Alkemi Network — State of the Ecosystem (April 2021)

By Alkemi Network, bridging CeFi to DeFi, building a decentralized liquidity network.

Join the Global Coin Research Network now and contribute your thoughts!

If you’d like to learn about crypto, join our Discord channel and be kept up to date with the latest investment research, breaking news and content, Crypto community happenings around the world!

Alkemi Network’s mission is to build an on-chain liquidity network with a suite of tools and products that serve as onramps for everyone to participate in decentralized finance

Alkemi Earn (‘Earn’), a decentralized borrowing and lending protocol, is live on mainnet and is initially focused on unlocking institution-grade capital to flow into DeFi.

The “Beachhead” Strategy: Institutional Adoption

The DeFi rally in the summer of 2020 generated a great deal of excitement, resulting in $70+ billion of asset value locked within less than a year. The retail-focused innovations of decentralized finance, however, haven’t yet made provision for institutional participation requirements such as compliance risks, market connectivity gaps, and insufficient financial tooling.

“Alkemi Network represents an ongoing transition between open-finance and DeFi today. The nature of money in the future will simultaneously be institutionalized and decentralized. Our investment in Alkemi Network is a bet on this future. ”

— Shiliang Tang, CIO of LedgerPrime

From Verified to Open: a two-part strategy to bridge CeFi to DeFi

Alkemi Earn is tailored to provide CeFi institutions with a frictionless portal to DeFi. Earn provides a trusted-counterparty on-chain experience that includes advanced reporting, risk management, and KYC / AML features. This constitutes the first chapter of the network rollout strategy.

With rising institutional participation, access will be extended to other users wishing to participate in Alkemi Network via a secondary permissionless pool, ‘Open’, for the Earn protocol. This constitutes the second chapter of the rollout strategy.

With this two-part strategy, permissioned ‘Verified’ and permissionless ‘Open’ liquidity pools will coexist on the same network, governed by the system’s native multi-utility token, ‘ALK’.

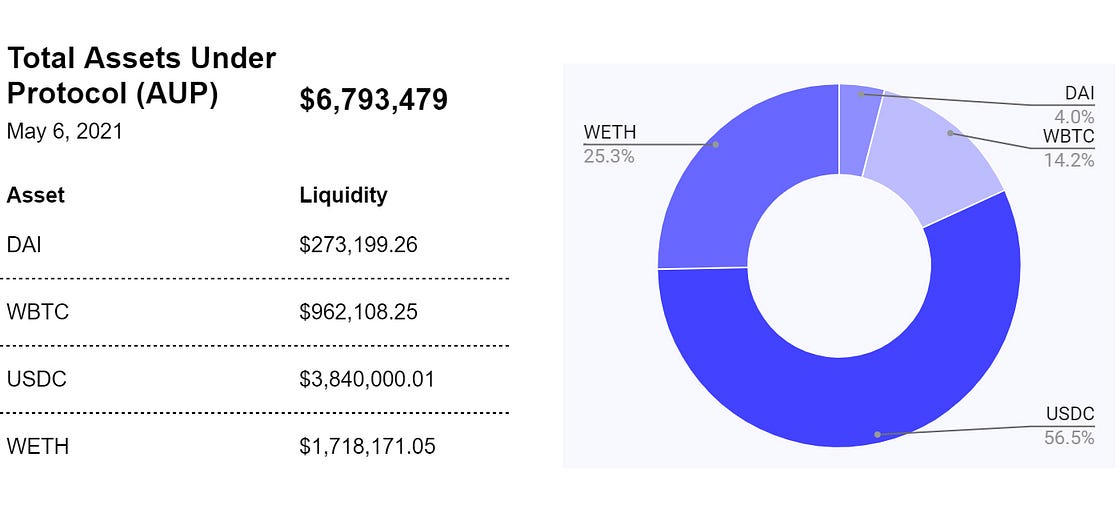

Current Market Snapshot

Earn launched with four permissioned asset markets (WBTC, ETH, USDC, and DAI), where participants have the option to participate in the pool after successful KYC verification and wallet allowlisting.

On March 15, 2021, Alkemi Earn began onboarding the genesis cohort of liquidity providers. Within 6 weeks, total liquidity has surpassed $6.7 million USD worth of assets under protocol (AUP).

A few quick observations from the initial deposits:

- The average deposit in the initial cohort was USD equivalent of ~$280k

- USDC is the top asset choice for deposits at ~56% of the pool

- ETH and WBTC follow at ~25% and ~14% respectively

- DAI was the least preferred asset for deposits at ~4%

Onboarding Early Users — What We Learned So Far

Alkemi Network initially prioritized onboarding lenders to build the liquidity supply in Earn. As of April 30th, 25+ KYC approved lenders have been onboarded to the ‘Verified’ pool.

