Raydium, Solana’s Darling DEX

The following is by Zachary Roth, professional writer, and Product Manager at Solrise Finance. Subscribe to Zachary’s newsletter, DAOJones, here.

Raydium is one of the premier dApplications built on the Solana blockchain. They’ve leveraged Solana’s fast transaction speeds and cheap fee structures to introduce a powerful suite of DeFi products with integrations from Project Serum.

Along with a user friendly trading interface, they offer yield farms, liquidity pools, and a launchpad for new Solana projects. Their governance token is RAY and it is the 221st largest cryptocurrency by market cap.

Raydium has succeeded in offering a wide set of products without diluting their quality, as is the case with many one-stop DeFi shops (I’m looking at you BSC).

I’m sure you know but I’ll just clarify:

- SPL (Solana Program Library) is a collection of on-chain programs that defines the token standard of the Solana blockchain. It is the equivalent of an ERC20 contract on Ethereum.

- To connect to Raydium, you will need an SPL wallet (I recommend Phantom or Math).

- Traditional AMMs do not have Order Books.

Functions

Raydium is a fairly new platform so the developers had time to observe and be inspired by projects being built on other smart contract enabling chains like Ethereum or Binance Smart Chain (BSC).

I see many similarities between Raydium and PancakeSwap on BSC although Raydium’s quality is much more consistent.

On Raydium, you can do the following:

Trade & Swap

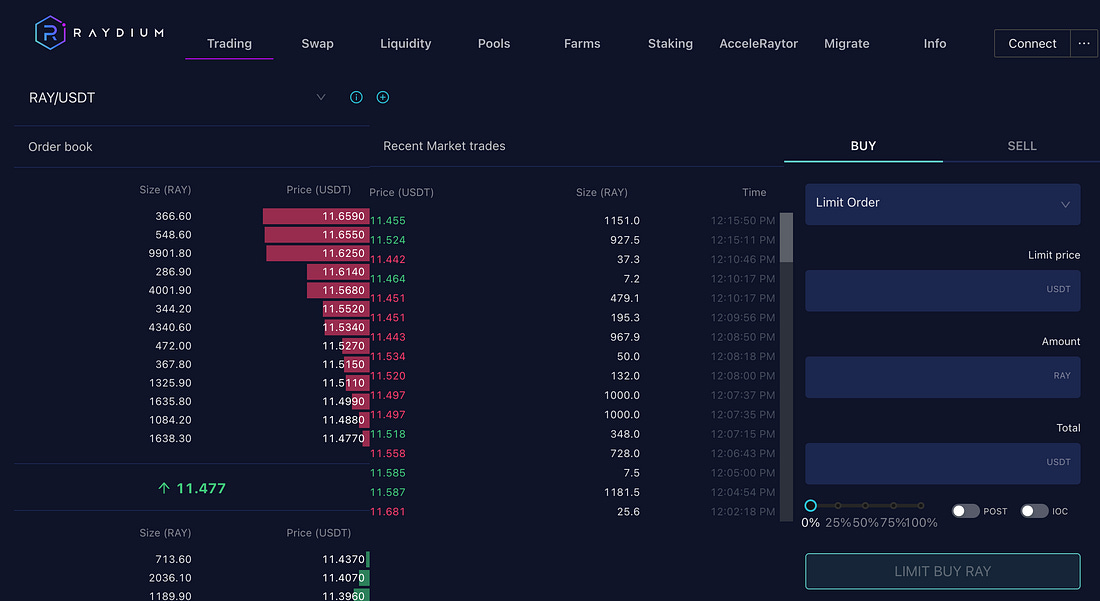

While Raydium allows you to swap (market order) any SPL token very quickly through Serum, you can also place limit orders within the DEX user interface.

Raydium’s infrastructure determines if trading through the Serum order book or a liquidity pool via an AMM would yield the best price and it executes accordingly.

This is innovative in the sense that two different types of liquidity are available. I’ve not seen that before within a single DEX; although It’s similar to 1inch’s DEX on Ethereum and BSC which aggregates all the quotes from different DEXes and allows the user to choose which one they would accept.

There have been times where I’ve seen 20% differences in quotes between DEXes. This industry is still nascent, you need to know what you’re doing or you’ll get rekt.

Most DEXes only offer regular token swaps and Liquidity Providing swaps but rarely offer limit orders or an order book interface. Raydium is able to provide both because of their integration with Serum.

Order books are helpful for two reasons. They show you the momentary sentiment of traders and they detail the potential liquidity revolving around an asset.

Most DEXes like Sushi & Uniswap are unable to offer an order book because their platforms are built with exclusively a traditional AMM.

Provide On-Chain Liquidity To Any SPL Token Pool

Liquidity pools and DEXes may be the future of finance. I’m not going to get into it here, but they’re worth looking into.

