Boson Protocol and Decentralized Commerce

Named after an elementary particle described as a force carrier that functions as the ‘glue’ holding matter together, Boson Protocol has made its mission to enable decentralized commerce ecosystems to ‘disrupt, demonopolize, and democratize commerce’.

Boson provides a toolset that introduces novel NFT contracts called Commitment Tokens. Through these Commitment tokens and the surrounding architecture, Boson looks to enable disparate entities to engage in trustless transactions of Things across space and time. Things are physical goods being transacted.

Boson Protocol Enables The Following For Any Thing:

- The tokenization of digital to physical redemption using NFTs structured as futures contracts encoded with game theory that incentivizes a decreasing amount of human involvement.

- Liquid digital markets for these NFTs.

- A robust commerce data market.

The stated vision of Boson is ‘To be the world’s open, public infrastructure layer for commercial transactions and their data’.

Boson is building a bridge between the Metaverse and the physical universe.

Purpose

“Commerce is a human endeavour that should not have its value captured by the few.” Justin Banon, Boson CEO

When the internet began taking over, idealists viewed the future as inherently decentralized. As time passed, it became clear that the infrastructure built within web2 was exorbitantly favorable to centralized scaling by companies like Amazon & Google. Commerce is a multi-trillion dollar global industry that is constantly being manipulated by these monolithic public companies that serve as the bridge between content and consumers.

If Amazon wants to ban you for having too many items returned, Amazon can do that. If Amazon wants to ban you from returning too many items, Amazon can do that. If Amazon wants to use data from sellers on their platform to build competitive product offerings and place their own offerings in front of their competitors, Amazon can do that. Apple can too. If Amazon wants to be a monopoly, Amazon can do that. You get the point.

While Amazon is obviously the main culprit here, institutions like Shopify, Etsy, Pinterest, Alibaba, Restoration Hardware, Home Depot, etc have similar problems – they’re just too powerful.

This centralization & rent-seeking by big companies is rampant across many industries; it’s become clear that it’s just the way of web2. Web2’s centralized scaling capabilities enabled the creation of multi-trillion dollar monopolies.

Web3 will dismantle them.

Web3’s infrastructure – public blockchains, NFTs, digital wallets, etc have given vendors an entirely new framework to operate within. You no longer need to rely on these immovable marketplace intermediaries to perform commerce functions or stay on top of commerce data.

There Are Two Main Issues Boson Is Taking Head-On:

- ‘The coordination of commercial transactions requires either centralized intermediaries or decentralized arbitrators to manage dispute mediation and transaction reversal. This adds cost and trust, which limits the scope and reduces the efficiency of commerce.’

- ‘Data collected from commercial transactions by centralized intermediaries is locked-away and used to strengthen anti-competitive market dominance which imperils the interests of the consumer, other firms and even governments.’

Boson has taken inspiration from the trustless & tokenized DeFi communities built around individual protocols. These DeFi communities are disrupting banks with their newfound abilities to transact and anonymously create digital value without having to enact toxic rent-seeking practices.

