The Effectiveness of L2 Airdrop

Airdrop has become a popular project tool to distribute tokens to potential users. However, the value and impact of airdrops have been a topic of debate within the cryptocurrency community. Some argue that airdrops are merely a marketing gimmick that has no real impact on the success of a project. However, others believe that airdrops can be a powerful way to incentivize users to engage with a project and create a community around it.

In this report, we will explore the effectiveness of airdrops specifically in the context of two Layer-2 Ethereum scaling solutions: Optimism and Arbitrum. We will analyze the impact of these airdrops on user engagement, token price, developer activities, and overall project success. By examining the data and trends of these airdrops, we hope to provide valuable insights into the effectiveness of this marketing strategy in the current Crypto landscape. So, let’s dive in and see if airdrops are truly useless or if they can provide real value to the projects and users involved.

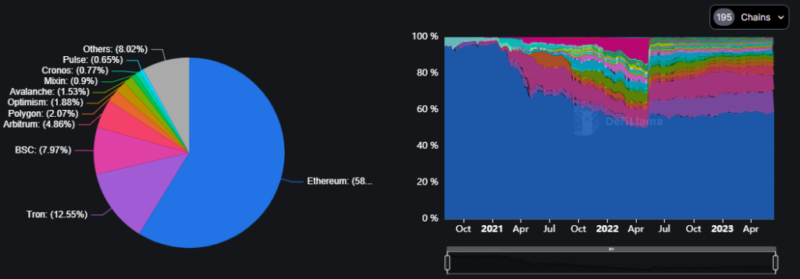

Network Activity Before and After the Airdrop

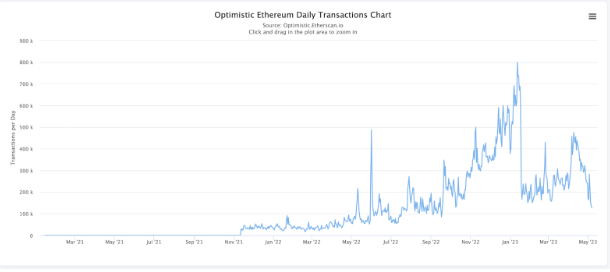

Source: optimistic.etherscan.io

The Unique Addresses Chart for both networks has experienced a parabolic rise since their inception, primarily due to the high gas fees on the Ethereum Mainnet compared to conducting transactions on Layer-2 solutions. Optimism saw a significant uptick in May 2022, with the unique addresses chart sharply increasing from 350,000 to 800,000. Although the primary reason for this increase coincides with users claiming the OP airdrop, the number of active addresses steadily grew by 3.2x from 850,000 to 3 million addresses in April 2023.

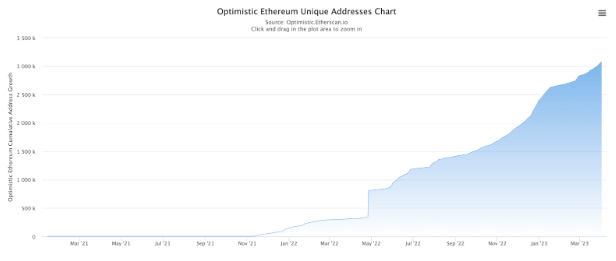

Source: arbiscan.io

Similarly, Arbitrum’s unique addresses have followed an upward trend. Notably, in July 2022, the network was upgraded to Nitro, which gave a boost to users, reaching the 1 million milestone. The number of unique addresses has since risen fourfold, with the latest strides occurring when the $ARB token launched, boosting the number of unique addresses to 4.5 million.

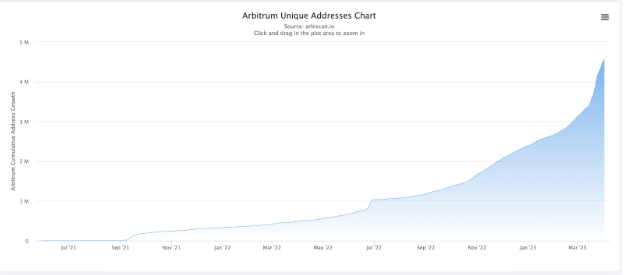

Source: arbiscan.io

Regarding daily transactions, both networks exhibit an upward trend. For Arbitrum, the numbers increased from 300,000 daily transactions and peaked at 2.7 million transactions per day, after the airdrop it is steady at 1 million daily transactions. In contrast, Optimism experienced a sharp decline in January 2023 to an average of 300,000 daily transactions. The decline in OP is attributed to the end of Optimism Quest Round 2, which means that the farmers who had been contributing to the growth in the number of transactions are no longer participating.

