Tech-Induced Crypto Market Cycles – “Is the Crypto Dead Now?”

The Brief History of Boom-Bust Crypto Market Cycles from a Technology Perspective

– Table of Contents –

So, Is It All Over Now?

How Cycle is Formed:

– Gartner Hype Cycle: “Technology Triggers the Hype”

– Jean-Paul Rodrigue’s Four Phases: “Smart Money Moves First”

The Tech Tree from Previous Cycles

– 2008–2013 Era

– 2014–2017 Era

– 2018–2021 Era

The New Tech Being Built

– Computing Infrastructure Improvements

– Decentralized Digital Identity

– Advanced Tokenomics

The Unwavered Trends to Mass Adoption

– Number of Users and Developers

Conclusion: Progressing Through Cycles

Links

Disclaimer

So, Is It All Over Now?

With the 2021 historical bull market in the rearview mirror, the crypto market is experiencing some of the most turbulent times this year. In macro, we have seen wars leading to sanctions, inflation picking up to a level not seen for decades, the start of the interest rate hike, and the market is talking about a possible recession or even a depression around the corner. In the crypto market, the NFT mania-induced sporadic bull markets finally caved in when the biggest algorithmic stablecoin project failed and dragged the whole market down. With $LUNA and $UST combined, $60bn worth of wealth evaporated. The turbulence has put some of the biggest players in crypto such as Three Arrows Capital and Celsius into insolvencies, leading to a market-wide contagion. It currently looks devastating for the crypto market. Some say the crypto was a collective Theranos all along.

So, is it all over now? To jump to the conclusion, we firmly believe it is not. Human nature for greed and fear will never change and the crypto industry has always had hype-and-bust cycles of its own through which critical technological breakthroughs were achieved. It then led to the next cycle pushing the industry one step closer to mass adoption. The pattern gets clearer when you look back in history. Now, it is a great time to look back and think about how an innovative technology gets adopted through cycles.

How Cycle is Formed:

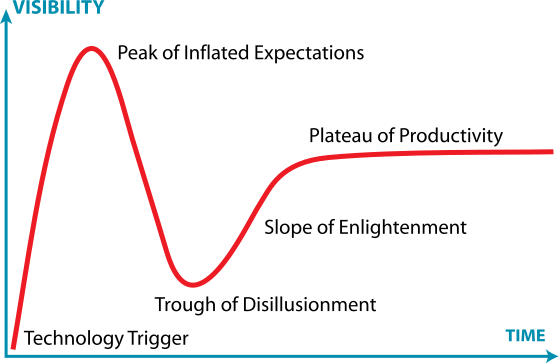

Gartner Hype Cycle: “Technology Triggers the Hype”

New technologies with bold promises often mature and get adopted through cycles. Gartner Hype Cycles provide a graphic representation of the maturity and adoption of technologies and applications, and how they are potentially relevant to solving real business problems and exploiting new opportunities. Gartner Hype Cycle methodology gives you a view of how a technology or application will evolve over time.

Innovation Trigger: A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist and commercial viability is unproven.

Peak of Inflated Expectations: Early publicity produces a number of success stories — often accompanied by scores of failures. Some companies take action; many do not.

Trough of Disillusionment: Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.

Slope of Enlightenment: More instances of how the technology can benefit the enterprise start to crystallize and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious.

Plateau of Productivity: Mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.

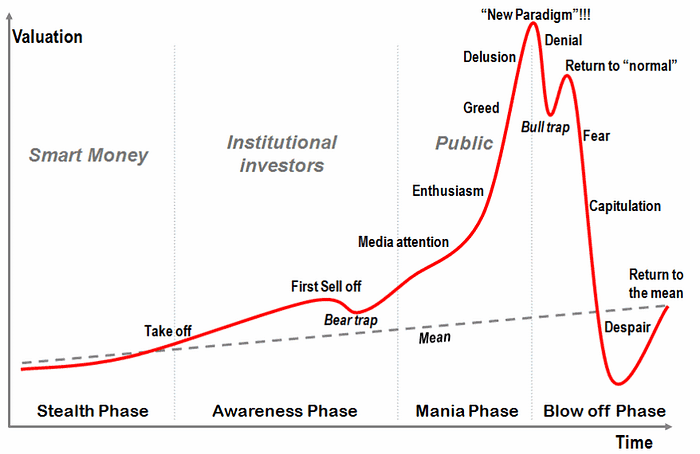

Jean-Paul Rodrigue’s Four Phases: “Smart Money Moves First”

