Everything You Need To Know About FloorDAO

TL;DR

- FloorDAO leverages NFTx and Olympus DAO to become a top decentralized Market Maker for NFTs.

- FloorDAO may adopt ve-tokenomics & gauge, similar to Curve Finance.

Back to FloorDAO

In a previous article about NFTs and liquidity issues, I covered FloorDAO briefly. Given that FloorDAO launched its first token in February 2022, it’s time to dive in deeper.

How DeFi Tried to Solve Liquidity Issue

Before diving into FloorDAO, let’s look back at how DeFi tried to solve the liquidity issue.

- DeFi 1.0

First-generation DeFi protocols, like Uniswap, offered high APYs to attract liquidity from users. Initially, this strategy worked to an extent. But over time, several problems emerged:

- Liquidity providers started to chase higher APYs and moved between different protocols and pools. Protocols grew pressured to offer higher APYs to attract longer-term, deeper liquidity relative to their competitors.

- DeFi protocols were able to promise high APYs through issuing native tokens. However, these native tokens often experienced hyperinflation and value dilution as a result of greater issuance.

- DeFi 2.0

What differentiated second-generation DeFi protocols, such as Olympus DAO, from earlier DeFi protocols was that they started to own liquidity pools by themselves. Through this mechanism, the protocols didn’t need to rely on external liquidity providers.

However, DeFi 2.0 still faces challenges. Protocols are sustainable only if the yield made by the protocol treasury is higher than the native token’s inflation rate. If this assumption breaks, the protocols do as well.

What FloorDAO is Trying To Do

FloorDAO is identical to Olympus DAO with the following exceptions:

- FloorDAO applies to NFTs, rather than DeFI.

- The goal of Olympus DAO is to make $OHM a decentralized reserve currency. FloorDAO, in contrast, aims to become a decentralized Market Maker that can offer stable liquidity to NFT projects.

To understand FloorDAO, we need to first understand NFTx and Olympus DAO .

NFTx

NFTx is a platform that creates NFT-backed tokens. NFT-backed tokens are tokens that represent ownership of a given NFT. NFT holders can deposit their NFT into the NFTx vault and mint corresponding ERC-20 (vTokens). With vTokens, holders can redeem their NFT from the vault.

vTokens allow NFT holders to do many things which were impossible with NFTs alone:

- Holders can easily sell vTokens on decentralized exchanges.

- By staking a vToken SLP (Sushiswap LP token) or a vToken itself, holders can earn yield.

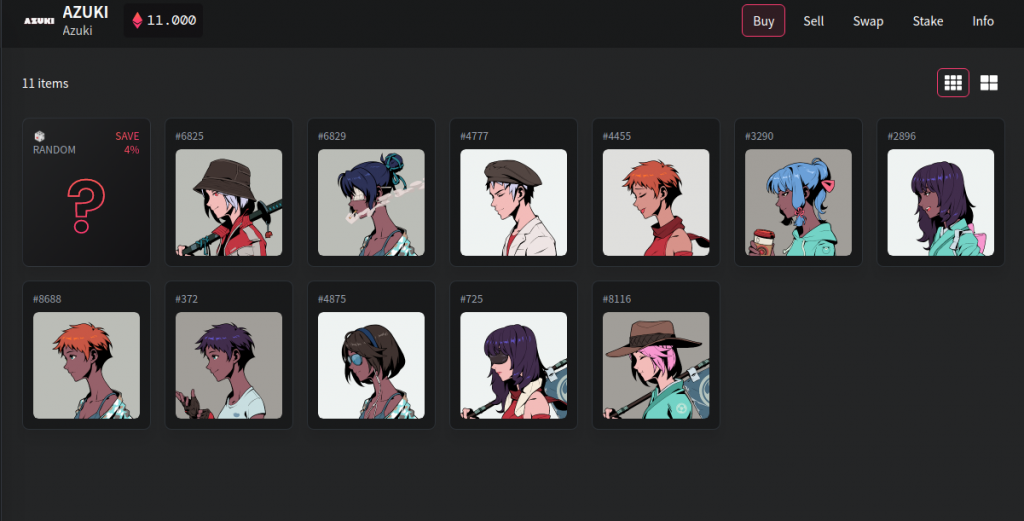

Example: AZUKI NFTx vault

These are the NFTs that are deposited in AZUKI NFTx vault.

By depositing AZUKI NFTs into the vault, the NFT holder can mint $AZUKI tokens, and with $AZUKI, the holder can redeem random NFTs from this vault, sell them on an exchange, or stake them for yield.