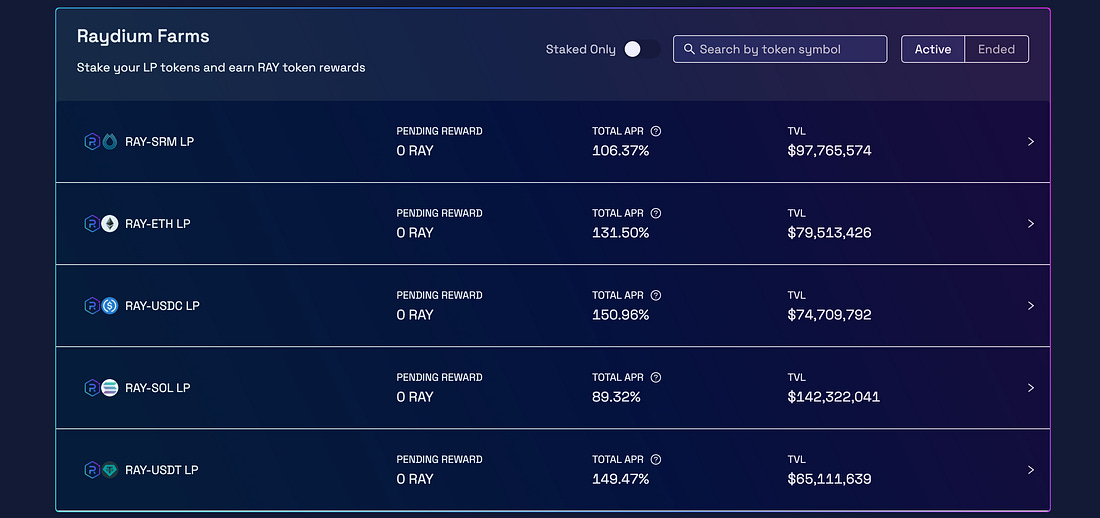

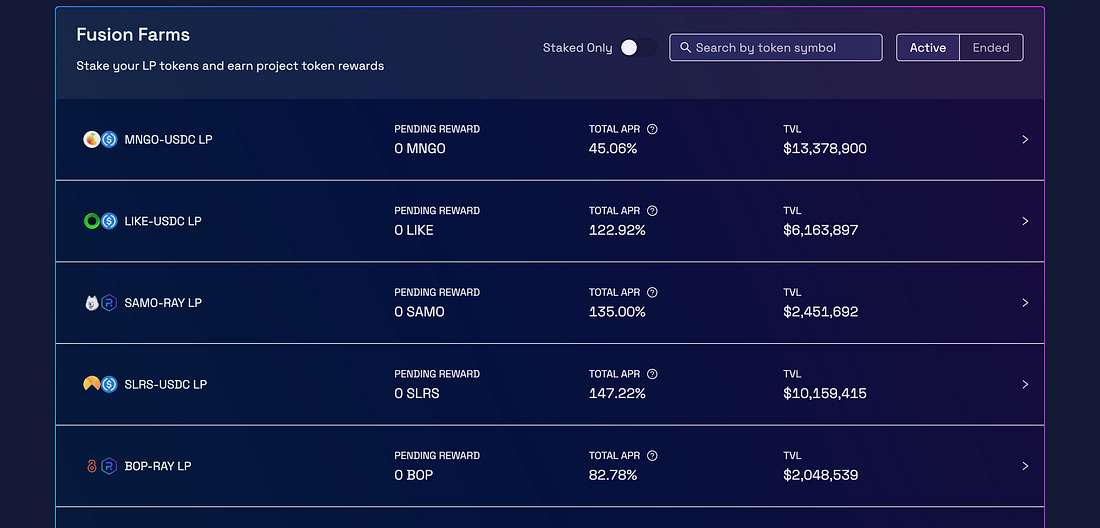

At the time of writing (08/29/21 17:43:11PM UTC), there were 17 liquidity pools on Raydium. 5 of these allow you to earn RAY, and the remaining 12 are what they call Fusion pools, which allow you to earn a different SPL token while also bootstrapping liquidity for that trading pair.

I italicized that to emphasize the concepts that you are essentially acting as a passive market maker and a venture capitalist when you provide liquidity to a liquidity pool.

You are providing liquidity to a token of a project that otherwise wouldn’t have that liquidity. This helps the project operate. You are investing in that project.

As stated, Fusion pools allow Raydium users to provide liquidity for these projects’ tokens on both the Raydium and Serum DEXes.