Besides the technological aspect of hype cycles, the different investors of money play different roles in each stage too. Jean-Paul Rodrigue’s famous chart depicts the formation of a bubble in four different phases.

Stealth: Those who understand the new fundamentals realize an emerging opportunity for substantial future appreciation, but at a high risk since their assumptions are so far unproven. So the “smart money” gets invested in the asset class, often quietly and cautiously.

Awareness: Many investors start to notice the momentum, bringing additional money in and pushing prices higher. There can be a short-lived sell-off phase taking place as a few investors cash in their first profits. The smart money takes this opportunity to reinforce its existing positions. In the later stages of this phase, the media starts to notice and those getting in become increasingly “unsophisticated”.

Mania: Everyone is noticing that prices are going up, and the public jumps in for this “investment opportunity of a lifetime.” This phase is not about logic but a lot about psychology. Floods of money come in, creating even greater expectations and pushing prices to stratospheric levels. Fairly unnoticed from the general public caught in this new frenzy, the smart money, as well as many institutional investors, are quietly pulling out and selling their assets. Everyone tries to jump in, and new entrants have absolutely no understanding of the market, its dynamics, and fundamentals. Prices are bid up with all financial means possible, particularly leverage and debt. At some point, statements are made about entirely new fundamentals implying that a “permanent high plateau” has been reached to justify future price increases; the bubble is about to collapse.

Blow-off: A moment of epiphany (a trigger) arrives, and everyone roughly at the same time realizes that the situation has changed. Prices plummet at a rate much faster than the one that inflated the bubble. Many over-leveraged asset owners go bankrupt, triggering additional waves of sales. There is even the possibility that the valuation undershoots the long-term mean, implying a significant buying opportunity. However, the general public at this point considers this sector as “the worst possible investment one can make”. This is the time when the smart money starts acquiring assets at low prices.

The Tech Tree from Previous Cycles

The Crypto/Web3 technology has gone through several cycles since the Bitcoin whitepaper was published in 2008. However, unlike fashion trends that never come back, the crypto industry always came back with even bigger cycles because it built critical building blocks from each hype-and-bust cycle. From each cycle, critical technological breakthroughs were achieved and led to the development that nurtured the next hype cycle along with the technological advancements. Below is a brief history, a Tech Tree if you will, of each previous cycle and technological breakthroughs.