This initial rollout unlocked valuable insights and opportunity for improvements:

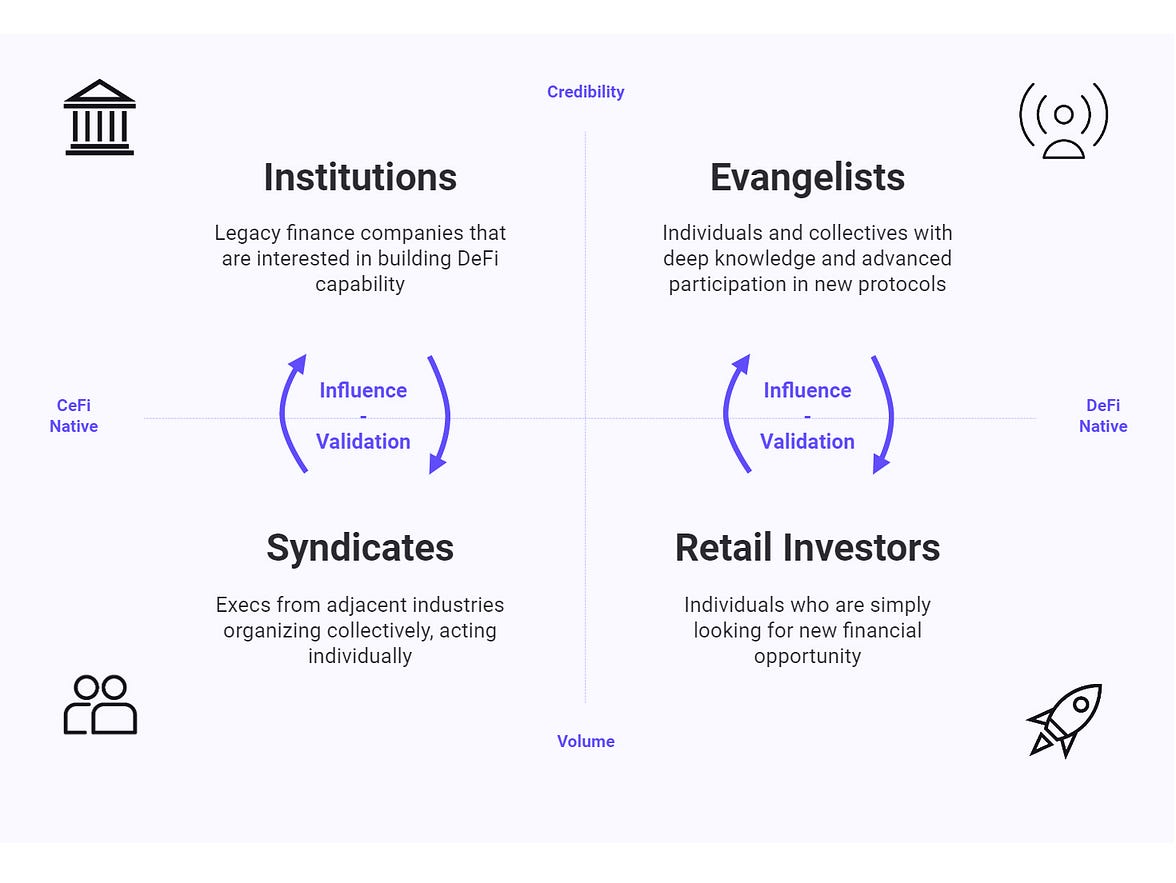

1. A positive reception from institutions

The majority of the initial lender cohort is institutions (select institutional users include: LedgerPrime and JST Capital). This is an encouraging indication for the value proposition of overcoming institutional adoption hurdles.

2. Institutional adoption is not limited to corporate entities

We observed considerable traction from syndicates, who organize collectively but participate individually. The majority of them are executives from the financial services or adjacent industries and are well-aligned with the institutional use cases. This was a key learning and we expect further growth in this category.

3. Compliance is a key feature, yet also an onboarding challenge

The KYC process introduces an element of complexity to the onboarding flow, both for applicants and the Alkemi Network core team. To streamline onboarding, we are taking measures to automate the process where possible e.g. fast-tracking low risk applicants through an integrated risk scoring mechanism.

What’s Next?

In tandem with growing Earn’s lender base, the immediate next step is to activate borrowing on Earn. This is set to launch late May 2021.

In addition, we have LOTS of exciting developments set to be announced in the not-so-distant future, including: new partnerships, asset markets, network utilities, and product feature innovations. Stay tuned!

To follow our journey, find us on social media:

- Follow us on Twitter: https://twitter.com/AlkemiNetwork

- Join our community on Telegram: https://t.me/AlkemiNetwork

How to Get Involved

As a liquidity network, Alkemi Network’s core mission is to increase the number of engaged participants. Institutions and individuals are all welcome to take part as we expand.

Join us and let’s grow Alkemi Network together!

- Interested in becoming a lender/borrower? Email us: hello@alkemi.ai

- Become an Alkemi Network Advocate: http://bit.ly/alkemi_advocate

- We are hiring! See our open positions here: https://angel.co/company/alkemi