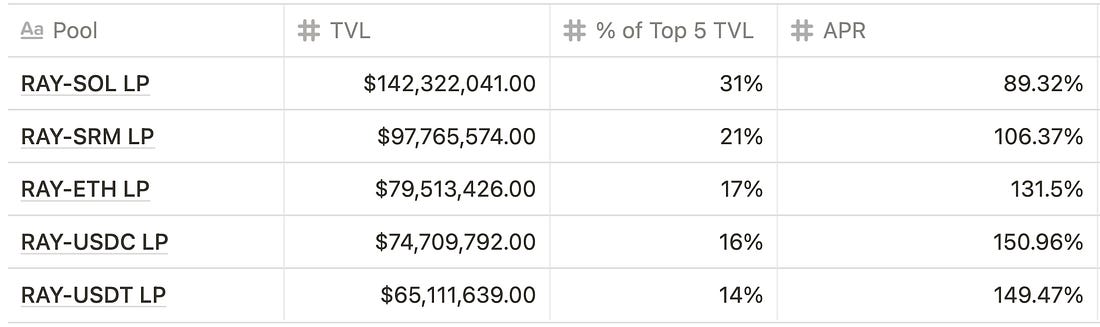

DAOJ APR & TVL

For fun, lets create new metrics of measuring Liquidity pool providing platforms. We’re still early so why not.

We’ll mimic the return of a full year of investing in the top 5 pools of the platform, as measured by TVL. Take the top 5 pools by TVL, and make a weighted average of total expected returns over the next 12 months as if it were a portfolio of securities.

It should be noted that these pools are not continuously auto-compounding (some pools are), so I am only using an arithmetic mean. Also, APR is only an estimate when using Liquidity Pools so take these numbers with a grain of salt.

The top 5 pools amount to $459,642,472 TVL.

The weighted average is calculated as follows.

$(0.31)(0.8932)+(0.21)(1.0637)+(0.17)(1.315)+(.16)(1.5096)+(0.14)(1.4947)=0.9513 or 95.13%.

A 95.13% return on $458,642,472? $436,306,584.

In one year, all else equal, the TVL of the top 5 pools on Raydium will be $894,949,056.

95.13% on over $400,000,000 in a year? Pretty good.

I like these metrics. Let’s define them.

- DAOJ APR: Weighted average of the 1 year APRs of the Top 5 pools by TVL on a LP platform.

- DAOJ TVL: The absolute dollar value of the projected TVL of these pools in 1 year at current rates.

John Bollinger inspired me to make metrics and indicators.

This is the first of many – I’ll figure out a better nomenclature system later.

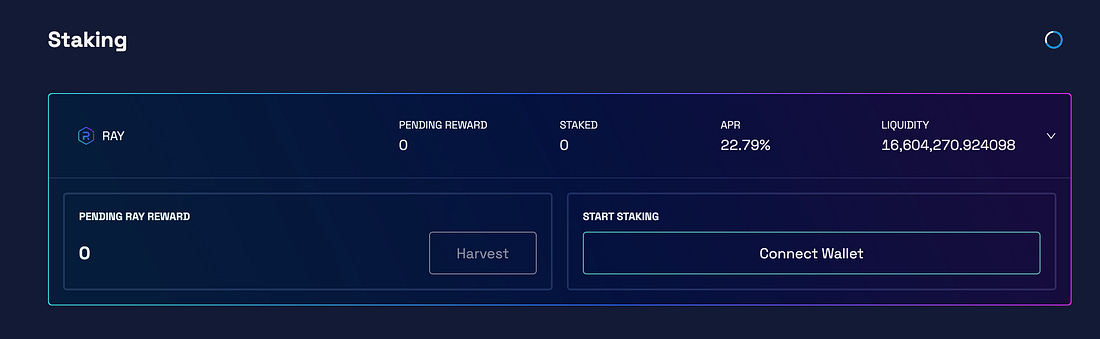

Staking

If you are a holder of RAY and you aren’t taking advantage of the staking available on Raydium, you are missing out on a very safe 22% annual return. The staking rewards here come from the 0.03% trading fee associated with every RAY trade.

Of course, your return is more RAY tokens. If RAY goes up, you’re up bigly. If RAY goes down, well at least you have more RAY. At the time of writing, there was 16,604,270.924098 RAY being staked. That’s almost $200,000,000 with a current RAY price of $11.73.

A few things to note about the RAY token. There is a 555 million RAY hard cap, emissions will last for 36 months with halvenings occuring every six months, and as stated, 0.03% of trading fees are awarded to RAY stakers.