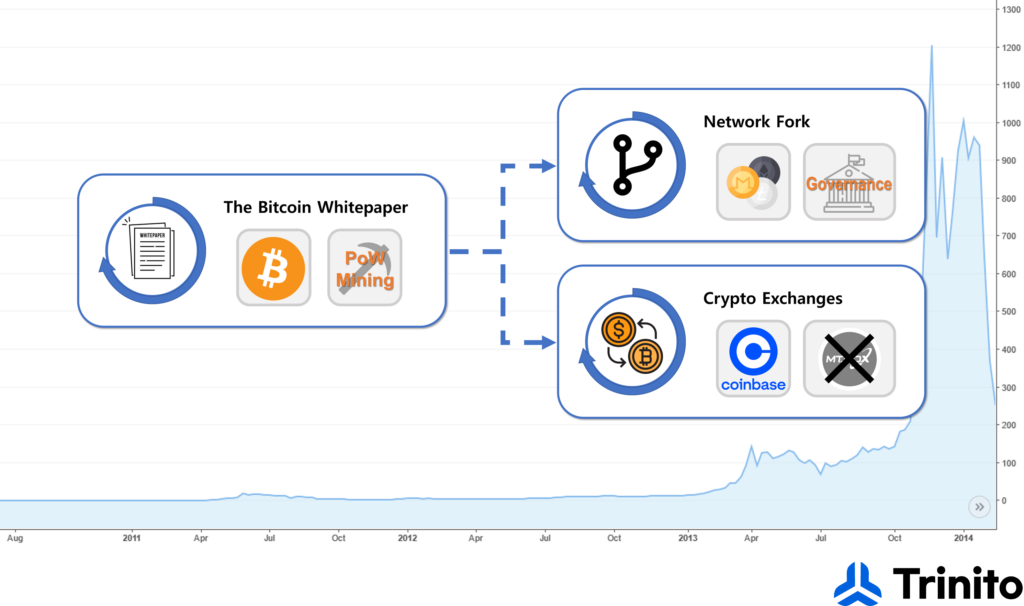

– 2008–2013 Era:

Bitcoin Whitepaper, Network Fork, Crypto Exchanges

The Bitcoin Whitepaper is arguably the first technological breakthrough that gave birth to the whole crypto industry in 2008. It laid the blueprint for the first working crypto asset in the world, Bitcoin, which is still the biggest and oldest crypto asset of all. One of the key components of Bitcoin is its consensus mechanism, the proof-of-work, which utilizes electricity and computing power to secure the networks. PoW miners have grown into an industry of their own that comprises more than just a few listed companies spread across geopolitical regions.

Many types of network forks followed suit after the emergence of Bitcoin. The source codes were publicly available, and the network was free of access for anyone. Soon, people experimented with different parameters and assumptions other than Bitcoin’s own to start their own altcoin networks. Litecoin was one of the early altcoins which was a source-code fork of Bitcoin. Litecoin is still around to this day valued at billion dollars by market cap. Forking opened the door for hundreds and thousands of altcoins and provided ways for people to lead a discussion as to how to run a network, a form of off-chain governance.

The first crypto exchanges were formed during this era. Some of the notables are Mt. Gox founded in 2010, Bitstamp founded in August 2011, Coinbase founded in June 2012, and BitFinex founded in December 2012. Some of these early exchanges like Mt. Gox didn’t survive for long and eventually collapsed but some others like Coinbase remained to be the cornerstone of the industry that not only survived the https://milfordmd.com/ test of time but paved the way to onboard hundreds of millions of users and act as the liaison for compliance with the regulators and governments.

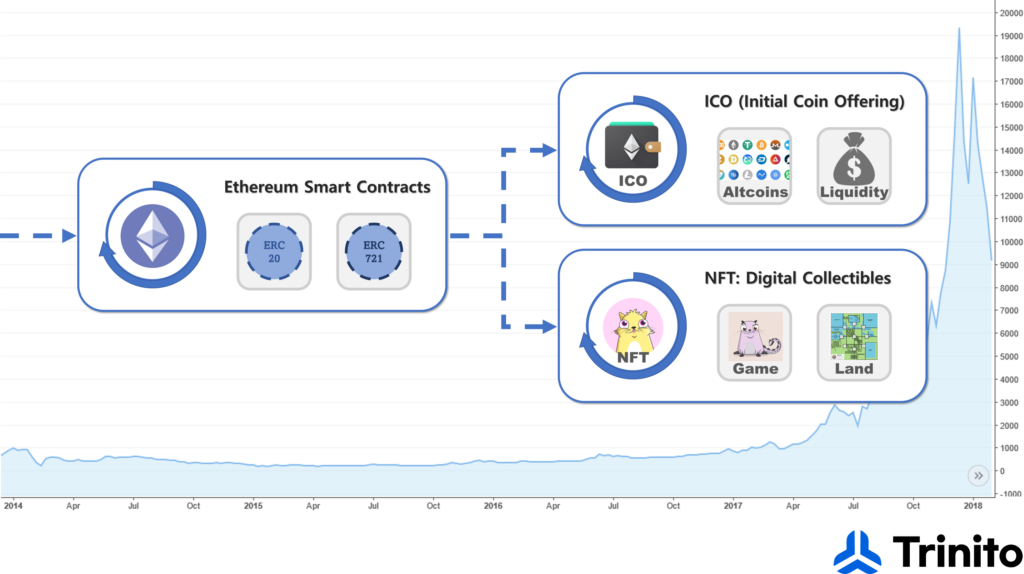

– 2013–2017 Era:

Ethereum Smart Contracts, ICOs, NFTs Primitives

Ethereum was designed based on the idea that Bitcoin and blockchain technology could benefit from other application development besides money. Initially conceptualized in late 2013 in a white paper by Vitalik Buterin, Ethereum had Initial Coin Offering from July to August 2014 paid via Bitcoin. The $16 million ICO and the $150 million funding of “The DAO” that took place in 2016 were marked as some of the biggest fundings in history up to that point. With more expressive coding language and protocol design, the Ethereum network made it possible to create and run decentralized applications and smart contracts with tokens of their own. The two most popular formats of Ethereum tokens were ERC-20 and ERC-721. These new inventions paved the road for thousands of new protocols and applications in the form of Initial Coin Offerings, Decentralized Finance, and Non-Fungible Tokens among many things.

The ERC-20 format of Ethereum provided the means of funding for thousands of Initial Coin Offerings(“ICO”). ICO was the new way to access capital markets and raise funds for tens of thousands of entrepreneurs with new ideas to start their own protocols for the potential of blockchain technology. 3,250 projects are estimated to have raised $21.4 billion during the ICO Mania in 2017–18. Many ICO projects from this era have not materialized their promises like other early-stage investments. However, ICO worked as a catalyst for the bull market at the time and provided the crypto economy its own means for financing new projects going forward (under different names such as IDO, IEO, Launchpads, etc.)

The ERC-721 format of Ethereum enabled the Non-Fungible Token (“NFT”) primitives in the 2013–2017 era. The NFT format in which each unit of token is unique was suitable for digital collectibles. Some of the earliest initiatives in NFT happened naturally in the form of digital arts and game items. “Quantum” by artist Kevin McCoy was published in 2014. For the most part of the 2013–2017 era, NFTs remained rather as a proof of concept for property ownership of digital arts and goods but never attracted the wider market’s attention. It was only when CryptoKitties was released in November 2017 NFTs exploded into popularity. Albeit short-lived, the success of CryptoKitties earned Axiom Zen, the studio that created CryptoKitties, funding from prestigious investors. Major news stations such as CNBC and Fox News covered the digital collectibles being traded with fervor amongst enthusiasts. Such a development inspired a generation of artists and entrepreneurs for the next cycle.