Considering the observed network activity trends, it becomes apparent that airdrops have substantially contributed to enhancing user engagement on both Optimism and Arbitrum networks. The implementation of airdrops has effectively augmented the quantity of unique addresses within each network, while simultaneously promoting a general escalation in daily transactions

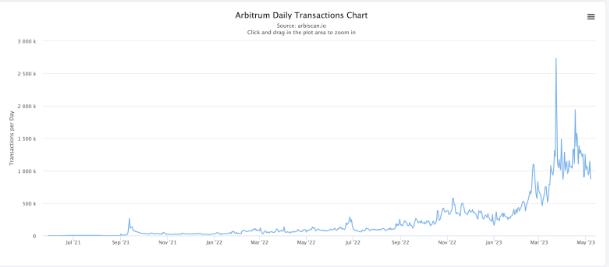

TVL Growth

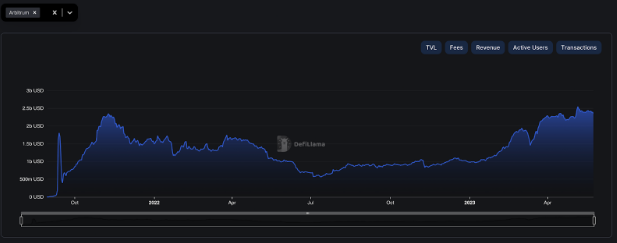

The progression of Total Value Locked (TVL) for Arbitrum reveals an intriguing trend. Throughout 2022, the TVL experienced fluctuations primarily due to an exodus back to Layer-1 (L1) platforms. This shift was driven by several factors, including market uncertainty caused by the fall of Terra Luna (L1), L1 downtime, bridge hacks, and the overall crypto winter. Despite these challenges, the TVL for Arbitrum demonstrated resilience and adaptability.

Source: Arbitrum TVL from DefiLlama

Following the token airdrop, Arbitrum’s TVL doubled and peaked at around $2.5 billion, signaling a strong vote of confidence from the market in the platform’s ecosystem. The rapid increase in TVL demonstrates that airdrops can effectively incentivize users to engage with Layer-2 platforms, ultimately contributing to their long-term success.

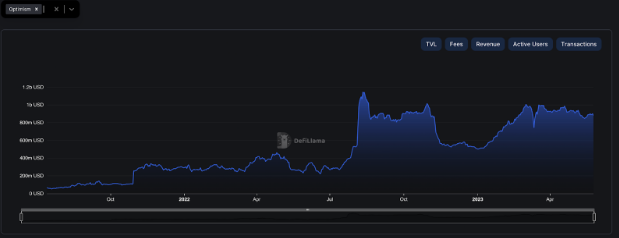

Source: Optimism TVL from DefiLlama

On the other hand, Optimism experienced a significant boost in TVL after introducing $OP token for Aave users in early August. This incentive doubled the platform’s TVL from $600 million to nearly $1.2 billion. However, following this initial surge, the growth metrics for Optimism’s TVL plateaued. This indicated that while airdrops and incentives can effectively drive short-term growth, sustaining this momentum may require additional strategies or improvements to the platform’s features.

To address this challenge and maintain long-term growth, Optimism introduced the Retroactive Public Goods Funding program. This initiative aims to support the development and maintenance of public goods within the Optimism ecosystem, ensuring a robust and sustainable infrastructure for the platform. By investing in public goods, Optimism aims to foster continued innovation, ultimately contributing to the platform’s sustained success and the broader Layer-2 landscape.

