Huobi Annual Financials – Reduction in Headcount by 17%

This free access of Global Coin Research’s insights is offered to our loyal readers as a representation of the unique information and insights our members receive weekly. If you’d like to receive all subscription content on our site and via our weekly newsletter, join here!

Subscribe above and get the best access into Asia crypto and blockchain right in your inbox ??

On December 16, Huobi Technology Holdings, an entity registered on the Hong Kong Stock Exchange, released its annual financial report as of September 30, 2019. To see the full report, go here: https://www1.hkexnews.hk/listedco/listconews/sehk/2019/1216/2019121601037_c.pdf

Since the announcement of its annual results, Huobi Tech stock is down by ~10%.

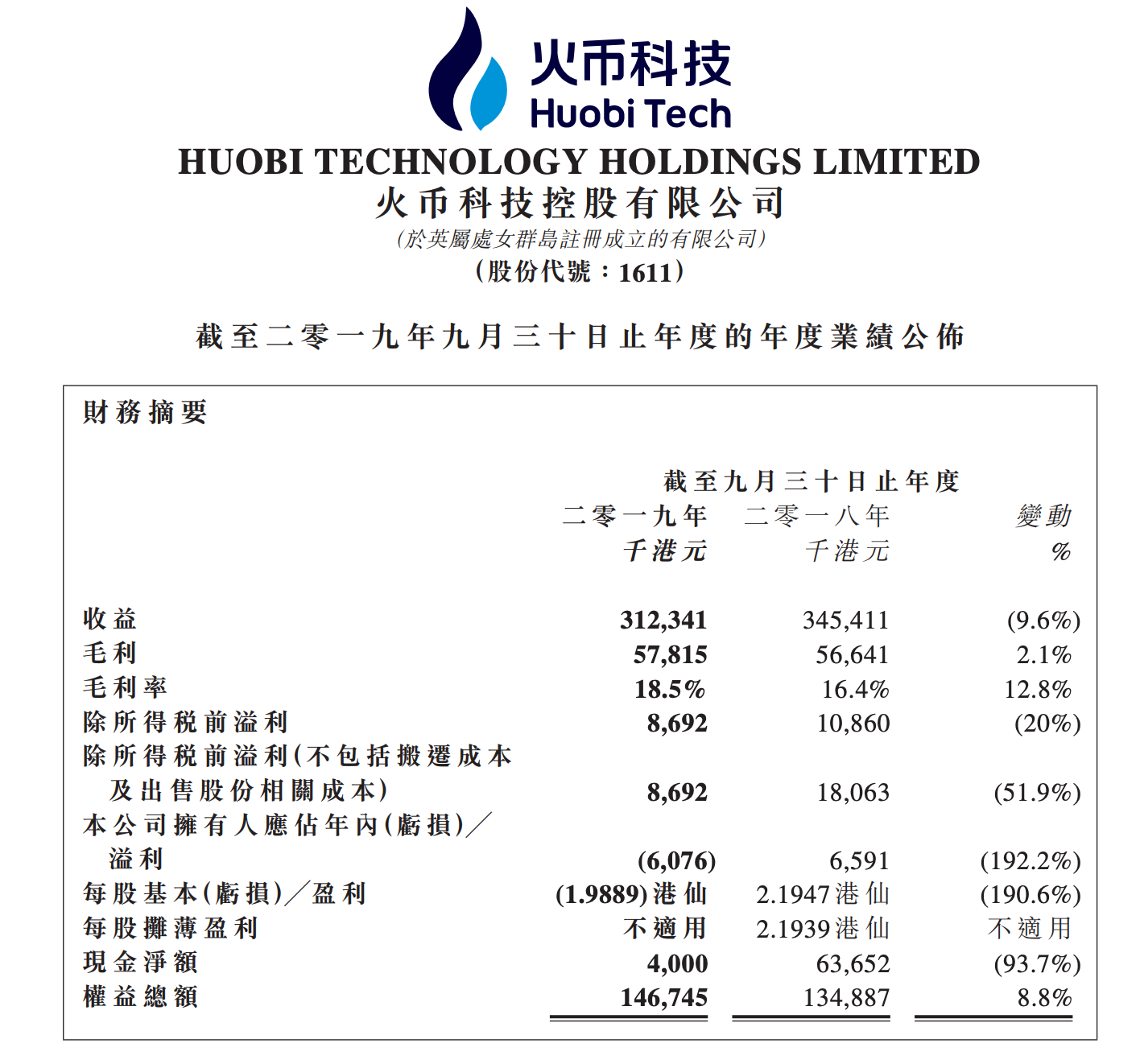

According to the financial report, Huobi’s full-year revenue fell by 9.6% year-on-year to HK $ 312 million; net profit attributable to shareholders was negative HK $ 6.076 million, compared with a profit of HK $ 6.591 million in the same period last year; loss per share was approximately 1.889 HK cents.

In addition, there were 672 employees in Huobi Technology’s fiscal year 2019, which was 139 fewer employees and about 17% lower than last year’s 811 employees.

Huobi’s Recent Merging of its Core Assets into Huobi Technology Holdings

The Hong Kong financial media Caihua News Agency has said that Huobi’s method of merging its core asset business into the public comapny Tongcheng Holdings, now renamed to Huobi Technology Holdings, is not feasible in such a short period time. Digital currency transactions have not yet to achieve regulatory development, and it is difficult to supervise. Therefore, the Supervisory Bureau will not bring more trouble for itself by trying to regulate it, and the digital currency business will only become more and more difficult to do in the domestic market

It can be seen that even the injection of the core assets of Huobi Exchange related business may not bring the current stage of healthy growth to Huobi Technology, but it will introduce the risk of uncertainty. Caihua News Agency believes that, as Huobi still owns technical products such as Huobi Cloud and Huobi Blockchain, it shouldn’t be excluded that Huobi will inject Huobi cloud, Huobi blockchain and other technical service product businesses directly into Huobi Technology’s “public shell” in the future.