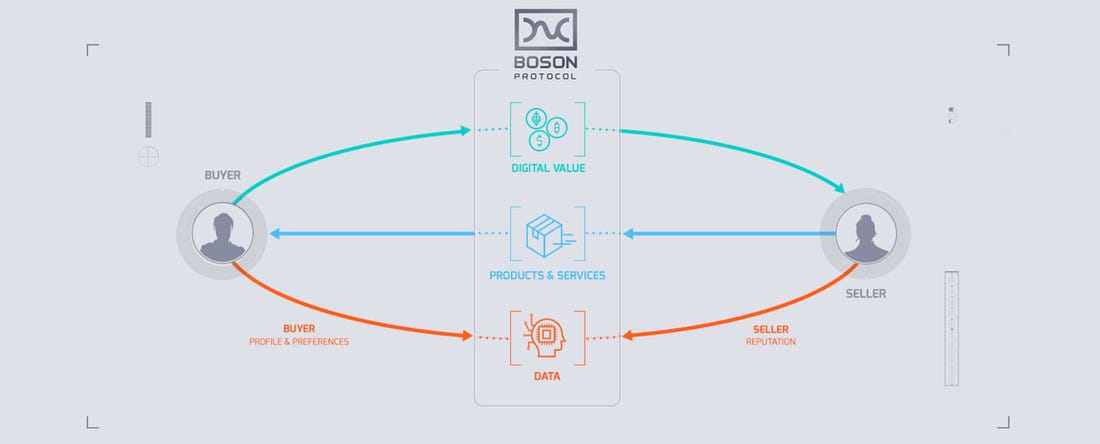

Boson is creating a new medium of exchange between Buyers and Sellers with a similar goal. There’s no need to rely on antiquated Antitrust laws and shady governments to protect you. You can rely on the permissionless transaction mechanisms brought about by modern cryptography and smart contract design.

Function

To understand the Boson Protocol, you must understand Commitment Tokens, Thing Tokens, and the role of BOSON tokens.

Commitment Tokens

A Buyer makes a commitment to a Seller to exchange digital value for a physical item (a Thing). This commitment is funded & tokenized into an escrow contract that is built into an NFT contract. The NFT serves as a voucher to buy or sell an item so Boson refers to them as NFTVs.

The NFT contract has an expiration date and is in essence acting as a futures contract where the Seller is obliged to deliver said item(s) listed in the contract at expiration.

Commitment Token holders are granted the right to transfer their token to another wallet or reliably and securely redeem the token for a particular Thing.

The Commitment Tokens / NFT Voucher Tokens have the following characteristics:

- Universal – Can represent any Thing.

- Interoperable – Can represent a standardized version of any Thing.

- Composable – Can be assembled into composite products.

- Programmable – Fully customizable within computing limits.

- Transferable / Storable – Between any standard web3 wallet.

- Stateful – Appropriately change state (redeemed / cancelled / failed / complained about) across the core exchange mechanism process.

