Synthetic Assets In The Evolving Crypto Landscape

Synthetic assets have been around for quite some time.

They’re simply assets that reflect the value of other assets.

A deed to a house is a synthetic asset just like a title to a vehicle is. A work contract synthetically values service as an asset just like various options strategies replicates financial exposures to other financial instruments. ETFs synthetically track and value a collection of underlying stocks and real estate is slowly becoming a tokenized digital asset class. NFTs are synthetically representing real-world objects as tokens representing socks and cubes are being traded for a hefty 6 figures. Boson Protocol is building the world’s first dEcommerce platform in Decentraland’s metaverse which will enable the trading of any real-world asset using NFTs built as futures contracts with a delivery mechanism.

Synthetics can also simply refer to representations of stocks, currencies, commodities, and cryptocurrencies. Each of the platforms below looks to enable these financial products to be traded in a trustless manner using blockchain technology and oracle systems.

Why Trade Synthetics?

You can tokenize, reflect and trade the value of anything with a synthetic asset, you just need a protocol and collateral to do so. Given the nature of non-custodial wallets and decentralized exchanges, users can now permissionless mint and trade synthetics no matter their disposition. No one can be censored from opening a position and users can interact with composible DeFi protocols that open up new doors that didn’t exist before – like decentralized investment firms.

The security and anonymity of trading on a blockchain is another aspect of synthetic trading that is very appealing. There’s no KYC process you need to go through and you’re essentially removing the counterparty risk of a centralized exchange, although you’re adding smart contract and de-pegging risks that need to be taken into account.

There exist a few variations of synthetic protocols in DeFi that serve different purposes such as how MakerDAO synthesizes the DAI stable coin against deposited collateral. For the purpose of this article, we’re looking at protocols enabling the minting and trading of synthetic assets that can represent virtually any digital and real-world value.

Mirror

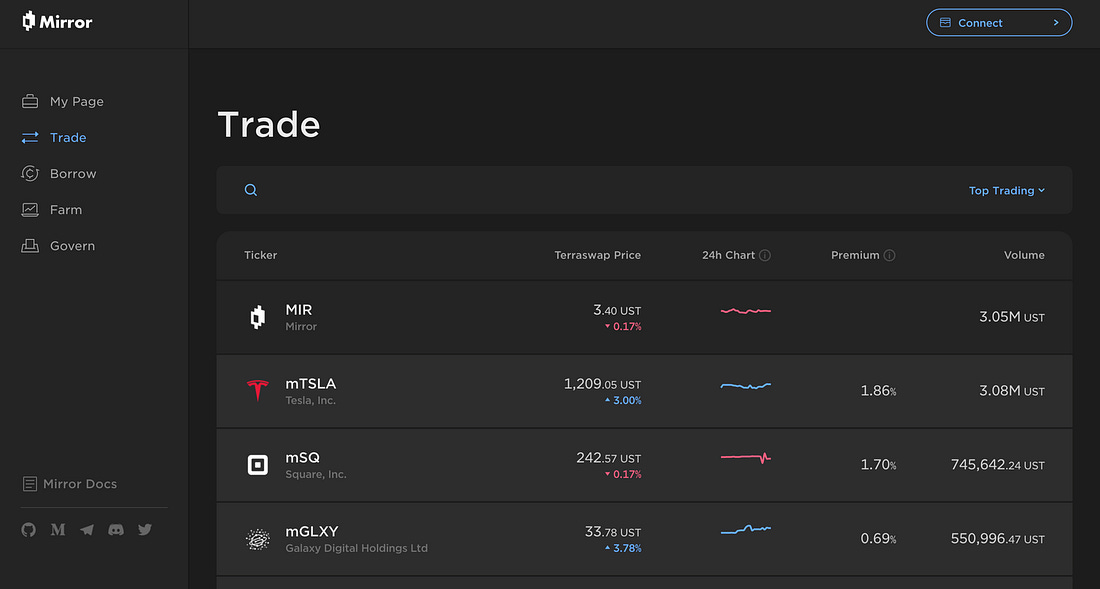

Mirror Protocol is a trading platform built on Terra that enables the decentralized generation of synthetic assets called mirrored assets (mAssets). These can be traded through liquidity pools on Terraswap and they replicate the price action of off-chain assets. An mAsset is minted when a user opens a position by depositing collateral. The smart contracts and liquidation mechanisms governing Mirror algorithmically ensure that there is always sufficient collateral backing and liquidity for all the mAssets. This is done through forced liquidations and incentivized Liquidity Providing.