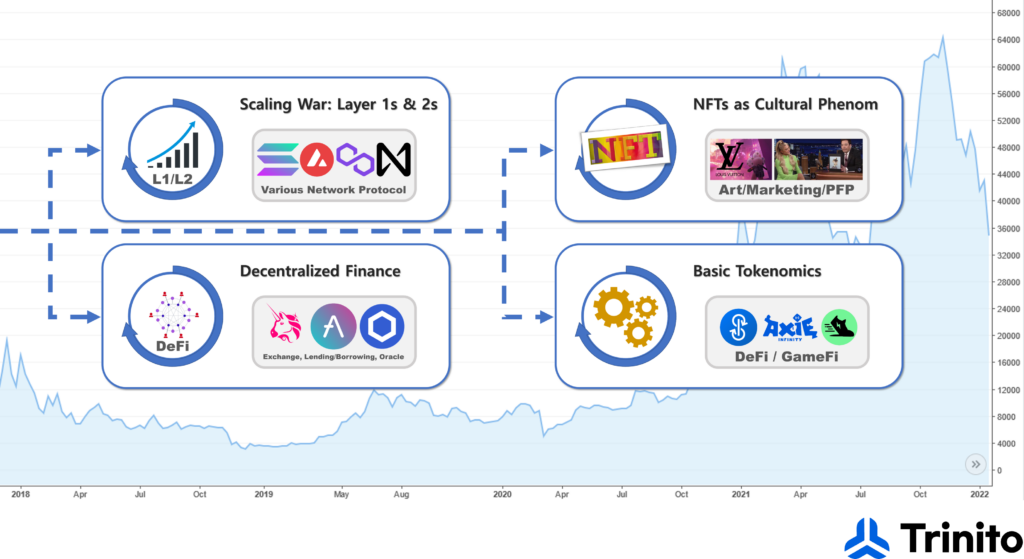

– 2017–2021 Era:

L1 & L2 Networks, DeFi, NFT as Cultural Phenom, Basic Tokenomics

Various L1 and L2 networks focused on scalability and low transaction fees such as Solana, Avalanche, Polygon, Near, and many more were launched in the 2017–21 era. Given the limited speed and capacity of Ethereum as opposed to the huge market demand for blockchain transactions, these other networks attracted great attention from both the market and developers. These networks provided the fast and cheap blockspace for retail dApps as well as backing new vital projects and research via grants, ecosystem funds, and other supports.

Decentralized finance, or DeFi, is a form of finance that uses blockchain technology, smart contracts, and decentralized applications (dApps) for financial services such as lending, trading, and investing on the blockchain network without any intermediaries. In the summer of 2020, a borrowing and lending platform Compound introduced its $COMP token to reward its users. With boosted incentives through the token emissions to users, Compound and numerous DeFi projects attracted a lot of new capital and users to their platforms during the DeFi Summer of 2020. DeFi is highly programmable, tamper-proof, composable, transparent, permissionless, and self-custodied. DeFi was a groundbreaking achievement for crypto real usage with great promises that would not have been possible outside of crypto.

NFTs gained cultural significance during this era. Non-fungible means only one unique item exists and there are no others like it. Before NFTs, the word digital was effectively an antonym for unique or exclusive. For example, the music and film industries have fought against digital piracy for a long time. NFTs enabled uniqueness (or non-fungibility) in the digital realm for the first time. It is no wonder that the culture, art, and fashion industries were the first to recognize NFT’s potential in 2021. These are the industries that innately understand exclusivity and uniqueness as a way to make value. Graphic designer Beeple auctioned his drawings as NFTs at $69m at Christie’s. Jay-Z and Justin Bieber changed their social media profiles to prestigious PFP(Profile Picture) NFTs. Louis Vuitton and Nike were among many that launched their own NFT marketing strategies. Some still may not have heard of crypto, but now everybody knows what NFTs are.

Web3 Retail Apps with Tokenomics as a growth hack: A lack of real usage has been the point of critics for a long time. However, with many building blocks in place, we finally saw crypto retail apps with millions of users in gaming and lifestyle categories. Axie Infinity has become the leader in the Play-to-Earn(P2E) gaming category with millions of gamers from Southeast Asia. StepN has become the leader in the Move-to-Earn(M2E) lifestyle category and also registered millions of users. The new P2E or M2E concepts were built on top of the crypto infrastructure such as faster blockchains, fungible tokens & NFTs, and basic tokenomics that was laid out before. These dApps proved the idea that crypto is not only about finance but also the continuation of the internet revolution, thus the concept of Web3.

– 2022 and onward:

What Potential Tech Trigger Is Being Built Now?

Even though the crypto industry has come a long way from zero to one in a little more than a decade, there is still much room to grow for it to unlock its full potential. As such, there are novel research and experiments at the frontier to make crypto not only more accessible but also something completely unprecedented before.