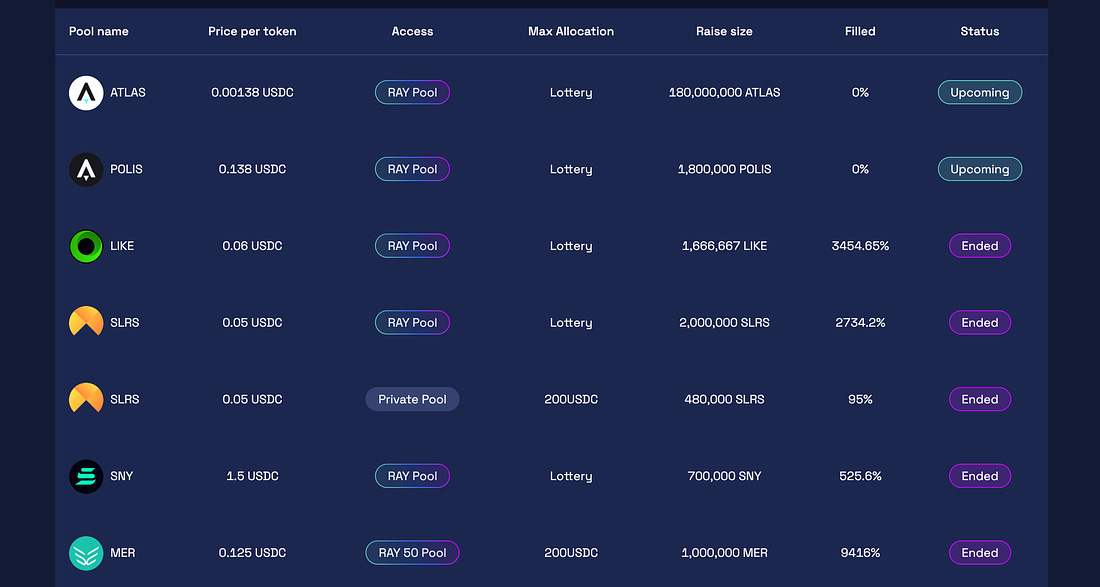

Fund / Bootstrap Projects

Launch pads are powerful platforms for new projects to fund operations and bootstrap liquidity. They allow anyone to submit proposals wherein people can purchase their token and provide liquidity to the trading pools to earn that same token. These events are called IDOs – Initial DEX offerings – and they are a very innovative, potentially lucrative way to fund projects. Raydium has their own launchpad called the AcceleRaytor program.

Given that Solana has just recently gained its massive popularity, there have only been a handful of projects who have gone through the AcceleRaytor program. As you can see – the price, allocation method, and raise size are the key metrics of these launchpads. When an IDO is expected to be ‘oversubscribed’, launchpads often organize a lottery system for participants to gain entry – this is the system in place at Raydium for most of the launch pad projects.

Star Atlas, a blockchain based play-to-earn game based in the future is about to launch on Solana (scheduled 09/01/21). The tokens, ATLAS and POLIS are being distributed through FTX (not US) and Raydium where you need to have had 150 FTT or 100 RAY staked respectively for 7 days prior to the launch.

With FTT at a price of $50, a FTX user needs $7,500 worth of the exchange token staked to be eligible for the IEO, initial exchange offering, portion of Star Atlas’ launch. With RAY at the price of $11.73 you only need $1,173 staked. This is where a segment of the FTT and RAY tokens’ value accrues from.

I learned this the hard way. RAY was around $8 on 8/26 when I realized this Star Atlas launch was happening. I’m ineligible to participate in the IDO because I needed to have RAY staked from 8/25! Well RAY has gone up about 35% since then as smart money is moving in on this IDO.

Conclusion

Raydium impressed me. This is the first platform on Solana that I have really dived into. I’m definitely going to use it as it’s magnitude seems to be similar to that of PancakeSwap on BSC. PancakeSwap dominates the trading volume on BSC and occasionally has more volume than Uniswap, the biggest DEX in the world.

With Solana’s quick transactions and very low fee structures, I can see Raydium’s trading volume eclipse that of PancakeSwap. BSC is an experiment in centralized decentralization and I am unsure of how long Binance will be able to keep that up. I do own CAKE tokens and BNB but that’s more so for exposure rather than an investment thesis.

The tokenomics of RAY are not inherently inflationary and the user experience on the platform was delightful. They are very transparent in their documentation and all of the Raydium contracts are currently in the process of a security audit with Kudelski Security.

Raydium is deeply integrated with Project Serum who is partnered with FTX. FTX has one of the greatest crypto investment track records in the world and is one of the earliest investors in Solana and Project Serum. This type of backing adds to my trust in the Raydium platform.

For good measure, the developers at Blizzard Money are entirely anonymous.

Raydium Links

- Website – Raydium.io

- Docs – raydium.gitbook.io/raydium/

- Twitter – https://twitter.com/RaydiumProtocol

- Solana RAY SPL address: 4k3Dyjzvzp8eMZWUXbBCjEvwSkkk59S5iCNLY3QrkX6R

- Ethereum RAY ERC-20 address: 0x5245C0249e5EEB2A0838266800471Fd32Adb1089

- Fill out this form to submit your project to the Raydium AcceleRaytor program.

- If you’re looking to build out features of your platform on Solana, be sure to get in touch with the Raydium team at connect@raydium.io.