Bitcoin Artifacts – A Narrative or The Bitcoin Renaissance?

Summary and Takeaways:

- From Zero to One: Bitcoin Artifacts attracted tons of attention in the early months of 2023, however the current infrastructure surrounding bitcoin blockchain was not prepared for it. Despite this, innovation and building happened quickly, in just 3 months we have already Analytics Portals, Artifacts Aggregators, as well as service providers which reduce the friction in order to start building and minting Artifacts

- Not your typical JPEG: Bitcoin Artifacts (inscriptions), although similar to NFTs given the metadata and art attached to them, possess unique characteristics as well. These include the 100% on-chain metadata inscription, the lack of an additional token standard as well as the lack of smart contract capabilities. Bitcoin Artifacts are positioned as a new type of digital asset in which new use cases are about to be discovered

- Beyond Euphoria: After initial traction with elevated levels in volume and activity, volume and transactions has decreased. However, the seed has been planted: users, builders and creators have started to put their eyes again on Bitcoin while companies and protocols from other blockchains are figuring out ways to interact with this nascent ecosystem

What they Are? Ordinals, Inscriptions, Artifacts, All the same?

People in the crypto community have used the terms “Ordinals”, “Inscriptions”, or “Bitcoin NFTs” interchangeably. But are they all the same? In our opinion, no

The Ordinals concept came from the “Ordinals Theory”. This was created by Casey Rodarmor, which he proposes that each individual satoshi ever created has an order and so it’s possible to label, track and identify across the blockchain from the moment it is minted. The implication is that each satoshi obtains a certain level of non-fungibility, as it’s possible to assign some sort of individual rarity to each one (provenance, time that has passed since it was minted, or any other sort of characteristic). As a practical example, the 230th satoshi would have an ordinal number of 230.

Inscriptions refer to satoshis on which something (a piece of metadata) has been inscribed (it can be an image, text, or video). It’s important to highlight that under this “concept”, there is not much importance to the order of each satoshi (Ordinal’s Theory). This development has been possible thanks to Tapscript (introduced at the Taproot upgrade) as well as SegWit, which allows a maximum size of 4 MB of metadata.

Individual Inscriptions can adopt the Ordinals Theory to enhance the non-fungibility aspect; that is what the crypto community has called “Bitcoin NFTs”, and we prefer to call them Bitcoin Artifacts to avoid further confusion with Ordinals and Inscriptions separately.

Are they just (normal) NFTs on Bitcoin?

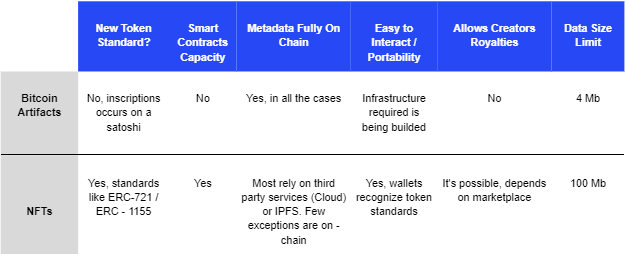

There are certain characteristics that make Bitcoin Artifacts from traditional NFTs on other blockchains:

- Metadata: Most traditional NFTs host the metadata using cloud servers (Google Drive, Dropbox) or IPFS. However, for Bitcoin Artifacts, the metadata inscribed in the satoshi is completely stored on chain.

- Standard Needed: Traditional NFTs rely on a new token standard to exist (ERC-721, ERC-1155); however, for Bitcoin Artifacts, that’s not the case: they live on each satoshi and do not need a new token standard to exist.

- Infrastructure Needed: By using specific standards to recognize traditional NFTs, the current wallet and custodial infrastructure allow easy identification and visualization of a specific NFT. In the case of Bitcoin Artifacts, existing infrastructure was not prepared to allow the individual selection of satoshis in a wallet. However, as we will see later, the infrastructure needed to support Bitcoin Artifacts is evolving.

