Mapping the Landscape of Web3 Venture Capital (Part 2/2)

(A Look Into Portfolios, Competitive Dynamics, Post-Investment Support, Fundraising Activity, and more.)

In Part I, we presented a database that aims to rank the top funds in the web3 venture capital arena across a number of key metrics & differentiators. This is a new tool mapping out competitive dynamics, portfolio construction, investment success, fundraising activity and much more across the expanding web3 VC ecosystem. We outlined a methodology that put emphasis on portfolio unicorns, post investment platform strategy, community & reputation, and other intangibles that help funds stand out in an environment where capital has become increasingly a commodity and founders lean on investors to build alongside them in the competitive arena of emerging technologies.

In Part II, we will dive into the next batch of elite Tier 1 funds who are pushing the industry forward with more than just savvy capital allocations. We will also dive into 2022 fundraising activity, with the most active funds, biggest deals and breakdown sector activity before sharing our final thoughts on the space going into the 2nd half of 2022.

Next up is…

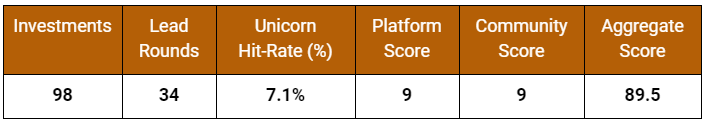

#6 / Dragonfly >|<

Links: Twitter // Portfolio // Team — Tier: 1

Key People: Haseeb Qureshi // Tom Schmidt

Overview

Founded in 2018, Dragonfly is a fund that emerged from the depths of the last bear market. They represent the OG ethos of crypto with an overt strategy to ‘stick to their cyberpunk, hacker-first roots’, a dynamic that seemingly diminishes with each cycle and broader mainstream adoption. This summer, the fund propelled itself into a new tier of crypto asset managers through the acquisition of MetaStable, a $400M hedge fund co-founded by Naval Ravikant in 2014 and one of the oldest investment funds in the industry (Pantera might like a word).

Let’s also take a moment to appreciate the dichotomy in their rebrand, from the simplicity of their new logo, which can be recreated and shared with just three keystrokes: >|< —to the polarizing maximalism of their website.

Portfolio

Dragonfly’s portfolio can be summed up by the overarching theme of DeFi, a break in the trend from many sector agnostic investment strategies that other firms on this list deploy. Over 80% portfolio sit in the DeFi arena, with 50 investments including L1/L2 protocols (ATOM, AVAX, NEAR, CELO) scaling solutions (Matter Labs, Mina), stables (MakerDAO – Rune is a Venture Partner with Dragonfly), DEXs (dYdX, 1inch, Derivadex) and a broad array of infrastructure (Crusoe Energy, Debank) & data providers (Coin Metrics, Dune). In addition to this clear DeFi theme, their portfolio also includes a number of CeFi players (Amber Group, Bybit, Woo Network) from early in the funds lifecycle to more recent early stage NFT bets (Showtime, TRLab).

Competitive Differentiators

Dragonfly is one of just a handful of web3 funds to demonstrate themselves as elite technical thinkers who have both the expertise and ability to build alongside their founders. Technical acumen matters immensely when investing at an institutional scale in a still nascent and dynamic industry and Dragonfly clearly realizes this. In a landscape where capital seemingly flows freely, the answer to the question “What can you do for me post-investment?” earns Dragonfly its place on the cap table. This is a fund full of certified giga-brain builders with a grasp on the evolving technical landscape that a traditional investor or capital allocator alone simply can’t compete with.

2022 Deal Activity

Yet another top fund to have an active first half to the year, with 31 investments year-to-date, the 10th most active crypto-native fund this year by deal count. With less than half of its investments going into Seed rounds (13), Dragonfly is taking a different strategy than others on this list by doubling down on its winners in the bear market. This is evidenced by a number of follow up rounds with established portfolio companies such as Dune (Series A ? B), Babel Finance (Series A ? B), Hashflow (Seed ? Series A), Axelar (Series A ? B), Skolem Labs (Seed ? Series A), Parcel Series A ? Venture) in 2022.

#7 / Sequoia

Links: Twitter // Portfolio // Team — Tier: 1

Key People: Shaun Mcguire // Alfred Lin // Michelle Bailhe

Overview

Sequoia is only the 2nd non-crypto native firm to break the Top 10. Founded in 1972 and amassing a whopping $85B AUM, Sequoia would be a Tier 1 candidate on just about every VC ranking. Their place among the crypto elites is also well earned, having raised a $600M crypto fund earlier this year along with regional investments in India and China’s emerging web3 landscape and investments into dozens of web3 darlings, and participating in some of the industry’s biggest deals of the year.