All off-chain assets obtain their price feeds from an oracle feeder which is elected through the governance proposals enacted by MIR holders. mAssets representing stocks can only be minted during regular trading hours, rather than 24/7.

The platform’s native token, MIR, is minted and distributed to LPs (Liquidity Providers). Given the fact that each trade requires a counterparty, the protocol has implemented sLP tokens which are exposures to being short an mAsset. Being short is another way of saying you are selling the asset in hopes of buying it back at a lower price. The necessity of sLPs varies depending on the premium or discount between the Terraswap and Oracle price so sLP holders can stake these tokens and generate a “dynamically increasing or decreasing” reward of MIR tokens. MIR tokens can then be staked to earn more fees and receive voting rights in regard to platform updates.

To understand Mirror you need to understand the market participants involved.

- Trader – Speculates and trades synthetic assets through Terraswap and is exposed to price fluctuations.

- Minter – Generates synthetic assets by depositing collateral which effectively enters them into a collateralized debt position (CDP).

- Shorter – A minter who then immediately sells the mAsset in return for sLP tokens which are staked to earn MIR as a result of price premiums between the oracle and Terraswap’s price. Basically – arbitrage.

- Liquidity Provider – Enables the trading of minted synthetic assets.

- Staker – LP and sLP stakers receive MIR rewards for providing liquidity and MIR stakers receive fees for CDP withdrawals.

Final Thoughts on Mirror

The structure of the incentivized Mirror ecosystem is interesting and has already amassed over $1.6 billion Total Value Locked (TVL) with over $100 million in MIR staked. These numbers are big and are a testament to the growing Terra ecosystem which has exploded in development over the past year.

Mirror is one of the biggest protocols built on Terra and is likely to be around for a while as it’s being integrated into more protocols like Kash.io, which is enabling its users to invest in stocks through Mirror’s assets.

Synthetix

Synthetix is a well respected protocol that enables the creation of both synthetic assets and synthetic derivatives, offered as ERC20 tokens. These tokens are interoperable across all of DeFi and the Synthetix protocol has been deeply integrated within Ethereum’s ecosystem through partnerships with the following projects.

Synthetix’ token, SNX, is locked up as collateral and synthetic assets like sUSD and sETH are minted against it. In this sense, sUSD and sETH become collateralized debt positions (CDPs). The platform recently implemented ETH as a secondary form of collateral although that may change in the future. Each synthetic requires collateralization ratios of 150% to 750% or more so unless the value of your collateral really takes a nosedive, you can be sure you won’t be liquidated when generating synths.

As described, these CDPs can fluctuate in value depending on the price action of the underlying value being reflected by the synthetic. SNX stakers are incentivized to backstop the risk of the overall debt system as they provide a functional layer of liquidity. In other words, SNX stakers are the lenders of last resort. As a result of taking on this risk, they are rewarded with exchange fees and new SNX tokens, which is where the value of SNX is derived.

Currently, you can trade any of the five synths available:

- Fiat currencies (sUSD, sEUR, etc)

- Commodities (sSI, sGC, etc)

- Cryptocurrencies (sBTC, sETH, etc)

- Inverse Cryptocurrencies (iBTC, iETH, etc)

- Cryptocurrency Indexes and their Inverses (sDEFI, sCEX, iDEFI, iCEX, etc)

Market orders on spot synthetics are the only trade formats available at the moment but the Synthetix team is working on implementing limit orders, stop loss orders, synthetic futures, synthetic margined products, and more in the near future. As described in their documentation, many aspects of these features are yet to be finalized.