- Use of Smart Contracts: Smart Contract Platforms like Ethereum have the ability to run smart contracts and DApps so that traditional NFTs are composable and can be used with other smart contracts, including those that allow royalty payments to creators. This is different for Bitcoin Artifacts, where the creation of smart contracts on the Bitcoin network is close to impossible and royalty enforcement is technically difficult.

- Pricing & Rarity: Traditional NFTs rely on metadata and traits to assign a certain rarity index to each NFT in a collection and, in most cases, use this to arrive at a specific valuation. Although newer Bitcoin Artifacts collections can work as a whole and have those traits, another important component for Artifacts is the timestamp and provenance (historical significance of the block of the satoshi) attached to the satoshi. As an example, the first 100 Artifacts inscribed would be more valuable given this historical attribution.

- Quantity: Bitcoin Artifacts depend on the number of satoshis already created, as they are inscribed in each one. The maximum number of Bitcoin Artifacts to be created is 21 million Bitcoins x 100 million satoshis / Bitcoin.

How are they created?

Apart from the differences described above, Bitcoin Artifacts also face some technical difficulties in the minting and inscribing processes. The minting process for traditional NFTs (such as those running on Ethereum or Solana) is currently well documented and mature, and even some platforms allow lazy minting. However, for Artifacts, the process is not so easy yet.

Initially, Artifacts could only be mined by those users who ran a complete Bitcoin node by using the ord app and running some command lines. The user needs to have some sats (preferably on another wallet) to pay for gas fees and do the inscription process.

Given this technical complexity, new tools are emerging to improve the inscription experience for the (non-tech-savvy) user. We will explore more about them in the following sections.

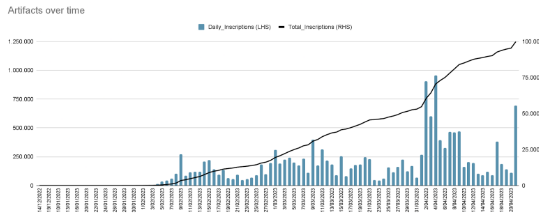

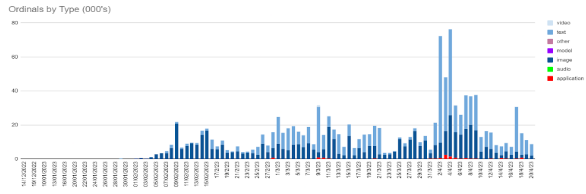

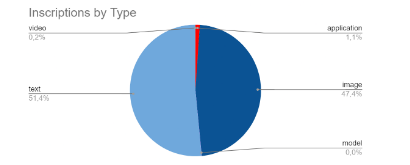

Traction: 1MM and beyond

What started as a small movement back in December ‘22 has grown exponentially in the first quarter of 2023, with the number of Artifacts (inscriptions) surpassing the first 1 million inscriptions mark during the first week of April. At the time of this writing, more than 1.104 MM inscriptions have been created on the Bitcoin network.

Source: Dune

This impressive growth in activity and traction generated +170 BTC in fees paid to the network, an equivalent of US$5.3 MM. This, although noteworthy based on the early activity Artifacts, is relatively small when we compare it with the fees generated on ETH NFTs (in which just on OtherDeeds Mint Day, the network burned +$150MM) .

Source: Dune

Source: Dune

Collections: Artifacts have attracted part of the Bitcoin native community but also caught the interest of OG traditional NFT projects from other ecosystems

Apart from individual Bitcoin-based Artifacts in which only one piece has been inscribed as its own, we are starting to see collections being built since March. When talking about them, we can separate them into two different groups:

Bitcoin Native Collections:

Bitcoin Artifacts started existing as individual “inscriptions”, but we are starting to see the formation of new groups of Artifacts under one brand, project, or team. Some of the most well-known collections so far are:

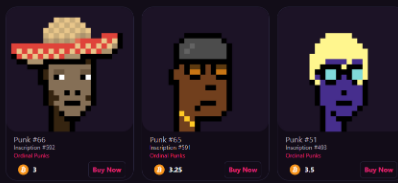

- Ordinals Punks: As a tribute to one of the OGs ETH collections, CryptoPunks, this artifact collection consists of 100 pieces minted as part of the first 650 “inscriptions” ever. The art is a 192×192 PFP similar to Crypto Punks.