Portfolio

For this report, we’ll glance past the investments in Apple, Airbnb, Doordash, Instagram or Notion (the software I’m literally using to write this report) and instead focus on the crypto-native bets, which alone put Sequoia among the web3 elites. The firm’s crypto portfolio is noticeably more concentrated than other funds listed here that are entirely focused on the space. It includes a number of calculated growth-stage bets on major infrastructure, exchanges & custody providers and scaling solutions, each with the ability to reach hundreds of millions of builders, traders, and individuals around the globe, including, FTX, Fireblocks, Polygon, Starkware, LayerZero and MagicEden.

Competitive Differentiators

In the sea of early stage funds formed around the 2018 downturn, Sequoia’s competitive edge is much more obvious to both crypto-natives and outsiders than many funds in these ranks. The firm brings a generational track record of success and outsized benefits for founders and LPs alike and there is no reason to believe their $600M foray into web3 will result any differently. Sequoia deploys with a level of size and reputation that brings the unique ability to turn a niche crypto company into a mainstream, global product.

2022 Deals

Opposed to many others on this list investing with an early stage focus into the fringe innovation of our sector, Sequoia’s bread and butter lies at the growth stage of a company’s lifespan, with later stage bets on established companies with revenue and product-market-fit. Leading Citadel’s $1.2B venture round, Fireblock’s $550M Series E, Polygon’s $450M round, LayerZero’s $135M Series A and participating in Magic Eden’s $130M Series B — Sequoia is moving with concentrated size in this arena.

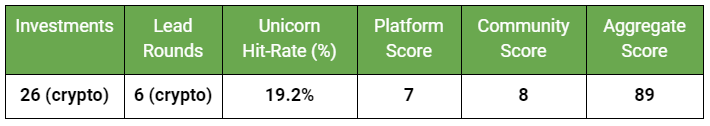

#8 / Variant Fund

Links: Twitter // Portfolio // Team — Tier: 1

Key People: Jesse Walden // Li Jin // Spencer Noon

Overview

Founded in 2020 by Jesse Walden and Spencer Noon, Variant later combined forces with Li Jin from Atelier Ventures in 2021 to merge into its current form— an early stage, thesis driven fund with deep concentrations across 3 major verticals: DeFi, Infrastructure and Consumer web3. Most known for their thesis on the ownership and passion economies, Variant brings a unique creative edge to their portfolio companies as thought leaders shaping the industry. They are also the youngest (< 1 year since Li joined) and most concentrated fund to break the Top 10.

Portfolio

Variant has crafted a calculated and concentrated portfolio over the last couple of years. With a total 41 portfolio companies, the fund has 19 consumer investments, 12 DeFi and 10 infrastructure plays which include such unicorns as Polygon and Worldcoin. Magic Eden and Phantom, both unicorns and key components responsible for Solana’s massive year-over-year user growth, are perhaps its two biggest winners to date. In addition, Variant backs its thesis with a number of investments into web3 creator tools: Sound, Mirror, Foundation, OnCyber, Ceramic, DRAUP and others.

Competitive Differentiators

With a team of writers, inventors, creatives and entrepreneurs to pair with the elite investing chops, Variant embodies what it truly means to be a thesis driven fund in this industry. Having pioneered novel sector frameworks around the ownership economy, they have found a unique edge of focused, consumer expertise in an arena filled with technologists, traders and generalists. As web3 proliferates over the next decade, Variant will no doubt be leading the pack with industry-shifting frameworks and more consumer-centric unicorns.

2022 Deals

Variant has executed 13 deals year-to-date and recently secured $450M of fresh funding to help elevate the fund into elite status. Six of the fund’s seven lead rounds have occurred within the last 8 months showing strong conviction in the depths of crypto winter— a period of time where many industry defining companies and protocols get their first investor checks. Notable investments include seed rounds into Aptos, 3Box Labs (Ceramic Network), Context, Empiric, Koop as well as participating in a rare growth round for the fund with an investment into Polygon.