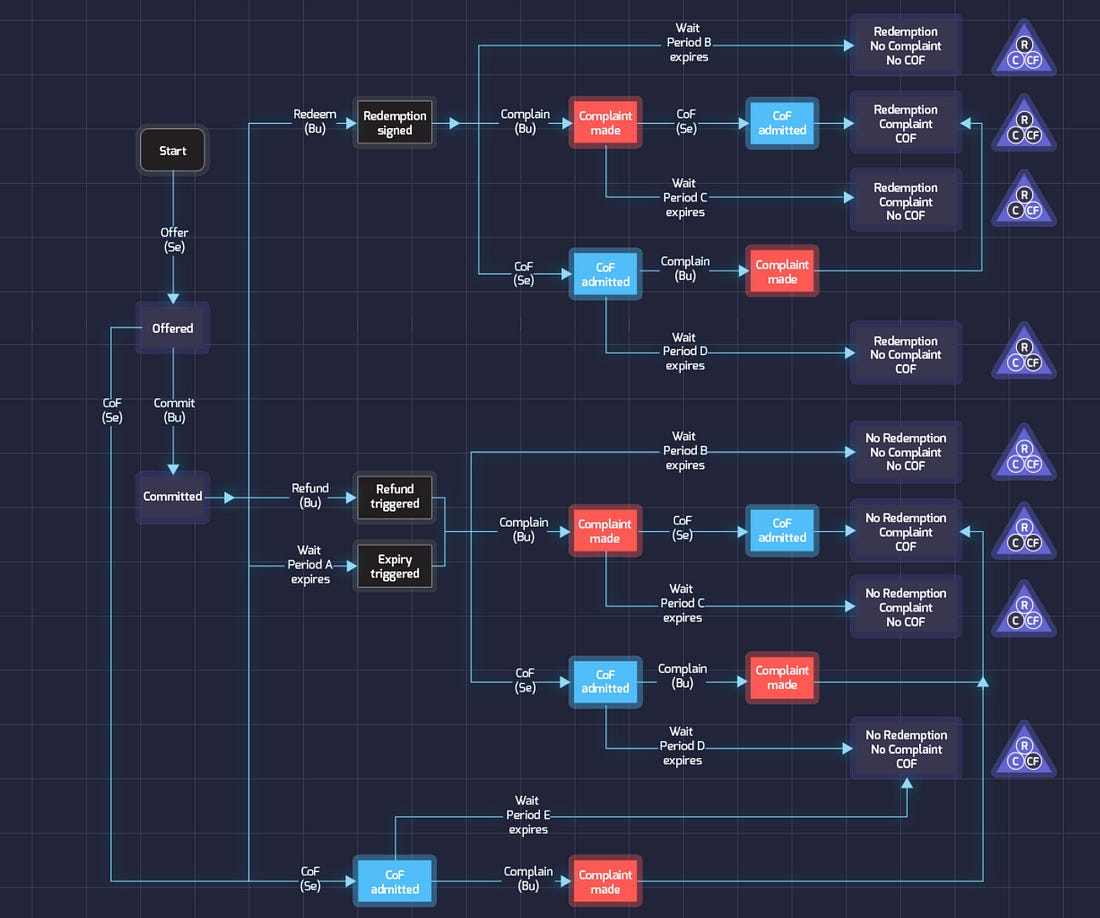

The governance of Commitment Tokens is taken on by the Core Exchange Mechanism which is where the programmed game theory comes into play.

Buyers and Sellers sequentially deposit up-front funds so there are varying levels of skin in the game on both sides of the transaction. The final deposit transfer process is structured to incentivize good behavior by both parties.

Using this sequential transaction process, Commitment Tokens are able to achieve a ‘Subgame Perfect Equilibrium’ which equates to each subgame of the original game as having a Nash equilibrium.

As those of you in the CFA curriculum know, Nash equilibrium equates to the equilibrium between players when each player knows the strategy of all the other players and has nothing to gain by changing only their own strategy.

The possible outcomes of the game are the triangles on the right side of the above diagram. CoF stands for Cancel or Fault which is an undesirable outcome, therefore the most desirable outcome of the game for all parties is ‘Redemption; No Complaint; No CoF’, which is the 4th triangle from the top of the diagram.

The purpose of this game theory being programmed into Commitment Tokens is to minimize the amount of disputes and arbitration required between Buyers and Sellers.

