Takeaways from Yearn Finance $YFI’s 1Q21 Earnings Report

$GCR is a Tokenized Community of Researchers and Investors in the crypto space. Join our community today to get access to all the best investments ideas and deal flow, workshops and direct access to founders and key players in the space.

You will need 100 $GCR tokens to join the Discord members-only channel. You can purchase the token on Uniswap here. Get a feel of the Discord community here.

On April 26th 2021, Yearn Finance released one of its most detailed quarterly reports. We dug into the details to evaluate how the crypto world’s top automated asset manager’s performance stacked up.

Summary

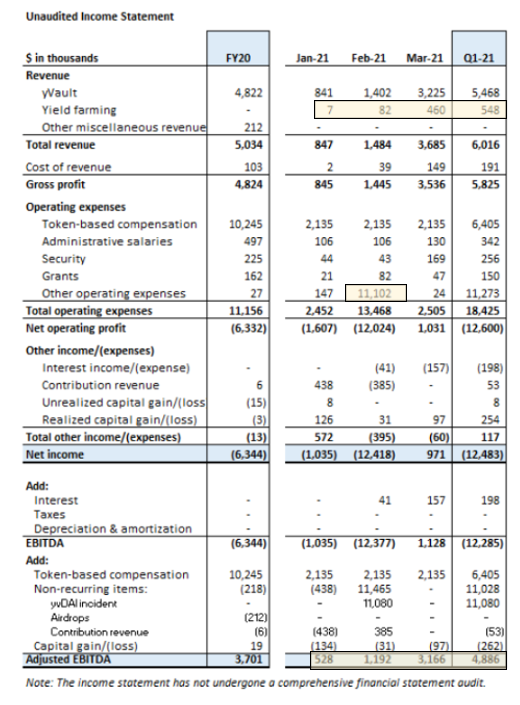

Overall, Yearn’s performance in 1Q21 has been stellar, exceeding all expectations. Revenue grew ~300% between Jan-21 and Mar-21 alone, led largely by yVaults. Yearn also introduced a yield farming product, for which it acquired startup capital by collateralizing $YFI tokens on Curve finance. While still nascent, the yield farming product grew 65X between Jan-21 and Mar-21. Net profit came in at ~30% for March, while Adjusted EBITDA came in at ~90% for the month. This netted to an average Adjusted EBITDA of ~83% for the quarter, 700bps greater than the 76% in FY20. $YFI still ranks #76 by market cap; if it maintains this level of performance, we don’t expect it to remain there for long.

Breaking Down the Numbers

Revenue

— Revenue grew ~300% between Jan–March, Q1 revenue eclipsed all of FY20

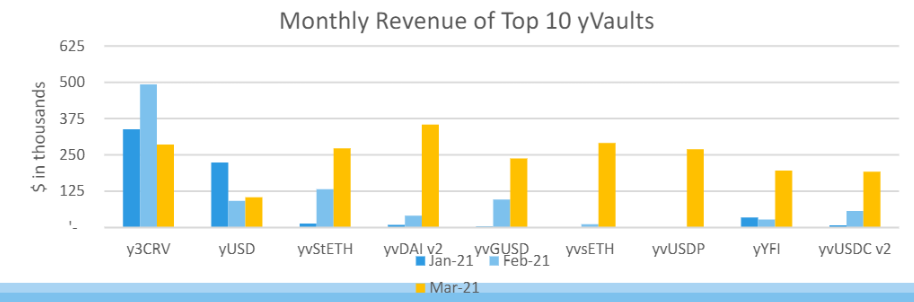

— yVault performance was strong, accounting for ~88% of revenues in March

— yVault revenue went from being concentrated in y3CRV in Jan and Feb to being relatively evenly distributed across 9 vaults, under v2 yVaults

— Yield farming will be a strategy to keep an eye on, having grown ~65X between Jan – March (~1% of revenue to ~12%)

— The yield framing strategy resulted in APYs of ~36%-52%

Net Income

— Yearn had a net profit of ~30% in March, which is very positive

— Net income for the quarter turned negative due to a one-time exploitation by a malicious actor on yVaults resulting in a ~$11M loss

Adjusted EBITDA

— Adjusted EBITDA grew from ~62% of revenue in Jan to ~90% most recently in March

— 1Q21 Adjusted EBITDA as a % of revenue was ~83% vs. 76% in FY20

Other Highlights

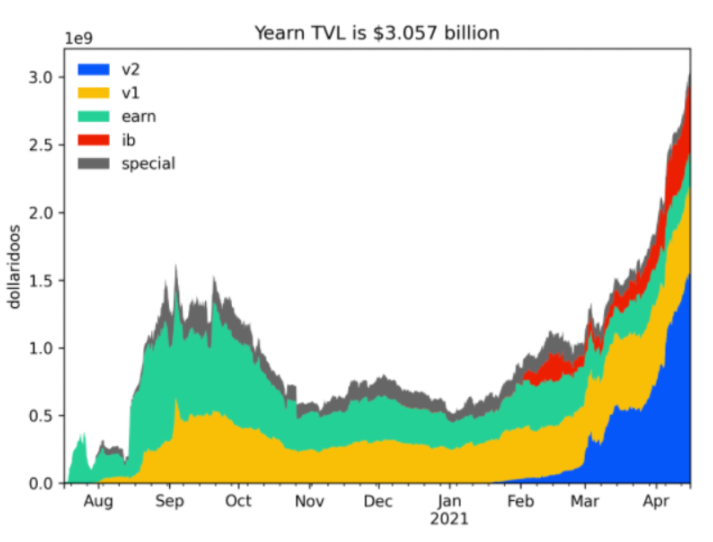

— This financial performance came on the back of impressive TVL growth. TVL growth entered exponential territory in March, led by v2 yVaults

— With the introduction of v2 yVaults, revenue spread also became more distributed across vaults by March, which is a positive sign for the stability and sustainability of the system going forward.

— In this report, Yearn announced a deal with Curve Finance, where Yearn will “retain 10% of all CRV rewards earned from yVault with Curve Finance strategies and lock it into Yearn’s yveCRV vault (the “Backscratcher”), with the exception of its yvUSDN vault. For the yvUSDN vault Yearn retains and locks 50% of the CRV earned into the “Backscratcher” vault.” Since the locked CRV cannot be withdrawn, this will put downward pressure on CRV supply, making it more valuable. This is bullish not only for CRV but also Yearn’s relationship with Curve Finance in the future.

Conclusion

Yearn Finance delivered a robust 1Q21 performance, with existing and new products demonstrating strong growth. If it is able to continue this performance, we expect strong demand for the $YFI token going forward.