Are NFTs Decoupled From Crypto Winters?

Are NFTs insulated from crypto winters?

This question was posed on the Bankless podcast recently.

It’s an important question because it can be used to determine how we might distribute our capital in times of crypto downturns and whether or not NFTs can in fact become a hedge of sorts against such downturns.

The episode’s guests — crypto thought leader Zeneca and Eric Connor of EthHub — speculated that NFTs were indeed decoupled from crypto prices.

However, it seemed like their evaluation was based more on gut feel than methodical assessment.

One of the arguments was that the average price of some collections had increased from 5 ETH to 12 ETH during the downturn. But with the price of ETH dropping by about 40% in the past 30 days, an increase in the effective Ethereum price is to be expected.

For example, if the hypothetical price of ETH was $100, and the price of ETH fell to $50, then an NFT worth 5 ETH would suddenly become worth 10 ETH — all other things being consistent.

In addition, pointing to individual collections is akin to cherry-picking to form a conclusion. But as any scientist will tell you, to have confidence in what a single study concludes, you typically need to see a vast body of independent studies coming to the same or similar conclusions.

In our case, the least we can do is look at a vast body of NFT collections — or at least a handful of them.

Of course, assessing such a question is plagued with pitfalls in a new and rapidly evolving market with so many variables that can influence price and demand.

Such variables include, but are not limited to, how new a collection is, speculation, media hype, popularity, influencer collaborations, novelty factor, the broader economy and political climate, competing demands on consumer attention, and so much more.

And after considering several other variables — including market cap, number of users, number of traders, transactions v sales — I decided that average USD price movements (because this seems to be a more accurate and stable indicator than ETH price), as well as trading volume movements, were perhaps the most telling factors related to a coupling or lack thereof.

The Impact of Economic Downturns on Traditional Art

Some imperfect parallels already exist IRL regarding economic downturns and decreased consumer spending — especially when it comes to discretionary spending such as artwork.

Sotheby’s — the world’s broker of fine art and collectibles — saw its revenue drop by almost 50% due to the global financial crisis of 2007 and 2008 (below).

Granted, physical artwork — unlike many NFT collections — offers holders no real utility beyond status, aesthetics, and potential capital gain.

But adding weight to this theory, every economist knows that when the economy faces a downturn or a recession, consumer spending drops with it.

And when an economy faces inflationary pressures, central banks poise themselves to increase interest rates, making credit more expensive and ultimately decreasing income, borrowing, and spending.

All of this, in turn, is likely to affect the NFT market — even if NFT-maximalists who are likely to be outnumbered by mere speculators — remain bullish.

Such maximalists might see the world in terms of ETH alone, but most of us — me included — still find our eyes darting back to the USD price as the ultimate source of value truth when evaluating NFTs.

And that will probably continue to be the case for the foreseeable future until web3 protocols become the defacto standard with which we navigate the world.

My Analysis

I should caveat this analysis by saying that it was limited by factors such as time, my mathematical expertise or lack thereof, and the rapidly evolving nature of the NFT marketplace.

It’s difficult and time-consuming, for example, to evaluate all collections as part of the same basket when some were launched over 12 months ago, and others only 12 weeks ago.

It is worth noting too that using the average price has some limitations. Everyone knows the old joke that when Bill Gates walks into a bar, the average net wealth of everyone in that bar goes to the moon. But that’s not an accurate depiction of their actual net wealth.

And when footballer Neymar and numerous other high-profile celebrities — who are more or less shielded from economic downturns — spend millions of dollars on popular NFTs, it can distort things.

So I took a somewhat simple approach.

I compared the drop in the price of ETH and Solana, against the average price and volume of transactions for each chain’s popular NFT collections.

I did this across both a 7-day and 30-day time period.

I’m sure this is far from a perfect science, but I share this to stimulate discussion. If there are gaps in my thinking — and there always are — I welcome you to point them out.

And I encourage someone with more mathematical chops than me to dive a little deeper.

ETH Price v Average Collection Price: 7 Days

The price of ETH fell by about 20% over the past seven days, and a cursory look at the average price of top NFT collections mirrors this.

ETH fell by about 40% over the past 30 days, and we saw some collections fall significantly during this period of time, but others soar.

This might be due to a lag between the market dipping, and consumption habits changing — especially as people bought the dip, and then realized it just kept on dipping.

The Robertson Lag

In fact, this is known as the Robertson Lag, named after famous economist Dennis Robertson. He posited that changes in income and wealth lead to a delayed consumption change.

