraging InsurAce’s insurance expertise and LI.FI’s multi-chain bridge capabilities, the two companies have devoted countless hours to research, development, and cooperation. The end result is a first-of-its-kind product that aims to revolutionize the DeFi insurance landscape by offering much-needed protection for users venturing into the complex world of Web3.

Blockchain bridges have long been recognized as a critical component of the DeFi ecosystem. However, their adoption has been hampered by the inherent risks associated with these technologies. Issues such as consensus mechanism failures, oracle manipulation, and data inaccuracies from decentralized exchanges (DEXs) can lead to erroneous fund transfers or slippage calculations. Consequently, these risks can result in the permanent loss of funds and diminished confidence in the DeFi space, hindering the widespread adoption of cross-chain transactions.

This is where Bridge Cover steps in, offering users a robust safety net against these inherent risks. The insurance product aims to compensate users for their claimable losses during specified bridge transactions, subject to the terms and conditions of the policy. In essence, if a user’s funds are lost during a cross-chain transfer due to a malfunction, hack, or vulnerability exploit of the specified bridge, Bridge Cover provides compensation up to the specified cover amount.

The claims procedure for Bridge Cover begins with the notification of a potential claimable risk event. InsurAce and LI.FI then conduct an investigation to verify the event, followed by an announcement through their social media accounts and channels to confirm or disconfirm the occurrence of a claimable risk event or extend the investigation time.

Claims must be submitted within the specified claim deadline, after which no claims under the cover will be accepted. Claimants are required to submit their proof of loss and ownership within seven (7) days from the day of claim submission. The Advisory Board will create a claim investigation report containing the investigation findings, draw a conclusion, and make a cover payout decision for valid claims only (referred to as the “Claim Outcome”).

Claims submitted before the claim deadline and after the release of the claim outcome have seven (7) days from the day of claim submission to submit proof of loss and ownership. The Advisory Board will determine the validity of such claims based on the claim outcome.

If a claim is approved, payments will be made from the Bridge Cover Fund in accordance with the criteria set in the claim outcome or appeal decision to successful claimants. The protocol is not responsible for any differences between the market value of tokens used in making cover payouts at the time of the payouts and the time claimants receive them.

To ensure a transparent and secure experience for users, the proof of loss and ownership requirements for Bridge Cover are rigorous. Proof of loss and ownership may include, but is not limited to:

- The specified bridge transaction identification number from LI.FI Protocol.

- Snapshots and links to the on-chain record of the slippage quoted by LI.FI Protocol in respect of the specified bridge transaction.

- Snapshots and links to the on-chain record of the source and destination chain of the specified bridge transaction.

- Snapshots and links to the on-chain record of the timestamp for the start and the end of the specified bridge transaction.

- A report from a professional security firm describing the claimable risk event.

- References to any relevant on-chain transactions.

- Any other evidence deemed necessary by the protocol.

Bridge Cover automatically terminates upon the occurrence of a claimable risk event or the expiration, maturation, or lapse of the cover.

The innovative Bridge Cover product is set to reshape the DeFi insurance landscape. By protecting users from the inherent risks associated with cross-chain transactions, Bridge Cover provides a much-needed safety net for those venturing into the rapidly evolving space. The comprehensive coverage, claims procedure, and thorough proof of loss and ownership requirements ensure a transparent, secure, and seamless experience for users.

As the DeFi ecosystem continues to expand and evolve, products like Bridge Cover will play a crucial role in fostering trust and encouraging wider adoption. Users are invited to take advantage of this cutting-edge insurance solution and experience the peace of mind that comes with knowing their cross-chain transactions are safeguarded. For more information on Bridge Cover and how to purchase it, visit the InsurAce and LI.FI websites, and join their respective communities for updates and discussions. Test the Bridge Cover out at jumper.exchange

The Bridge Cover product by InsurAce and LI.FI is a game-changer for the DeFi insurance sector. As the world of Web3 grows increasingly complex, innovative solutions like Bridge Cover are essential in ensuring users are protected against the numerous risks associated with cross-chain transactions. Don’t miss this groundbreaking opportunity to enhance your digital asset protection with InsurAce and LI.FI’s innovative Bridge Cover product.

About LI.FI:

LI.FI is a cross-chain bridge and DEX aggregator addressing interoperability challenges in the multi-chain ecosystem. By aggregating essential bridges and offering a middle layer between blockchains and decentralized applications, LI.FI provides a one-stop solution for developers and users. Key features include an upgradeable smart contract, intelligent routing backend, JavaScript SDK, and a customizable widget. LI.FI is neutral towards all blockchain platforms and focuses on enhancing user experience. In addition to simplifying interoperability, it connects bridges to DEXes and DEX aggregators, allowing cross-chain swaps, and supports bridge builders by wrapping their bridges and offering a tailored SDK. Overall, LI.FI aims to unify the fragmented crypto landscape.

About InsurAce:

InsurAce, a decentralized global risk cover protocol, offers mutual protection for digital assets against risks such as hacking, smart contract bugs, and stablecoin de-pegging. The platform features two membership-governed mutual pools and uses the $INSUR token for membership rights. With smart contracts issuing covers and a seamless user experience, the need for intermediaries is eliminated. The platform’s unique selling points include Low Fee Portfolio Cover, a Wide Product Range, SCR Mining, and Reliable Transparent Payouts.

This article has been written and prepared by Daniel Thomson and GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

*****