Thing Tokens

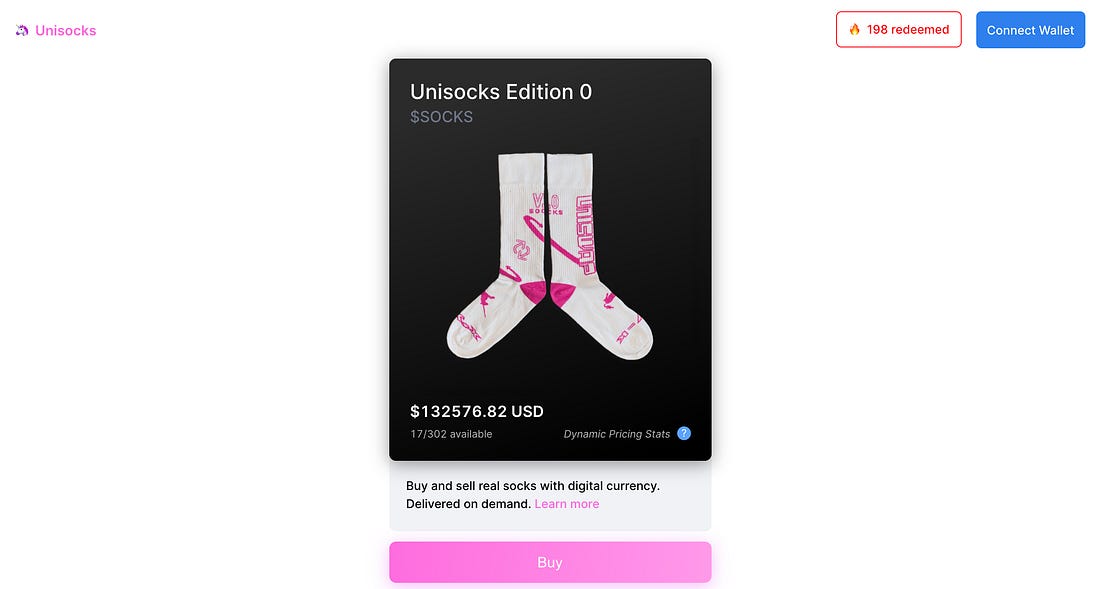

Thing Tokens, which conform to the standard ERC20 contract, are used to purchase Commitment Tokens. Think of a Thing token as a ‘generalized Unisock’ and the Commitment Token as an add-on futures contract.

Unisocks are an amazing experiment in scarcity. There were 500 real pairs of Uniswap merchandise socks tokenized as SOCKs and deposited into a liquidity pool on Uniswap along with their starting value worth of ETH.

Each SOCK token represents the redeemable ownership of 1 pair of socks and is minted with a bonding curve, hence the 11,048.07% increase in price from the original $12.

You can either sell the token back to the liquidity pool or redeem it for the physical socks where the Uniswap company will ship a physical pair to you anywhere in the world.

At the time of writing, the price of a $SOCK was $132,576.82 and 192 have already been redeemed.

Thing tokens are similar.

The interoperability and composability of Thing tokens enables them to be fitted or retrofitted into any existing DeFi infrastructure. They are tradable in the same way you can trade SOCKs between different wallets and they can ‘plug’ into AMMs (Automated Market Makers) to create liquid digital markets.

Examples of their use cases within DeFi include product price discovery on DEXes, yield optimization, and the crowdfunding of non-existent products through ITOs (Initial Thing Offerings).

BOSON Tokens

Incentive is the invisible hand that Adam Smith was talking about. Markets love incentives, just look at Carbon Credits or Tesla’s profitability.

Boson built reward mechanisms within the Thing / Commitment Token relationship to incentivize good behavior by both Buyers and a Sellers – but that doesn’t tell the whole story. The core objective of the Boson Protocol is to ‘maximize the supply of quality redemptions’. In other words: facilitate successful commerce transactions.

