How Does Tokenmak’s Liquidity Staking Market Work?

Protocol mechanism, token economics, and the development status of Tokenmask

Did You Know?

Every two weeks, the $GCR Community gets together for our exclusive token club, discussing and highlighting interesting and noteworthy blockchain and token projects.

Join us at GCR.community!

Tokemak is a novel protocol for sustainable liquidity.

In our community huddle, we discussed protocol mechanism, token economics, and the development status of the project.

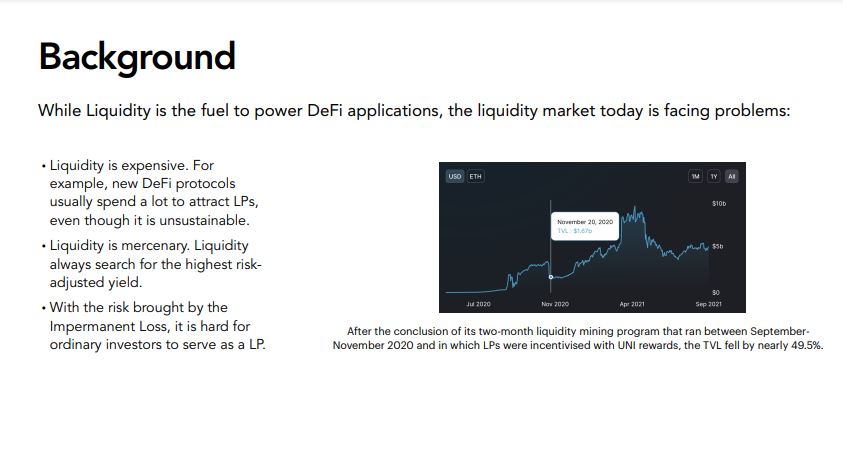

While Liquidity is the fuel to power DeFi applications, the liquidity market today is facing problems:

(1) it’s expensive

(2) its mercenary, expensive

(3) additionally, with the risk brought by the Impermanent Loss, it is hard for ordinary investors to serve as a LP

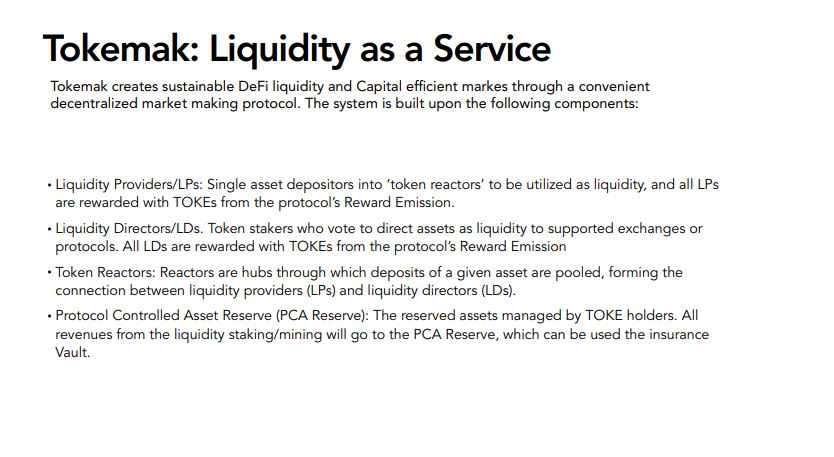

Tokemak creates sustainable DeFi liquidity and Capital efficient markes through a convenient decentralized market making protocol.

It’s built on these four types of participants:

(1) liquidity providers

(2) directors

(3) reactors

(4) Protocol Controlled Asset Reserve

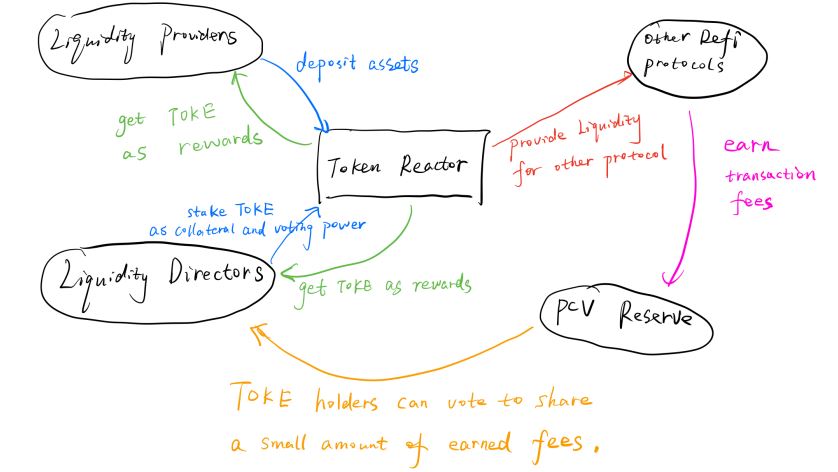

See image:

Here’s how they interact:

The staked TOKE’s voting power is determined by that amount of #TOKE in a given token reactor.

If there is a large supply of assets in a token reactor but a small amount of TOKE directing those assets, those TOKE have greater liquidity directing power.

Notably, the risks of LPs are minimized:

(1) Tokemak makes LPs whole by drawing the asset in deficit from PCA reserve

(2) Tokemak draws system-wide asset surpluses into PCA

(3) When PCA cannot cover withdraw, the TOKE staked is backstop So LPs will only suffer contract risks.

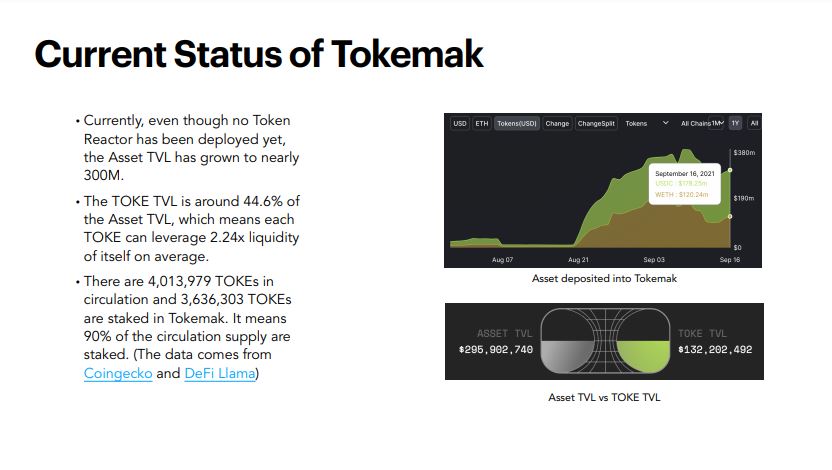

Currently, the Asset TVL has grown to nearly 300M. – The TOKE TVL is around 44.6% of the Asset TVL, which means each TOKE can leverage 2.24x liquidity of itself on average -90% of the circulation supply are staked.

So… Should I buy some #TOKE now?

Great question- > Join our Discord community, get involved in the discussion, and get complimentary access to the full deck!