Given the lack of infrastructure at the moment, the collection started trading on Discord servers and Google Sheets at the beginning. At the time of writing, the floor is 3 BTC.

- Taproot Wizards: This collection also has historical (unique) value as it came with the largest block size and transaction in history (nearly 4 MB), representing part of Bitcoin history. The art is based on hand-drawn NFT wizards made by independent artist Udi Wertheimer

- Bitcoin Shrooms: This collection starts at Inscription #19, positioned as one of the earliest in Bitcoin artifact history with significant historical provenance.

Despite the popularity and excitement for the collection, the project has not minted or opened sales yet, and their Discord is temporarily closed, creating even more hype. On the other hand, the collection is expected to contain 210 Artifacts.

So far the project timeline has been:

- The project started in October ‘22 with a Genesis tweet.

- At Blockheight 772919, the first Bitcoin Shrooms inscription is published (#19 overall):

first inscription - At Blockheight 773778, the complete collection is published and revealed as a list of hashes.

- Bitcoin Rocks: Following the iconic and one of the first collections on Ethereum, Ether Rocks, Bitcoin Artifacts has its own tribute collection called Bitcoin Rocks. The supply of the collection is 100, and according to the team behind it, floor is 7.4 BTC

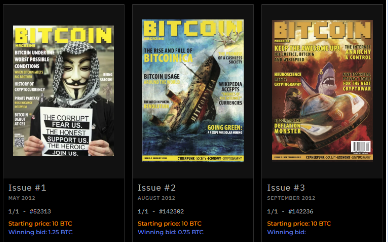

- Bitcoin Magazine: One of the OGs and most historical crypto and bitcoin-related publications decided to launch its first-ever artifact collection: “https://covers.bitcoinmagazine.com/.” This collection of 23 pieces features the 23 covers of the printed version of the Bitcoin Magazine and was sold on a trust-minimized Dutch auction through the artifact-based marketplace Gamma. With the acquisition, each winner will receive a physical copy of the edition they purchased. At the time of this writing, the collection holds a floor of 0.2 BTC.

Different from what we are used to seeing in other blockchain ecosystems, the typical collection size for Artifacts is much smaller, with not many collections going with 1,000 items.

Existing NFT Projects interacting with Artifacts:

Apart from collections that native to the Bitcoin network, the ecosystem has also attracted some of the most reputed collections that started on other ecosystems:

- TwelveFold by YugaLabs: YugaLabs, the team behind BAYC, launched their own Bitcoin based Artifacts, in a collection named “TwelveFold”. The team decided to go with an auction on this 300-size collection (288 items were auctioned and 12 kept for donations, other events). According to On Chain Data, the team made $16.5MM (733 BTC) with auctions between 7.12 BTC – 2.25 BTC. At the time of this writing, the collection had made 820 ETH in trading volume and has a floor price of 25.5 ETH (1.79 BTC), according to Ordinals Market

- OnChainMonkey (OCM): The first full-on-chain collection in the Ethereum network decided to also interact with Bitcoin Artifacts. The team behind Metagoods inscribed 10,000 artifact NFTs into a single inscription. With this move, the collection becomes the first 10K-size collection on Bitcoin. The Artifacts will be airdropped to holders of the OCM original collection.

- DeGods: One of the leading collections in the Solana Ecosystem (which recently migrated to Polygon) decided to burn 535 NFTs and move them to the Bitcoin network. The collection was inscribed on March 17th and currently has a floor price of 0.76 BTC and a total volume of 56 BTC.

Trading Activity:

Secondary market activity was fueled by excitement about inscriptions as a new type of digital asset on top of Bitcoin increased during 1Q 23. At the time of writing, there have been over 65,000 transactions totaling over $22.01 million in trade volume.

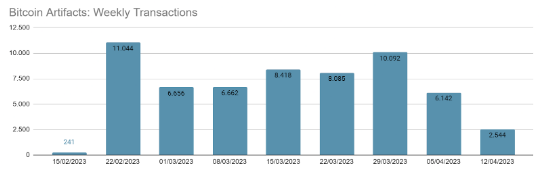

The initial excitement that helped develop richer infrastructure led to ATH trading volumes back on February 23 with a peak of +11K transactions, and since then transactions have decreased to levels between 6K and 10K.