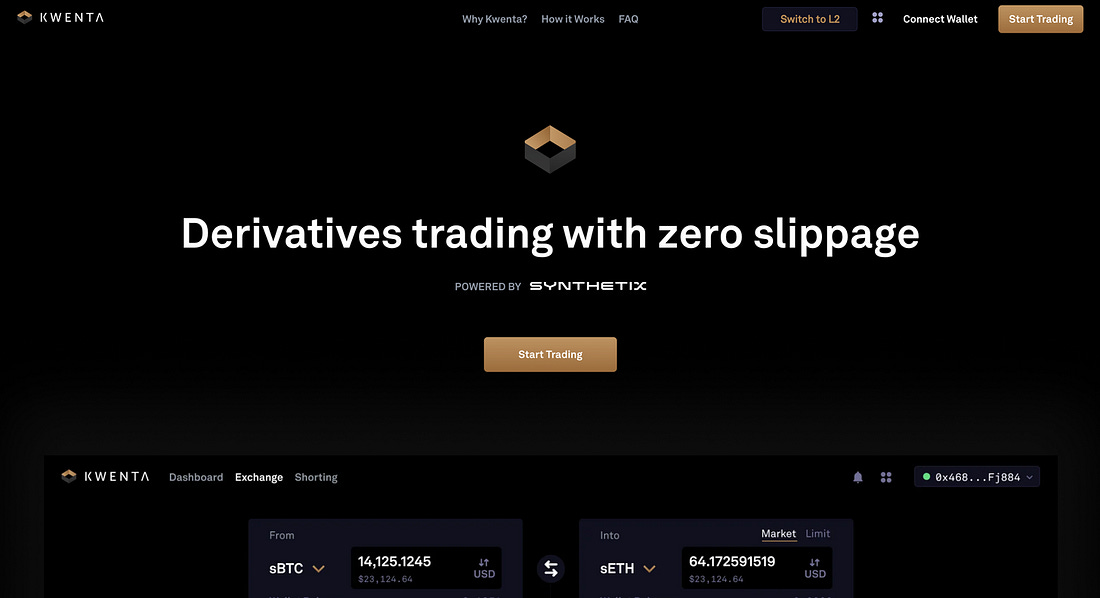

To get involved now, you can mint and trade synthetic’s synths right from the Kwenta DEX. From here, you’ll be able to trade on any other ERC20 compatible DEX with liquidity for synthetics like Uniswap or Sushiswap. Just exchange your SNX or ETH for an asset and you’re good to go.

Final Thoughts on Synthetix

Synthetix is one of the earliest movers in formulating synthetic assets on a blockchain. Having been around since 2017, it has become a vital aspect of DeFi’s historic rise in usage and popularity.

The integrations have instituted a staying power that ensures Synthetix is likely to be around for a while. The protocol has over $700 million in deposited collateral and forms the crux of the dHedge platform, which enables users to formulate and invest in portfolios of cryptonative and synthetic assets. The Synthetix protocol is powerful, the team has already implemented a handful of live products, and their roadmap is ambitious. It’s definitely worth watching.

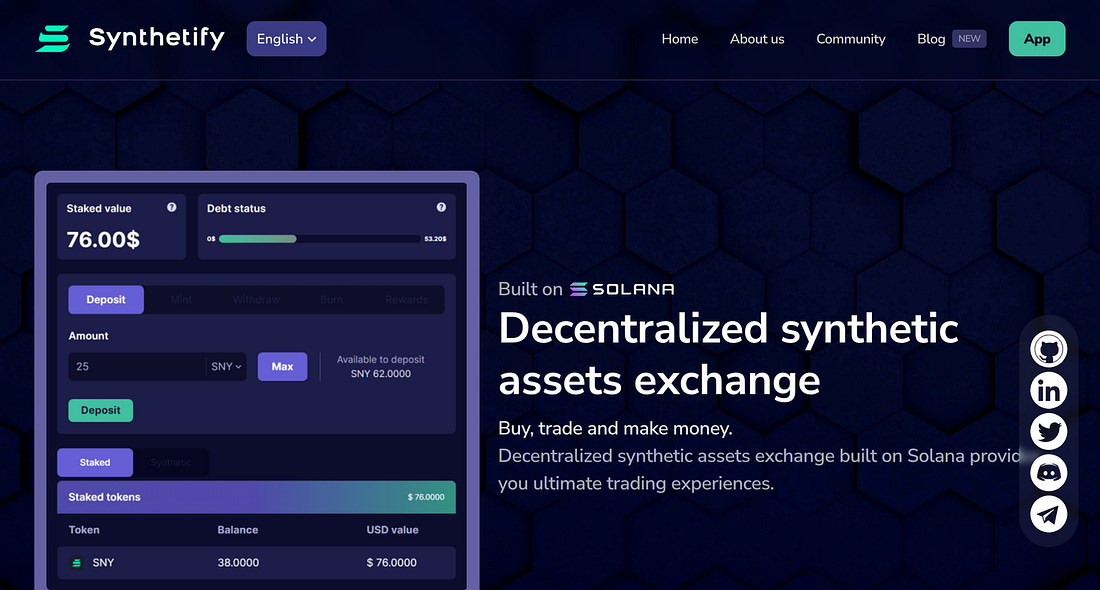

Synthetify

Synthetify is the synthetic asset exchange built on Solana. Solana is amazing for numerous reasons but particularly because of its massive transactions per second (TPS) metric which increases as computing power increases. Given that the fees are <$0.01 per transaction, this seems to be the perfect place for institutional money and high-frequency trading firms to work their way into cryptocurrency. In fact, this is already happening.