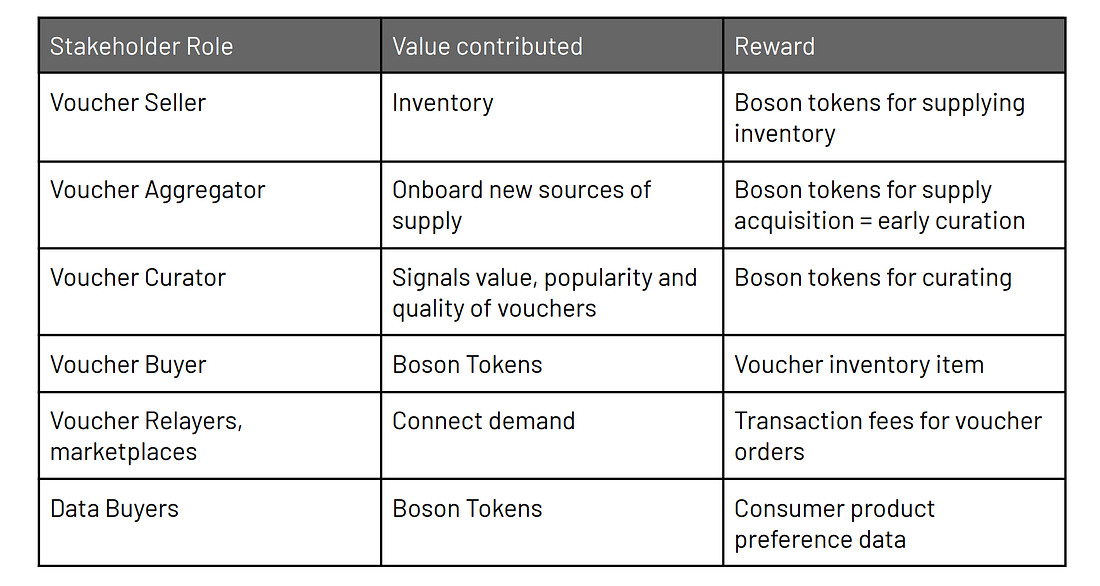

To do so, Boson implemented the BOSON token (Bosons) as a monetary reward for actors within the Boson eco-system who help the protocol reach their objective.

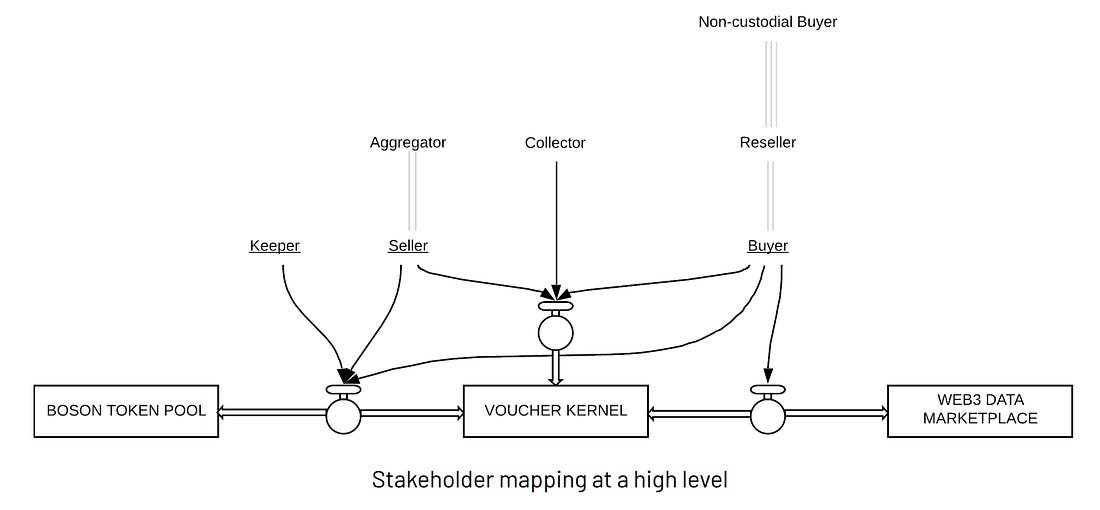

Below is a high level overview of the main stakeholders within Boson Protocol.

Gluons

For each voucher, there is a unique derivative called a Gluon that represents the stake of the participant holding the voucher and the associated BOSON reward.

Vouchers with higher amounts of Gluons indicate items that are expected to be of a higher quality than items with lower amounts of Gluons.

Let’s say Seller posts a voucher with the belief that it will deliver an item that is highly valued in a no-complaint transaction. The Seller would be incentivized to stake more capital than the minimum required in order to be exposed to more Gluons which increases the chance of receiving more BOSON rewards.

This is an engineering marvel in that it decentrally incentivizes market participants to partake in high-quality transactions of high-quality physical goods. For a more detailed analysis of all the game theory involved, including math, check out the Boson Whitepaper.