Source: Dune

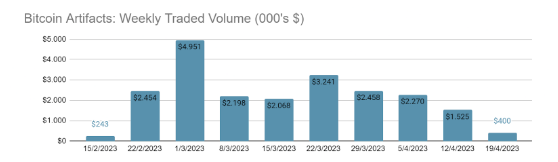

Trade volumes have decreased sharply since the peak during the first week of March ($4.95MM weekly volume). At the time of this writing, the volume had decreased to levels around $1.0-$1.5MM

Source: Dune

Although this could mean a loss of interest in the vertical, the activity levels at the infrastructure level and the beginning of initiatives to onboard more people to Bitcoin Artifacts are in their early stages and are being developed very quickly, with the potential to continue attracting relevant players from other blockchains.

The Ecosystem: Who’s Who?

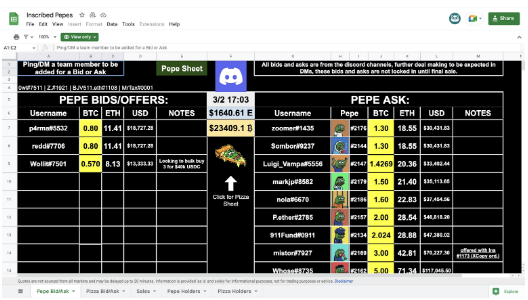

In the initial days of Artifacts, the infrastructure required to interact with, collect or trade them was lagging. This caused the first trades to be done on a P2P basis, utilizing Discord, Google Spreadsheets, and third-party parties to escrow the deals.

Source: Internet

Furthermore, as we mentioned earlier, wallet infrastructure was also not prepared to handle and identify specific satoshis. On the minting side, given minting complexity, a new type of service called Inscription as a service was needed.

Infrastructure is being built quickly

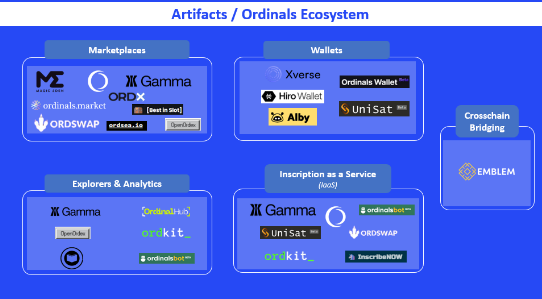

Given the interest in Artifacts, innovation started happening. Below, you can find an ecosystem map around Artifacts.

Note: The presented map may not reflect a 100% complete landscape of all companies, projects, or protocols in the ecosystem, and was created with the available information at the time of the writing

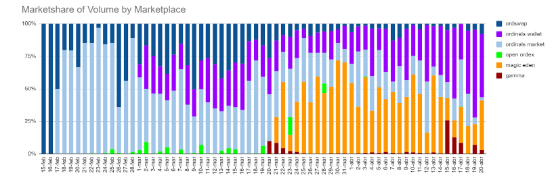

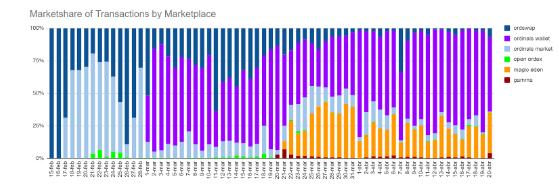

Marketplaces: The infrastructure around marketplaces has developed quickly, evolving from P2P deals on an OTC basis to more than five marketplaces. Furthermore, we had already seen the entrance of well-established players from other blockchains: Magic Eden, creating a more multi-chain ecosystem.

The move seems wise; the Solana-based NFT marketplace managed to obtain +50% at its launch on the Bitcoin network and, at the time of this writing, has facilitated the second most transactions (32%) and traded volume (30%).