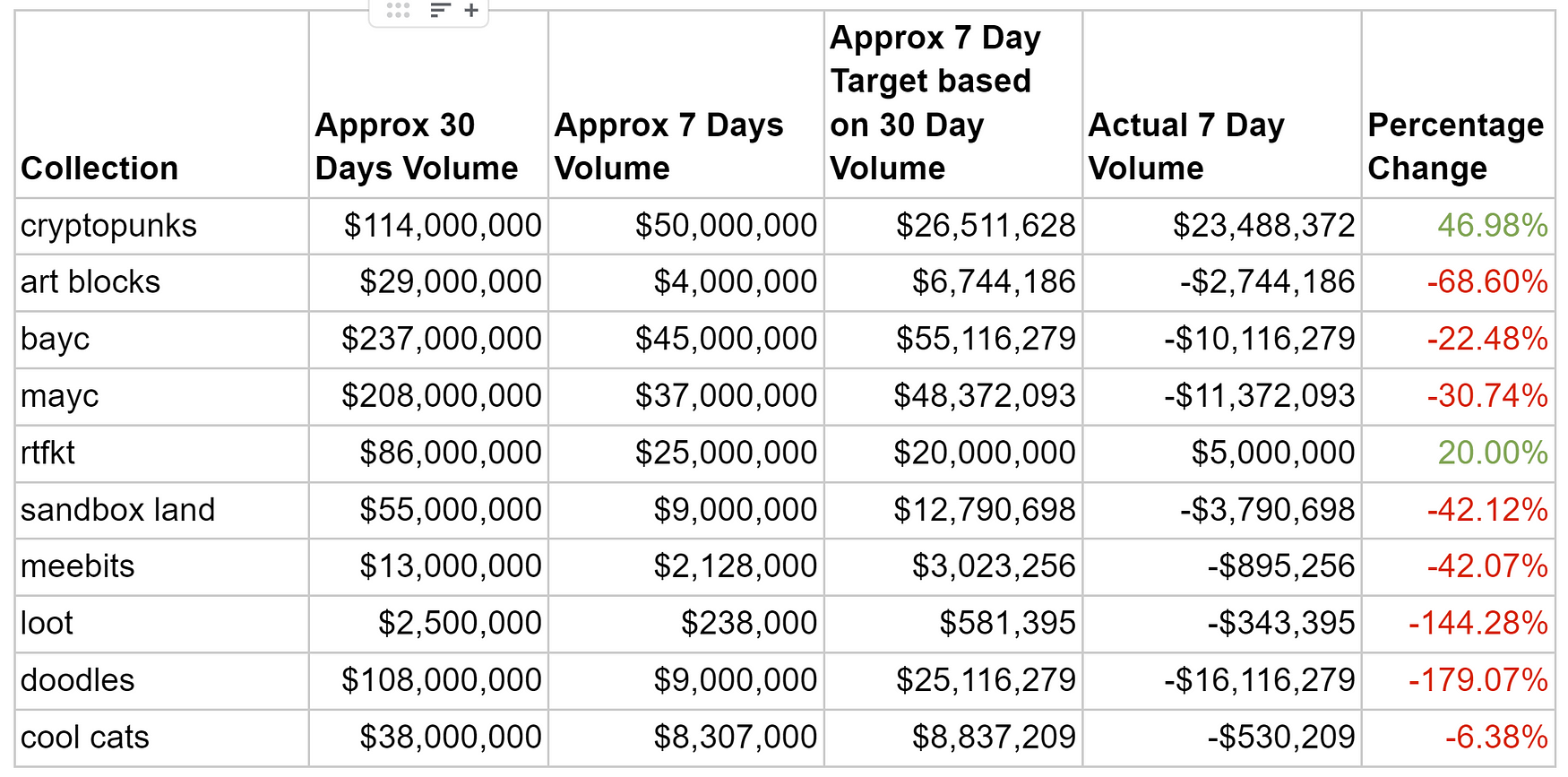

ETH Trading Volume v 30 Days Ago

Trading volume was down too compared with 30 days ago.

My rough calculations are below.

Except for Cryptopunks and RTFKTK’’s collaboration with Murakami, 8 of the top 10 collections all suffered a drop in volume. Bored Apes volume dopped by roughly 20%, Art Blocks by 70%, Sandbox Land by 40%, Loot by 140%, and Doodles by 180%.

Solana

And a similar phenomenon plays out on rival L1, Solana — even without the exorbitant gas fees of ETH, with average trading volumes falling by about 40% in the past 30 days, a period in which the price of SOL fell by over 50%.

What About Less Popular Collections?

But what of less popular collections? Well, it varied.

A cursory eyeball scan of less popular collections revealed huge discrepancies in trading volume growth and average price growth across collections.

It’s worth noting that when an NFT collection is new and likely to be cheaper to mint, people might speculate and put money into it, even during economic downturns — especially if the collection has fostered a strong community and run an effective marketing campaign in the lead up to its drop.

What Do We Feel?

And perhaps the best judge of all of this might be ourselves and the sentiment of our friends.

Do we find ourselves spending more on NFTs or less, having seen our crypto portfolios diminish in reticent weeks, or are we simply going to HODL out, and wait for the market to bounce back before investing?

I know plenty of people who are locking in their losses and running — not something I would advise (but this post doesn’t constitute financial advice, and your financial circumstances are unique to you).

Even Zeneca himself posted the following to his Twitter recently.

Sure, he wasn’t talking about NFTs per se but a token that gives holders utility — something strikingly similar.

The market does indeed determine how we choose to allocate capital.

Final Thoughts

But given all of this, I think it is still hard and too early to tell.

In the event of a prolonged crypto winter — one that lasts 3 to 6 months, or heaven forbid, even longer — the answer might become a lot more evident.