Computing Infrastructure Improvements (scaling and interoperability)

The inherently costly nature of decentralized computing has long been the bottleneck of crypto for everyday users to use the infrastructure in the same fashion as they would use their smartphone apps such as YouTube or Instagram. It’s slow and expensive to use crypto and various competing networks fragmented the liquidity and user base. As of now, there are so many promising projects that focus on solving the scalability and interoperability of blockchain. Zero-knowledge proof, plasma, sharding, and sidechains are some of the popular approaches for scaling that are actively being researched. Modular architecture, web assembly, bridges, and layer-zero technology are all prominent efforts to improve the interoperability between different blockchains. As the computing infrastructure improves, many entrepreneurs will find that previously unattainable business models are possible.

Decentralized Digital Identity

There are many problems with a centralized digital identity such as cyberattacks. Today, crypto centers around all transferable assets like tokens and NFTs but still lacks the means to encode social relationships that form one’s identity. DeFi is mostly transferring or collateralizing assets. GameFi and Web3 apps are being criticized for hyper-financialization. E. Glen Weyl et al. crystalized the idea of decentralized identity through tokens (Soul Bound Token or “SBT”). Decentralized digital identity could have the potential to unlock undercollateralized lending markets through reputation, thwart and compensate for coordinated strategic behavior, create novel markets with decomposable, shared rights and permissions. It could be another zero-to-one moment like DeFi or NFT that will inspire and bring excitement to the market.

Advanced Tokenomics

The incentive system with tokens has been crucial for the early successes of dApps but the quote-unquote tokenomics of these dApps have been often criticized for their unsustainability. The crypto industry is much warier of the front-loaded simple tokenomics and in the search of more sustainable and harmonious incentive systems. With tokens being the synonym of digital ownership which is crypto’s core value proposition, tokenomics will always be at the center of crypto networks and applications. There is still so much to explore in its potential and there is little doubt that the next big thing in crypto will have a new playbook in tokenomics which will bootstrap its growth and stability.