Source: Dune

Magic Eden’s bet on Artifacts goes one step beyond, as the company decided to launch an “Ordinals Creator NFT Launchpad”, With this move, the company expects to leverage its proven UX, know-how, and resources to help expand the Artifacts Ecosystem as well as onboard creators in “order to grow a larger market for tokenized assets on Bitcoin.”

On the other side, it’s worth mentioning OpenOrdex, the first open-source and fully decentralized marketplace. Different from other marketplaces, the platform uses partially-signed Bitcoin transactions (PSBTs), in which the user creates a PSBT with its desired price and then accepts it and shares it with the network. A buyer, then, can accept, sign (complete the signature), and settle the deal. With this process, listings and trades occur on a P2P basis without incurring marketplace fees.

Explorers and Analytic: In order to increase collector activity and traded volume, a robust set of discovery and analytical tools is needed so users can research inscription activity and track collections. Platforms like Gamma, OpenOrdex, and Ordinal Hub, among others, are working in that direction, helping users identify the specific sat and its ordinal position, id, blockchain weight, collection supply, and other characteristics.

Inscriptions as a Service Provider: The process of inscribing an individual satoshi can be complex for the normal user as it’s required to run a complete Bitcoin node. In order to simplify this process and provide a seamless experience for users to interact with, companies like OrdinalsBot, Gamma, and UniSat were born.

Wallets: At the beginning of the Artifacts movement, wallets lacked the support of individual satoshi selection, a key feature in order to interact with them and send them to other users. However, this has changed, and now wallets like HiroWallet or Xverse support and detect ordinals.

Cross-Chain Bridging: Apart from the growing interest in ordinals and native collections, we already see cross-chain interactions between Bitcoin Artifacts and other blockchain NFTs.

For example, the Ethereum-based NFT Lending Protocol Arcade, was able to make possible the first ever Bitcoin NFT-backed loan, which was backed for an Ordinal Punk and settled for 32 ETH, making much more composable Bitcoin native Artifacts.

The infrastructure and tools around Bitcoin Artifacts is moving and advancing from its early stage.We could expect that tools and infrastructure to support seamless experiences, as demand from users and collectors increases.

This can be positively benefited by the synergies and investments of well-established firms in the Bitcoin ecosystem. As an example, the bitcoin mining firm, Luxor, acquired Ordinals Hub, one of the leading analytics platforms in the Artifacts Ecosystem.

What’s next? More than just “NFTs on Bitcoin”?

Bitcoin Artifacts are in their infancy, but they have managed to catch the attention of the overall crypto community. This led to the formation of new communities around Artifacts and attracted players from other ecosystems, which, according to some members of the crypto community, led to the rise of a new “Bitcoin Renaissance”, pushing the boundaries of what is possible to build on Bitcoin and opening the door to a new wave of innovation led by exciting and new use cases.

Given the immutable and censorship-resistant characteristics of Bitcoin as well as its status as the “OG” crypto asset, it’s possible that the art and Artifacts created in the network can be perceived as treasured collectibles: a permanent digital piece with a strong focus on ownership of the assets and their provenance rather than being used for trading with a profit expectation. This may explain the low levels of trading volumes and the elevated minting and bidding costs paid by collectors in recent auctions and mints. If this is true, it’s possible that OG artists can also move and decide to interact with this network, trying to connect with art collectors and the strong Bitcoin native community.

Furthermore, the on-chain nature of these Artifacts and collections has made visible and increased the importance of on-chain art, in which the complete set of metadata is “inscribed” on-chain. Collections like On Chain Monkeys were one of the earliest to explore this on the Ethereum chain, and it might be possible that more collectors consider this when acquiring a digital asset and creators consider this instead of relying on third-party services.

On the other hand, there might be nascent use cases, including on-chain decentralized censorship-resistant media, in which the information is inscribed as an ordinal. This and other use cases might push forward what some members of the Crypto Community call the Bitcoin Renaissance.

One way or another, one thing is true: Artifacts have started a flare of curiosity, and it might be possible that as with NFTs some years ago, a new wave of innovation is about to ignite.

[This article has been written and prepared by Renato Martinez and GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.]

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

*****