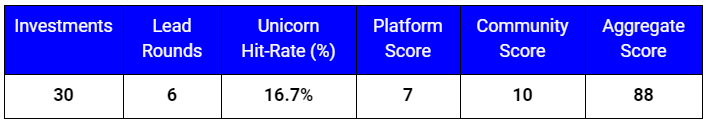

#9 / Electric Capital

Links: Twitter // Portfolio // Team — Tier: 1

Key People: Avichal Garg

Overview

Electric Capital was founded in early 2018 by a group of technologists and entrepreneurs who started a half dozen companies, selling 5 of them prior to launching the fund. It’s another fund that ‘embodies the build alongside our founders’ mentality as much as anyone in the industry. Having raised $1B in fresh capital in March, a $600M liquid fund and a $400M venture fund, Electric is primed to build an enduring portfolio while helping founders scale with its unique combination of entrepreneurial and technical expertise. The fund also publishes one of the best annual reports in the industry, the Electric Capital Developer Report.

Portfolio

Electric’s portfolio includes a host of name brands that have emerged as some of the largest companies in the industry. In particular, Electric has seen success betting on the early foundations of the Solana ecosystem— with multiple rounds into Solana’s leading NFT marketplace, Magic Eden; Solana block explorer, Solscan; as well as the decentralized options/futures market on Solana, Zeta Markets. On top of riding the growth of the Solana ecosystem, Electric has made numerous chain-agnostic bets in DeFi (Frax, dYdX, Coinflex, Tokemak, Aurora) as well as the popular yet still nascent arenas of DAO & NFT tooling (LlamaDAO, Comm, JPG, HeyHey, Hyy.pe) and CeFi investments into Kraken, Genesis Digital Trading and Bitwise.

Competitive Differentiators

Joined only by the likes of Paradigm and Dragonfly in an elite technical class, Electric Capital is architecting the future of this industry alongside the builders they fund. The firm takes this to the next level by offering its invaluable expertise across protocol design (governance, tokenomics, liquidity & custody solutions) community design, & product strategy that goes far beyond simple capital allocation. A lethal combination of deep technical prowess and decades of entrepreneurial experience give the firm another unique moat in a space seemingly saturated with capital.

2022 Deals

Electric’s investment volume had taken a noticeable dip in 2022 despite raising $1B in fresh capital. This is likely a calculated strategy to manage capital more tightly in a down market that is overshadowed by a suspect macro landscape. With just 15 investments year-to-date, 9 went into seed rounds along with being the lead investor into Magic Eden’s highly publicized $130M Series B at a $1.6B valuation.

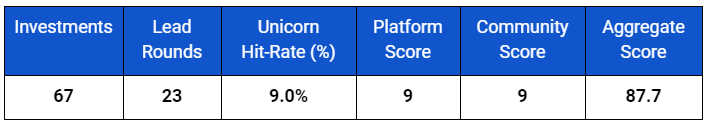

#10 / Multicoin Capital

Links: Twitter // Portfolio // Team — Tier: 1

Key People: Kyle Samani // Tushar Jain

Overview

Multicoin Capital was founded in late 2017 right as the first parabolic move in the crypto markets captured mainstream attention. They are a thesis-driven fund that believes crypto will create the largest one time shift in wealth in the history of the internet. Having gotten their legs under them during the ICO boom/bust, they were established and ready to deploy capital through the entirety of the 2018/2019 bear market cycle when many top funds were just forming. It was here that Multicoin made a large bet in Solana’s Series A and surrounding ecosystem that helped lead to their famed 20,000% returns (Oct 2017 – Dec 2021).

Portfolio

Multicoin hasn’t strayed away from accumulating a diverse group of portfolio unicorns over the last few years— including FTX, Dune, LayerZero, and Worldcoin. They also hold liquid positions in ETH, SOL, RUNE, and other DeFi tokens. Perhaps the most defining focus in their portfolio is Solana. Beginning with its Series A in 2019, the fund has continued to shovel capital into the ecosystem with follow-on investments in Solana’s token equity round in 2021, along with investments into Solcan, Saber, Drift, Grape, MarginFi, Metaplex & Clockwork. It is because of the strong growth in the Solana ecosystem from a developer and user perspective that the fund sits on this list. The Solana trade will go down as one of the best the industry has seen since buying BTC itself in 2009.

Competitive Differentiators

Beyond deploying capital into promising companies aligning with their thesis, the fund isn’t well known for a robust post-investment platform strategy or hands on technical building with their founders. Multicoin’s competitive differentiator is reaching deep conviction in enduring themes before they become the flavor of the week.