Applications

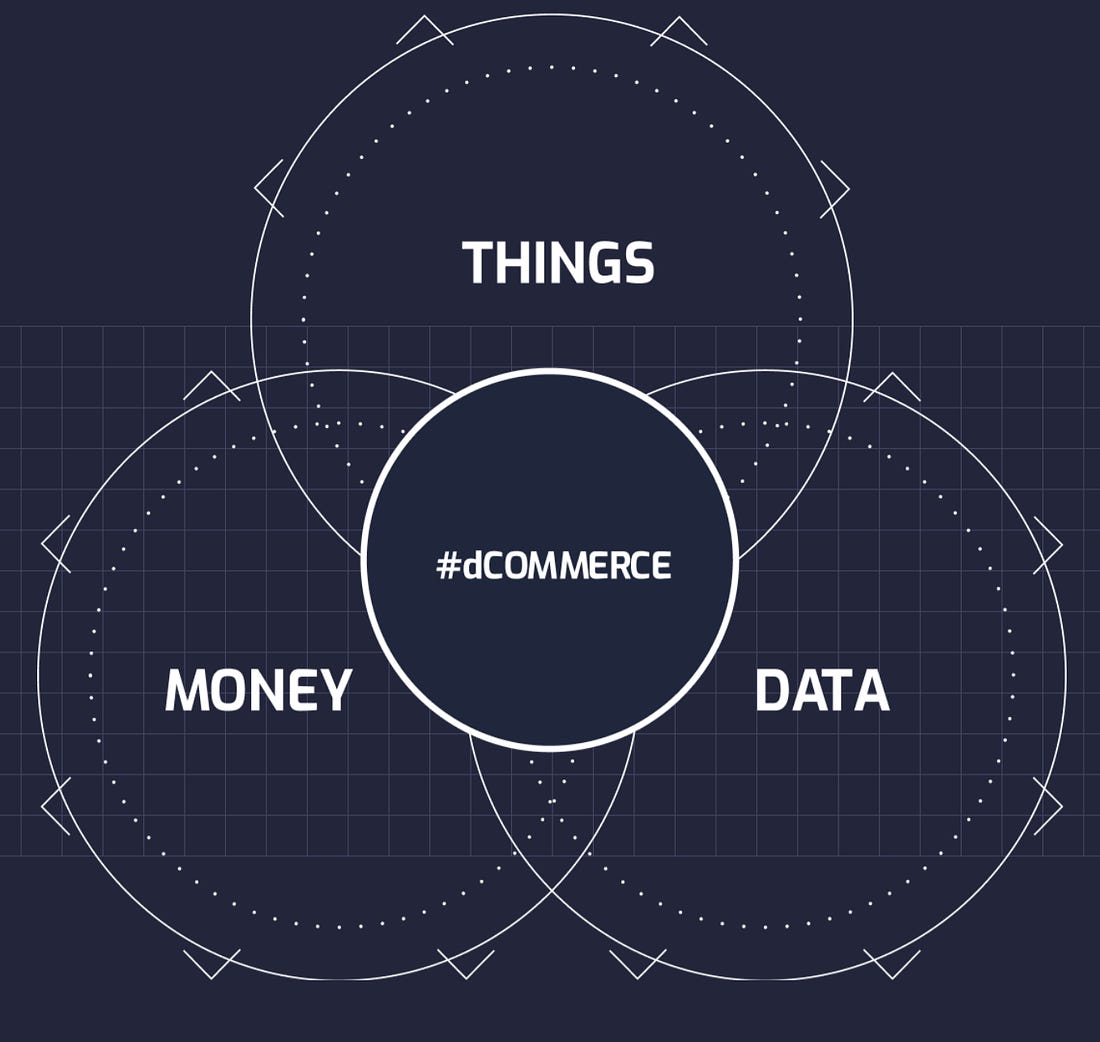

Is your brain spinning? Did you think there would be such a seamless way to exchange digital and physical value? It’s just money, data, and Things.

Unisocks, while unrelated to Boson, is basically a proof of concept for decentralized commerce of physical goods.

While the Boson protocol is built for that, below is a list of some other potential use cases suggested in their white paper.

- Online Commerce

- Non-Monetary Vouchers – Think automated & auditable food stamps representing real food for those in need.

- M2M commerce (Machine to Machine) – Let your autonomous car purchase new tires for itself.

