KRW 4tn for Bithumb Seems Expensive if True

“Korean Big Four CEX” FY21 Snapshot [big / mid / small / very small]

Over the last few days, there have been numerous press articles (both in Korea and abroad) stating that Sam Bankman-Fried (SBF)’s FTX is in advanced talks to buy Bithumb. We’ve mentioned in one of our previous posts [“Bithumb must have been much more conservative with additional hiring and SG&A expenses (given owners wanted to sell the company)”] that Bithumb’s owners indeed have been willing to sell. While we cannot confirm whether the recent chatters are true, it could be useful to look back on where Bithumb currently stands in Korea. https://karensingermd.com/

As seen above, Bithumb was (and still is) a firm number 2 CEX in Korea across all categories. Roughly speaking, the platform is responsible for around 20% of the Korean CEX market currently dominated by Upbit.

As mentioned during our previous post, the gap between Upbit and Bithumb has widened coming into 2022 but nevertheless, Bithumb still is a solid number 2 in Korea way ahead of Coinone and Korbit.

One of the local press articles is saying FTX put a KRW 4tn price tag for Bithumb (Korean link: http://www.s-today.co.kr/news/articleView.html?idxno=4326) which we believe seems quite outlandish.

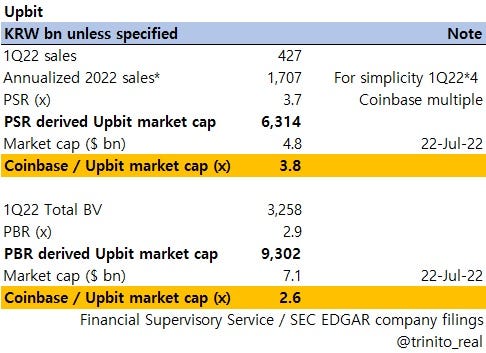

Back in June, we mentioned Upbit’s valuation (cross-checked with Coinbase) was at around KRW 9tn (as seen below). When the table below was posted, Bithumb was valued at around KRW 1tn levels.

Now If we update the numbers with the latest Coinbase’s consensus estimates from Bloomberg, Upbit’s valuation doesn’t change dramatically (KRW 9.3tn). However, it is widely known that the estimated valuation for Upbit has come down to about KRW 7.6tn lately as trading volumes have decreased more than 30%. So comps against Coinbase are overstating the current Upbit valuation versus actual value.

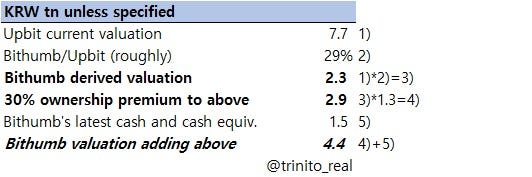

If we do the same exercise for Bithumb (below), we arrive at KRW 3.2tn. However, as discussed a few lines ago, this is a very optimistic number compared to reality. Recent OTC transactions actually value Bithumb at around KRW 0.7tn.

If we consider Bithumb’s value at around 30% of Upbit’s (as is the case with disclosed financials), we arrive at roughly KRW 2.2tn (30% of KRW 7.6tn) which is still way off from the KRW 4tn. Even if we add a 30% typical ownership premium, this only reaches KRW 2.9tn.

It is only when we add Bithumb’s 1Q22 cash balance that we see a KRW 4tn-ish level.

Anyhow, if the current stated rumors are true (which we believe are not, to be honest), FTX is very “optimistic” or might be overestimating Bithumb’s value (from where we currently stand).

On a side note, Bithumb’s corporate governance is very complicated and in the Korean market, Bithumb-related stock plays are known to be Vidente (121800.KQ), Bucket Studio (066410.KQ), Inbiogen (101140.KS) which are all up a lot since the market open today (25 Jul). Interesting…

Written by Eric Yoo, Co-Founder at Trinito, and contributions from SungPil Huh, Head of Investment at Trinito.

#Bithumb #Upbit #Coinone #Korbit #Coinbase #Crypto #CEX #Valuation #Vidente #Bucketstudio #Inbiogen #FTX

Disclaimer

This is not investment advice and is for informational purposes only. You should not construe any such information or other materials as legal, tax, investment, financial, or other advice.