The Unwavered Trends to Mass Adoption

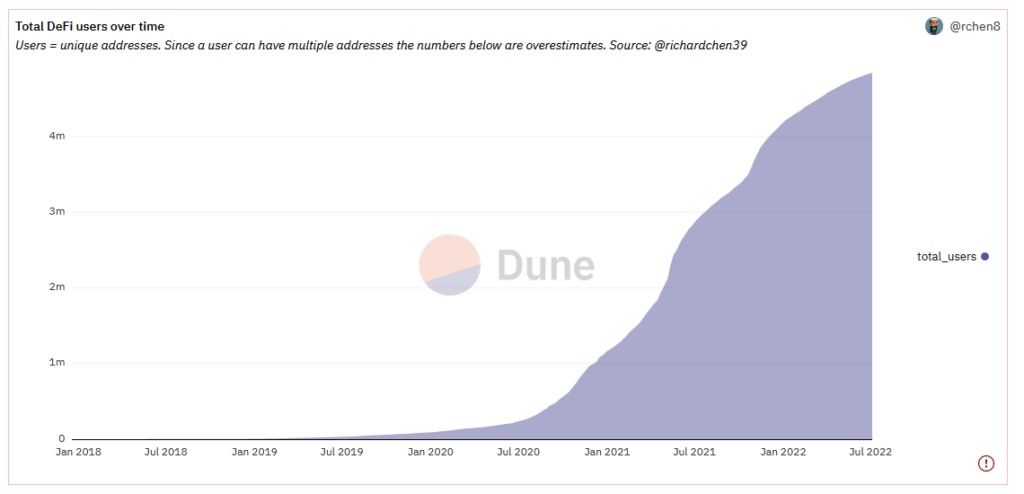

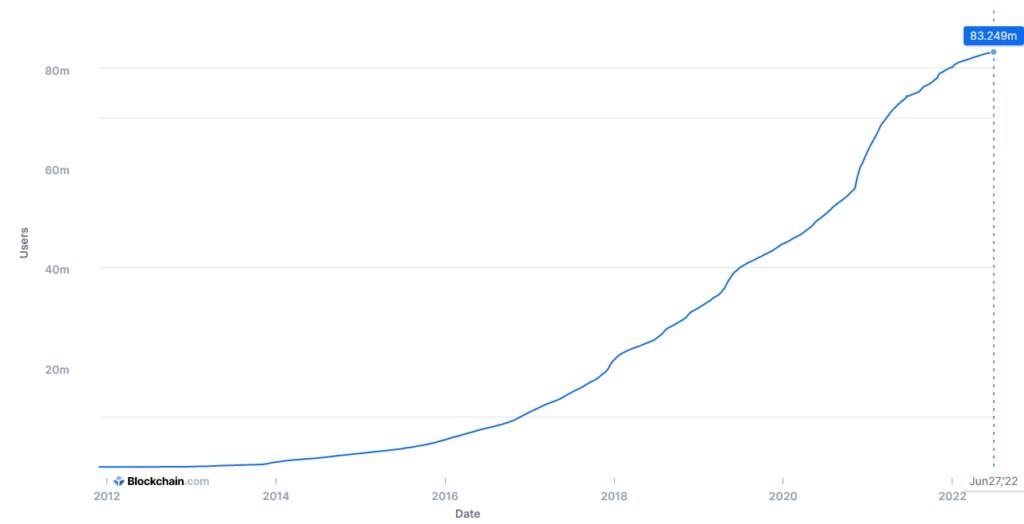

Not everything moves in erratic cycles in crypto. Despite the volatile ups and downs of prices and investors’ sentiments over the years, some metrics of the crypto industry are pointing toward progress only up and to the right. Below are such metrics to mention but a few.

Number of Users

The number of the crypto population is in a constant upward trend. The above chart shows Blockchain.com’s number of users measured by wallets in a smooth upward slope. Crypto.com reports that the worldwide crypto owners to be 295 million in December 2021, increasing 178% from the beginning of 2021. Assuming the world population ages between 15 to 64 at 5.2 billion, (65% of 8 billion), the worldwide crypto adoption at around 5% puts the industry in the early adopter stage with the mainstream adoption chasm not too far ahead.

Number of Developers

Developer engagement is an early and leading indicator of technology adoption. Electric Capital reports that the monthly active developers that commit code in open source crypto and Web3 projects hit the highest in history at the end of 2021 at over 18,000. Over 34,000 new developers committed code in 2021 which is the highest in history. What’s promising for a bear market is that the developers who joined during the last bull market in 2017 and 2018 largely stayed throughout the bear market over the next few years even as network value fell 83% from its peak.

Conclusion: Progressing Through Each Cycle

We have seen business cycles go through booms and busts repeatedly. The peaks and troughs of cycles get more protruded when new innovative technology is developed and adopted. Crypto technology is undoubtedly an innovative technology that is inspiring so many people and opening up so many possibilities. Therefore, exaggerated bull and bear markets have been observed in crypto over the past years.

At Trinito, we believe that the pattern of progressing through bull and bear market cycles will persist in crypto for years to come. The human nature of greed and fear will never change. Critical building blocks are being built during the bear market. Technological breakthroughs and important experiments will be achieved by the entrepreneurs and researchers with high conviction to reap the reward in the next bull market. Looking back at the technological catalysts developed during bear markets that sparked the next bull markets from the previous cycles shows exactly such patterns in crypto. We believe what gets built now in the bear market will provide the groundwork for the next bull market and we will find all the ways we can to support them for their survival and success.

Written by SungPil Huh, Head of Investment at Trinito, and contributions from Eric Yoo, Co-Founder at Trinito.

#cryptocurrency #Bitcoin #Ethereum #DeFi #NFT #SBT #dApps #bullmarket #bearmarket #marketcycle #technology

Links

https://99bitcoins.com/bitcoin/historical-price/

https://thenewstack.io/web3-developer-ecosystem/

https://consensys.net/reports/web3-report-q3-2021/

https://dune.com/rchen8/defi-users-over-time

https://blog.portion.io/the-history-of-nfts-how-they-got-started/

Disclaimer

This is not investment advice and is for informational purposes only. You should not construe any such information or other materials as legal, tax, investment, financial, or other advice.