- Loyalty & Rewards – Standardized, composable, interoperable loyalty programs & credit card reward systems. Imagine exchanging your Southwest Airline miles for $SOCKs on Uniswap.

- Games – Video games can grant physical gifts to players for achieving certain levels of success. (A REAL Mystic Axie??? – just kidding)

- Gaming – Enable blockchain games to distribute prizes as NFTVs or $BOSONs.

- Crypto Exchanges – Enable exchange tokens to be redeemed for physical rewards.

- Service Bookings – Secure bookings permissionlessly with 2 sided deposits.

- Tokenized Networks – Exchange network tokens for digital / physical goods & services.

Governance

Boson enacted a 3-phase structure of decentralizing their governance and are currently in the Startup Phase.

- Startup Phase – Achieve ‘protocol-market-fit’ by rapid iteration through opinionated leadership.

- Network Phase – Enable minimally extractive fees to be charged for vouchers and ultimately incentivize market participants to contribute valuable work.

- Community Governance – ‘At time of writing, it is anticipated that the governance structure will be a decentralized autonomous organization (DAO), structured to ensure regulatory compliance as well as resist capture from centralized entities or groups.’

Roadmap

In order to scale, Boson estimates they will need to handle on average 10 transactions per second, with peaks potentially being more than 10x that. To do so, they decided to utilize the most battle tested layer 1 – Ethereum, which can generally handle dozens of transactions per second.

Boson raised $36,000,000 in token sales and USD that funded teams across protocol design & architecture and legal engineering & game theory while also scaling the employee count to over 50. The Boson token is #511 on CoinMarketCap with a market value of around $60 million.

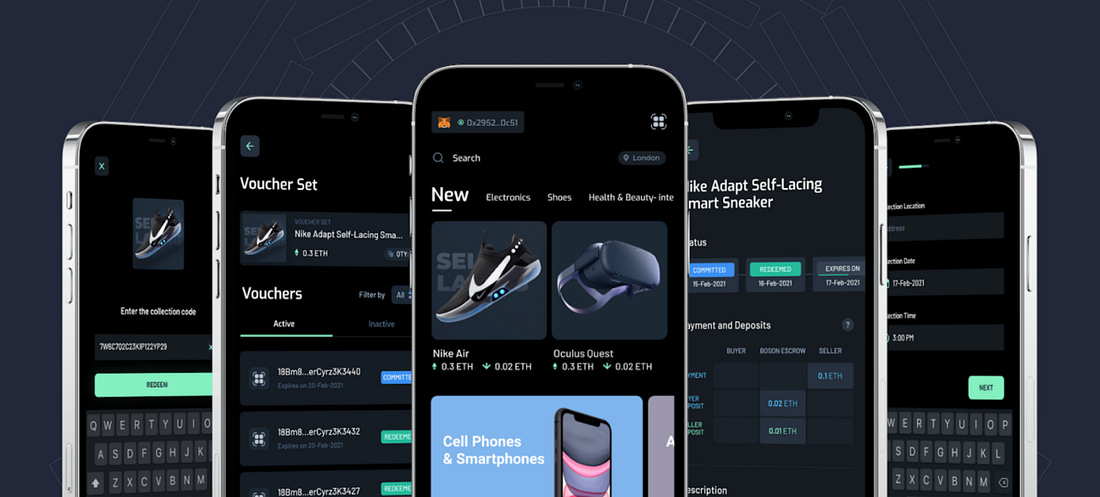

Along with prolific hirings, Boson has released a DEX for any Thing, an app to reference transactions, and began a groundbreaking experiment in Decentraland.

