DeFi Users in Asia are Booming and Underestimated

This is a guest post by Camila Russo, a financial journalist writing a book on Ethereum with Harper Collins This post was initially shared on the Defiant newsletter.

Hello defiers! Welcome to The Defiant, Japan edition. I’ll dedicate today’s newsletter to give an overview of the DeFi ecosystem in the East versus the West. It was my talk at the DeFi.WTF conference with Diane Dai of DeFiLabs.

To Find Asian DeFi, Look at Users

If you take a look at the top projects and investors in decentralized finance, you’ll come out thinking it’s mainly a Western game. Look at the users, and that picture starts to change.

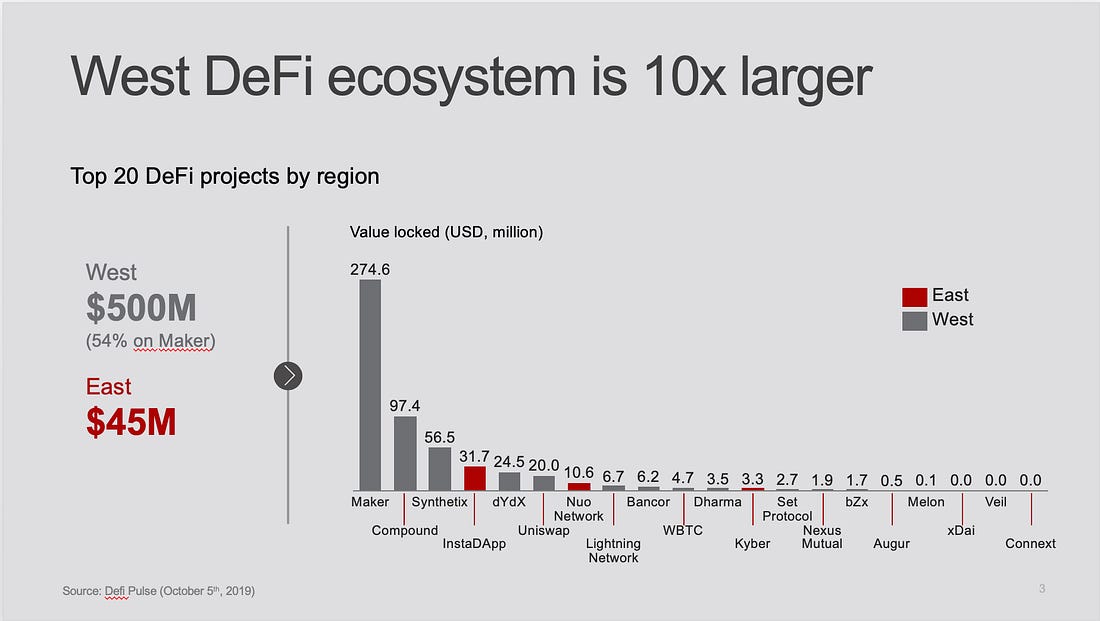

Of the 20 DeFi projects listed in DeFi Pulse, which has become an industry reference, only three (InstaDApp, Nuo Network and Kyber Network) are based in Asia, and they represent just about 10 percent of the ~$500 million locked in these financial protocols. Even when looking for active projects not listed in DeFi Pulse, like Ren and Loopring, they don’t really move the needle.

The same is true when looking at the main investors in the top 10 DeFi projects by value locked. The most active investors are mostly based in Western countries, with just two funds out of the 11 with the most DeFi investments in Asia.

While Asian projects and investors seem uninterested in decentralized finance, that’s not the case with users.

To get a gauge of where users are coming from I took a look at website traffic using SimilarWeb, and a significant portion is coming from Asia. The biggest share of MakerDAO users are in China, and they rival U.S. users in Compound and dYdX. Many users may be using VPNs, so Asian users may actually be under-represented.

The data show Asian users are interested in decentralized finance, even with not many big Asia-based projects. Project developers and investors in the East might want to consider this as potential for wider adoption.

There’s the perception that Eastern users don’t care about decentralization as this grand moral goal, but like everyone in the world, they care about making money. They also care about ways to avoid censorship in authoritarian governments. And that’s why they may be flocking to decentralized protocols even if company founders and investors haven’t caught up yet.