These firms want exposure to DeFi of course but they also want to be able to do what they have done with traditional financial products – but better. A decentralized synthetic asset exchange like Synthetify will enable them to do just that. Using oracles that bring off-chain price feeds on-chain, Synthetify will be able to offer any asset to be traded on Solana. Sure, there exist other synthetic platforms like the ones listed in this article and more but none of them are built on Solana. As a result, Synthetify has lots of potentials.

Synthetify utilizes a unique model where traders deposit collateral to enable them to trade synthetics against a collective debt pool. The supported collaterals are USDC, SOL, SNY, and renBTC. SNY stakers earn a proportional share of exchange fees associated with the debt pool. These fees are currently capped at 0.3% per trade.

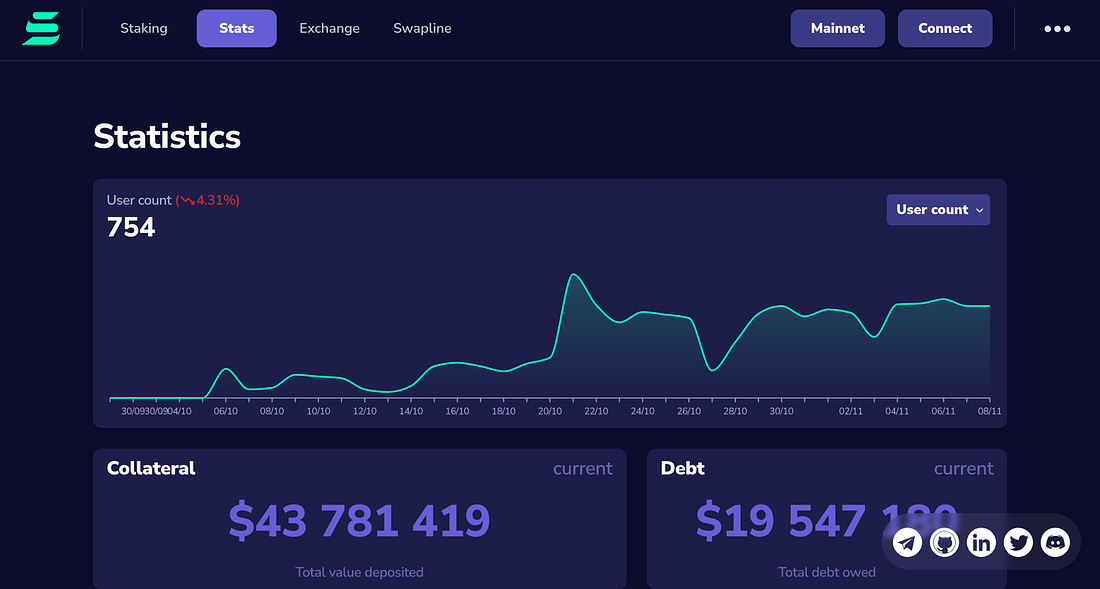

As you can see in the above image, the user count is fairly low but the collateral and debt pools within the platform are fairly high. They’re not quite as big as Mirror or Synthetix but they’ve only been around for a few months. Give it time.

Conclusion

As you’ve probably heard, we in crypto are still early. Although the asset class is now more than $3 trillion, that is still minuscule when compared to the world’s multi-hundred trillion-dollar equity markets and quadrillion dollar derivatives markets.

I hope you realize that synthetics are everywhere when you start to look for them. All the examples I described in the intro are just the tip of the iceberg. Things can get very weird very quickly. Buying DOG, not DOGE, but DOG exposes you to an ERC20 token which is backed by an NFT of the $4 million photos (now worth multiple hundred million) of the actual Shiba Inu dog that became the mascot of the DOGE token. The DOG tokens represent fractional ownership of the NFT itself and are backed by collateral – they’re basically the same as all the synthetics described in this article.

Competition is unbridled in this crypto renaissance and it is fun to watch. Let’s keep an eye on these protocols and check back in on them at a later date.

The following is by Zachary Roth, professional writer, and Product Manager at Solrise Finance. Subscribe to Zachary’s newsletter, DAOJones, here.

Platform Links

Mirror: Website | Docs | Medium | Twitter | Discord | Telegram

Synthetix: Website | Docs | Blog | Twitter | Discord

Synthetify: Website | White Paper | Docs | Twitter | Discord | Telegram