Apricot: Next-Gen Lending Protocol

At Apricot, our mission is simple — build next-gen financial products with the user first in mind. Thanks to Solana’s high TPS & low transaction costs, and after months of hard work and product iterations, we finally have something worth sharing!

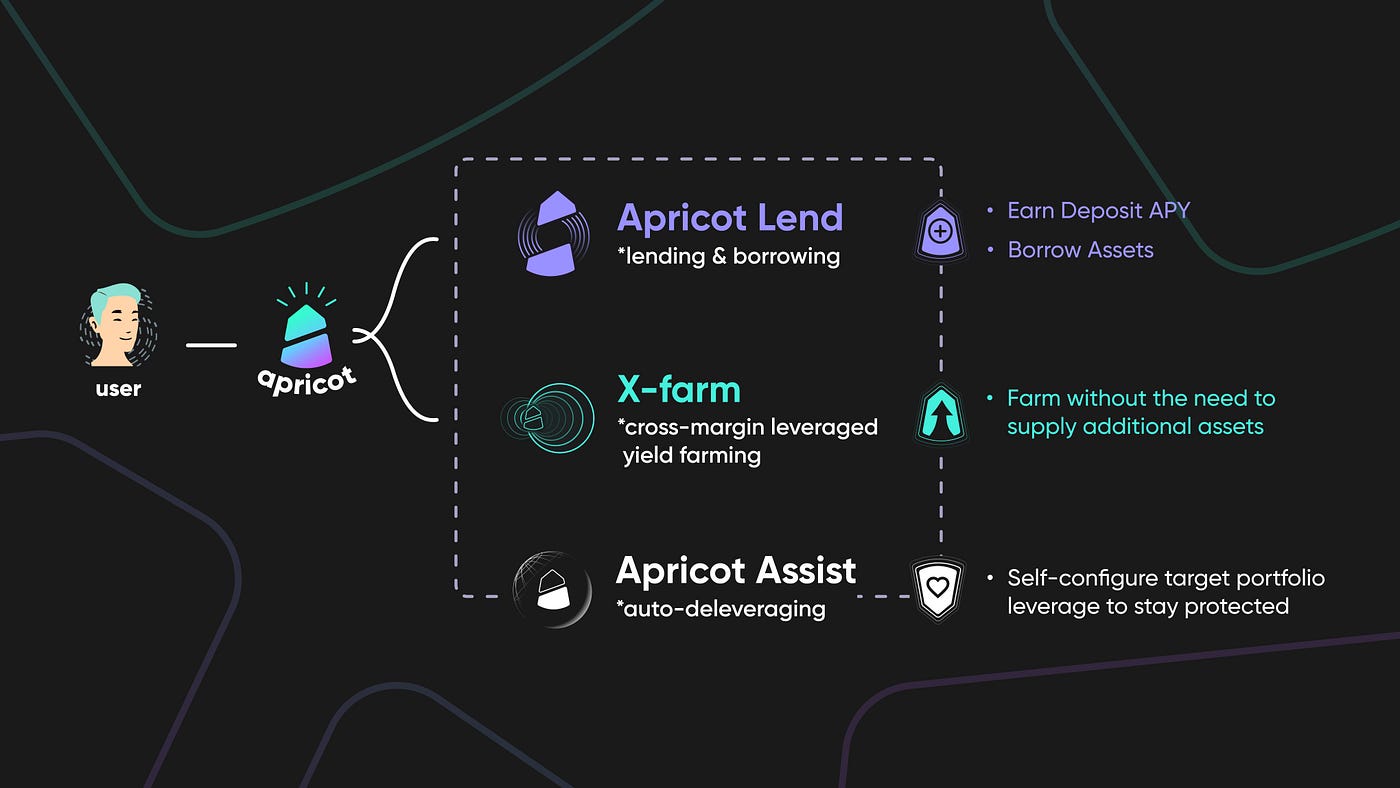

Apricot is comprised of three products, Lend, X-Farm, and Assist.

Apricot Lend ?

lending & borrowing

Apricot Lend is our base layer protocol where you can deposit selected crypto assets to earn interest. You can also borrow from the platform against your deposited assets as collateral.

Apricot Cross-Farm (X-Farm) ???

cross-margin, leveraged yield farming

X-Farm enables users to start leveraged yield farming without the need to own any of the underlying tokens.

In ordinary yield farming of a stablecoin-pair, e.g. USDC-USDT, you would need to convert your assets — such as SOL — into those stablecoins and then pool them.

X-Farm enables you to deposit those non-stablecoin assets as collateral and borrow both stablecoins with up to 3x leverage. These stablecoins will then be auto-pooled and staked for LP tokens, resulting in 3x farming yield.

SOL (collateral) -> USDC, USDT (3x) -> USDC-USDT LP tokens (3x)

While X-Farm greatly and efficiently increases users’ access to additional yield without forcing them to sell any assets, we still must address the risk of leverage — liquidation.

We designed our next product specifically with this in mind.

Apricot Assist ??

automated, self-deleveraging tool

Nobody likes to be liquidated.

Nobody likes the feeling of being watched, forced to endure that ever-present dread of liquidators at the gate, each eager to burst through and profit by ripping away your collateral the moment your account goes underwater. ?

At Apricot, we know users deserve better tools to manage their positions along with fewer sleepless nights!

We have built Apricot Assist, an automated self-deleveraging assistant that you can configure to help you reduce your account’s leverage with your specific risk profile in mind.

Using Apricot Assist, you will be able to control:

- WHEN to start selling or redeeming your collateral assets

- WHAT and HOW MUCH assets should be sold or redeemed

From the example above, you opened a 3x leverage USDT-USDC LP position against your SOL.

SOL (collateral) -> USDC, USDT (3x) -> USDC-USDT LP tokens (3x)

However, now the price of SOL falls dramatically overnight. Thankfully, you authorized Apricot Assist to help you perform the following, for example:

WHEN: when “borrow limit used” reaches 95% (liquidation at 100%)

WHAT: redeem X amount of USDT-USDC LP tokens back to USDT and USDC, and repay the corresponding debt to get back to 90%

Apricot Assist’s timely intervention produces the following outcomes:

- “borrow limit used” goes down to 90%, back to safety

- All initial SOL principal is preserved

- Size of USDC-USDT LP position has decreased (lower leverage ratio, less rewards)

As a user, you can program when Apricot Assist gets activated and how many LP tokens get redeemed and etc. using the Assist Simulator.

As a result, you will retain full control of your account even during periods of market volatility, and can avoid liquidation altogether. In upcoming articles and documentation, we will discuss this product and some of its current limitations in greater detail.

Thanks for your support and we hope you will be delighted with our product!

As we set out to launch on testnet this coming Friday, we will be sharing more details and a step-by-step user guide to help you get started, so stay tuned.

Provide testnet feedback on our Discord to win Apricot NFTs!

Meanwhile, if you want to join our growing team at Apricot Finance, we’d love to hear from you!

Email general@apricot.one to say hello and learn more about our openings.