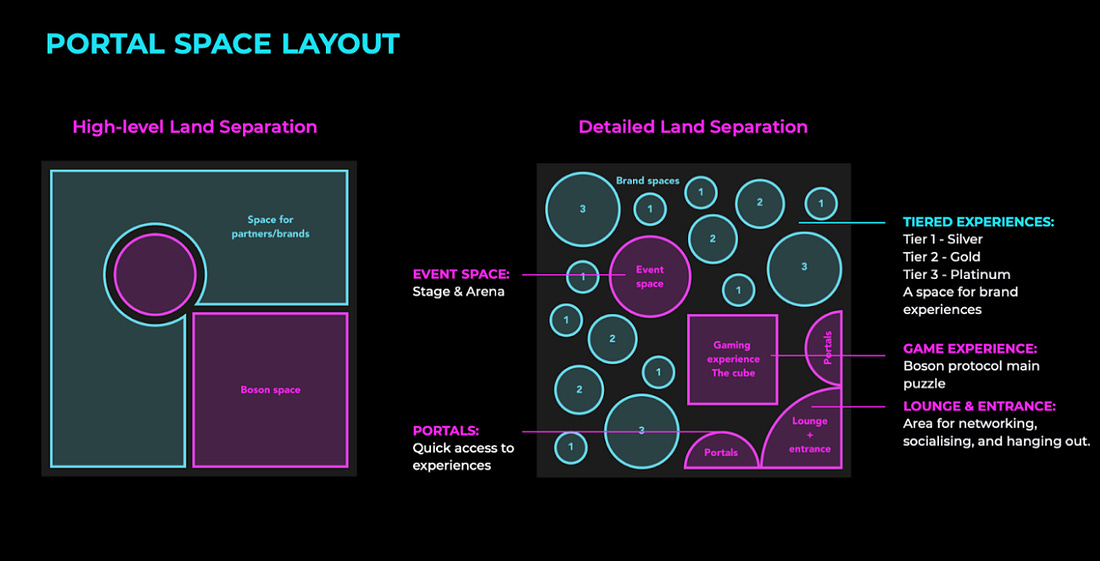

Boson successfully completed a purchase of over $700,000 in digital real estate within Decentraland’s Vegas City. Through their collaboration with Polygonal Mind, Boson is creating Portal, the world’s first lifestyle and commerce playground. Portal will enable creators and brands to sell NFTs that are redeemable for real-world products and services.

Now that funds have been raised, the team has been formed, and a strategy has been implemented – Boson is in what it calls the ‘hyper blitzscale’ mode of development.

For a more refined definition of what hyper blitzscale means to Boson, check out their Roadmap article on Medium.

Conclusion

Commerce is a natural process of giving and take. There are discounts and premiums on items dependent on market demand, but with the advent of centralized scaling, a handful of companies have taken advantage of billions of consumers and millions of small businesses.

The gatekeeping and rent-seeking of the intermediaries and arbiters involved is nothing new. It’s just a byproduct of the fact that commerce is so resource-intensive. Only Kings and Parliaments had the funding to scour the globe for optimal ways to deliver goods, so only Kings and Parliaments were in control of the world’s trade.

Do you blame Amazon for being a monopoly? All Jeff did was to act on a vision of the future that turned out to be correct… and then he got greedy. Boson looks to flatline intermediaries like Amazon and prevents other Amazons from happening.

Boson is pioneering the future of decentralized commerce.

If they pull it off, they’ll become one of the most important protocols in the world.

Their $60 million dollar market cap would be a drop in the bucket of how much value would be accrued. Given the magnitude of the issues at hand and the ethos of decentralized governance, you can imagine the benefit that Boson could have on society.

There are risks. Some of which are layer 1 failures, smart contract risk, regulation, and competition but as they have stated – they are open to changing their settlement layers and are working on full-scale compliance with international law.

They have progressed very quickly, the protocol is transparent, the passion of the founders is focused, and the roadmaps are clear.

Boson is well ahead of its competitors and even further ahead of the incumbents. If anyone can enable dCommerce, its Boson.

The above is by Zachary Roth, professional writer, and Product Manager at Solrise Finance. Subscribe to Zachary’s newsletter, DAOJones, here.

Boson Links

Boson Socials: Twitter | Medium | Telegram | YouTube | LinkedIn

Boson Links: Website | Whitepaper | Litepaper | FAQs