Olympus DAO

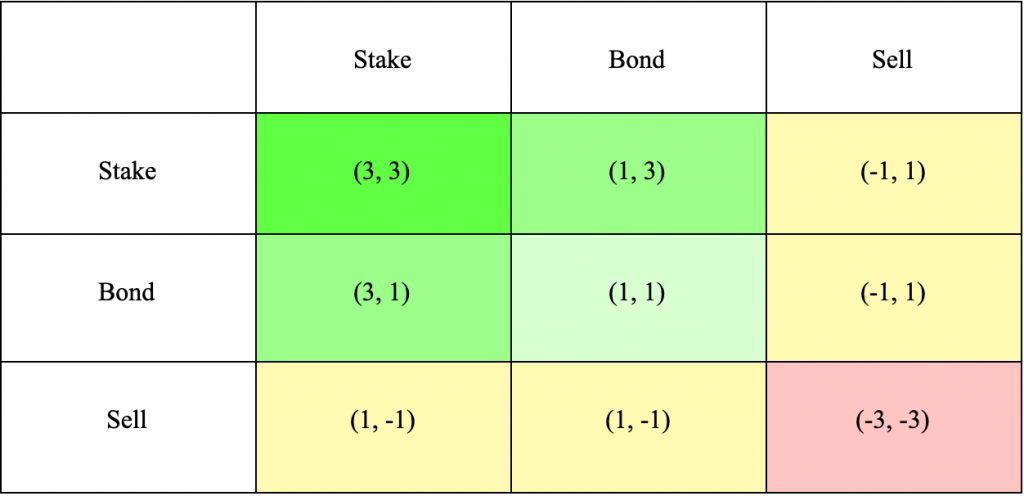

Olympus DAO enables three actions: Bonding, Staking, and Selling.

First, Bonding involves minting $OHM at a discount price by bonding certain assets to the Olympus DAO treasury. Second, Staking can earn $OHM holders a high yield. Lastly, Selling is literally selling $OHM.

How it Works

Like Olympus DAO, FloorDAO also allows for Bonding and Staking.

Bonding

Bonding is a mechanism that enables the sale of specific assets to the protocol in exchange for its native tokens.

You can bond certain assets to the FloorDAO treasury and mint $FLOOR at a discount price. For now, FloorDAO only accepts $PUNKS, which is the Cryptopunks NFTx vault vToken.

Staking

Rebasing is a mechanism that allows your staked native tokens balance to increase automatically based on the given yield.

If a user stakes $FLOOR, $FLOOR transforms into $sFLOOR, and every 8 hours, it gets rebased. The rebase yield must stay within a certain range, as too low a yield will not be attractive enough for users and too high a yield will break the protocol due to hyperinflation.

How to Make a Profit

For FloorDAO to be sustainable, it must use the assets collected by Bonding to yield a higher return than the inflation rate of $FLOOR. FloorDAO plans to address this issue in the following way:

- Accumulate vToken and vToken LP by Bonding.

- Deploy these assets to NFTx by staking or as a liquidity provider (LP).

- Trades would check the high vToken price and buy the floor price NFTs to initiate an arbitrage exchange.

- Make profit from vToken swap and NFTx vault fees.

Although only $PUNKS is available, FloorDAO will add more NFT projects in near future.

The Future of FloorDAO

In this medium post, FloorDAO proposed a few mechanisms that may be integrated into FloorDAO in the future:

1. Ve-tokenomics

Ve-tokenomics is a mechanism that distributes the protocol’s voting power in proportion to the amount and duration of locked tokens. When applied to FloorDAO, this mechanism should theoretically decrease the total $FLOOR circulation and incentivize long-term investing in the token.

2. Gauge

For FloorDAO, the gauge system gives different “weight” to each NFT project in proportion to its veFlOOR amount.

With ve-tokenomics, gauge can be integrated into FloorDAO. Through proportional voting power, $veFLOOR holders can help guide the direction of FloorDAO through voting on how to resolve key questions for the DAO.

If FloorDAO achieves success, many NFT projects may want to have their NFTs added to the platform as a way of gaining greater, and more stable, liquidity.

3. Meta-governance

If lots of NFT projects’ vTokens are added to the FloorDAO treasury, $FLOOR would theoretically function as a meta governance token, which would influence the governance of multiple NFT projects, and subsequently increase the demand for $FLOOR.

Thoughts On The Future

Optimistic

If FloorDAO succeeds in offering stable decentralized liquidity to certain NFT projects, similar to Curve Finance, many NFT projects may compete to accumulate $FLOOR, which would lead to more Bonding and an increase in $FLOOR’s price.

Pessimistic

Because FloorDAO uses the same mechanism as Olympus DAO, they also share the same weak points. First, if the yield is not high enough, FloorDAO must lower the inflation rate of $FLOOR and it will fail to attract more users. Second, both Olympus and FloorDAO depend on the condition of the NFT market. If the NFT market slows down, both Olympus and FloorDAO will also likely suffer a decline.