Multicoin has however received some negative backlash from builders in the community for dumping large, material supplies of L1s and Altcoin tokens onto the public markets after receiving favorable private market pricing with no lockup. This dynamic isn’t unique to Multicoin as many funds in the space have been accused of this, especially in the Solana ecosystem, but perhaps due to its outsized success and notoriety in that ecosystem, Multicoin has been the poster child of the alleged grift.

2022 Deals

Ahead of the aggressive market downturn in Q2, Multicoin had its busiest quarter to date as a firm in Q1 with 19 deals. They’ve also showed outsized capital commitments to their portfolio companies having led 18 of their 32 deals from — FTX, Hivemapper and 3Box Labs’ Series A’s, to early seed investments into array of NFT, DAO and web3 tooling/infrastructure and yet another alt-L1 with Sei. The combination of volume and conviction put Multicoin into elite status yet again this year.

2022 Fundraising Activity

The web3 fundraising environment has been littered with lessons this year— for founders and investors alike. Following the high-flying, post-covid, money-printer-go-brrr cycle, the macro landscape shifted— be it the continued interest rate hikes, geopolitical conflicts across the globe, or looming threat of recession in the US, public market valuations have tumbled causing a cascade of market-wide repricing in private markets that is still ongoing.

While some large funds have been affected by the existential fallout in the crypto markets (3AC, Galaxy, Delphi, & Hashed), the top venture funds have been a ray of stability and enduring confidence by consistently deploying capital. With a conviction to their thesis’ and timely capital raises, they not only live to invest another day, but are executing sizable bets in the depths of crypto winter that could solidify them as kingmakers next cycle.

VC firms invested $33 billion into crypto and web3 startups in 2021 and are currently on pace to nearly double that in 2022. Despite the broader market wreckage, funds have deployed a total of $30.3B in funding in the first half of 2022 alone.

Most Active Funds

Source: Crunchbase, 9/4/2022

*List excludes non-crypto-native funds: Sequoia, a16z, LVP, TCG, Slow, USG, Ribbit, USG

Biggest Deals

Source: Messari Fundraising Database, 9/4/2022

Key Takeaway: Deal size has slowed down since the aggressive deleveraging earlier this summer with zero deals breaking the Top 10 in size of capital raised since the Terra/LUNA/UST (May) and 3AC fallout (June)

Fundraising by Sector

Source: Messari x Dove H1 Report, 9/4/2022

Key Takeaway: Infrastructure and CeFi are showing signs of sector maturity with a stronger focus on later stage growth rounds. NFTs & Web3 are still in their early discovery phases with investors shoveling capital into the gaming vertical. DeFi funding has cooled off after heavy investment inflows early in the bull cycle and continued uncertainty around the regulatory landscape.

Final Thoughts

- Many crypto native funds found a sweet spot for their latest raises, not too big to diminish returns but large enough to move with size — this is the $400M-$600M range seen with Multicoin, Variant, Framework, Pantera, Dragonfly, Binance, Seven Seven Six, Bain Crypto, Sequoia, and a few others. It will be interesting to see how these funds return capital vs the a16z, Paradigm, Electric Capital, each raising between $1-5B.

- Many of the top funds were formed in the depths of the 2018 bear market. It will be interesting to see if any new ones forged in this bear market will emerge as power players in the next cycle

- Gaming has been the top vertical in terms of dollars raised in 2022. I believe crypto-native gaming will be the catalyst to bring in the next wave of new market participants – similar to NFTs the last couple years

- Community engagement and technical acumen play a bigger role in securing spots on competitive cap tables than in the traditional web2 VC landscape

- Down rounds are only getting started and will continue into 2023 as companies who have burned through their cash (following raises at inflated valuations) seek capital at lower (more realistic) valuations, and eager VCs mark down their investments, toppling expected returns for LPs

- A number of investment DAOs have emerged over the last cycle with one even breaking into the Top 50 rankings. Honorable mention to keep your eye on going into the next expansion: OrangeDAO, Global Coin Research (us!), MetaCartel, FlamingoDAO, PlsrDAO, and many more.

Sources:

- Crunchbase

- Messari Fundraising Database

- Messari x Dove Metrics H1 Report

- Fund websites (linked above)

Disclaimer: The views and opinions expressed in this report and accompanying database are not to be taken as investment advice for fact. There are inherent biases when choosing which metrics to rank groups, as well as potential inconsistencies across the multiple data providers that were sourced. You may not agree with ranks, tiers, metrics or categories used by the author, and that is fine. The author is not currently employed at any funds or companies listed or ranked in this report or database.

[End Part 2/2]

Written by: Cody Garrison // In collaboration with: Global Coin Research