Post Airdrop Analysis

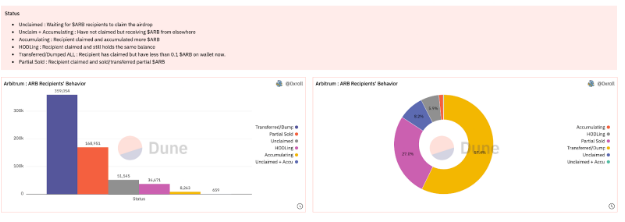

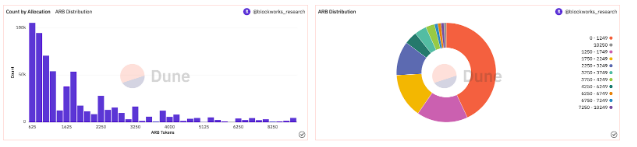

Source: Dune Analytics, 0xRoll

A pivotal question to consider is: what happens after the airdrop? Analyzing data from the Dune dashboard curated by 0xRoll reveals insightful trends regarding the behavior of recipients in the Arbitrum network. Approximately 57.4% of recipients transferred their tokens, and an additional 27% partially sold their allocation. Therefore, an estimated 84.5% of recipients liquidated at least some portion of their airdrop. While a smaller fraction of recipients chose to hold or accumulate their airdrop, this group is significantly outnumbered by those who opted to sell.

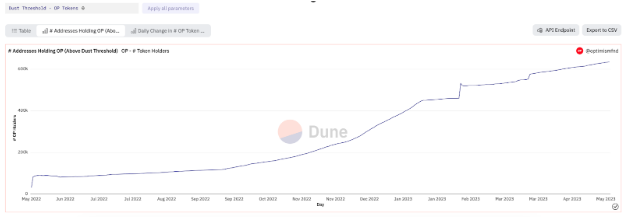

Source: Dune Analytics, Optimism Foundation

On the Optimism network, we must infer the number of recipients who liquidated their tokens based on the residual balances or “dust” in their wallets. Following the first round of airdrops, the number of holders peaked at 90,000, but within 17 days, this figure had decreased by 10% to 81,000. A similar trend was observed after the second round of airdrops in February 2023, with the number of holders dipping by approximately 2%.

This pattern presents a fascinating phenomenon warranting further exploration. The behavior of airdrop recipients raises questions about the broader implications for the Layer-2 networks involved. Does the inclination to liquidate airdropped tokens indicate short-term interest fueled primarily by the prospect of immediate gains? If so, why are Optimism recipients more hesitant to dump the airdrop compared to Arbitrum’s recipient? Do OP holders have more confidence in their assets going up than Arbitrum?

Price Impact

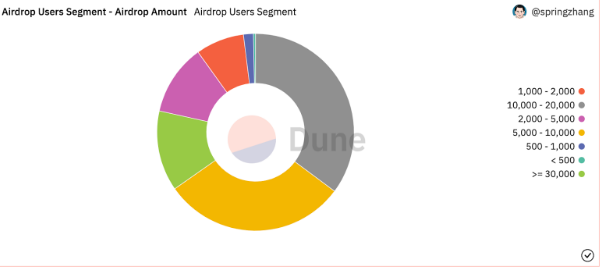

Optimism (OP) has a circulating supply of 314,844,141 OP coins and a maximum supply of 4,294,967,296 OP coins. Users of the platform can receive a maximum airdrop allocation of 30,000 OP. If sold at the all-time high (ATH) price of $3.22, which occurred in February 2023, this allocation would be worth nearly $100,000. However, the average holder received around 1,000 OP, which, if sold at the ATH price, would net them $3,000. It is worth noting that the ATH for the OP token did not occur immediately after the airdrop; rather, it happened almost a year later. This suggests that the airdrop had a more sustained, long-term impact on the token price.

Source: Dune Analytics for Optimism, springzhang

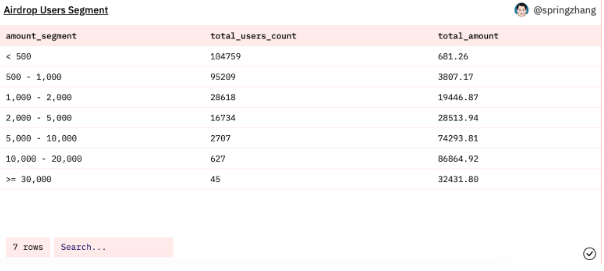

Arbitrum (ARB) has a circulating supply of 1,275,000,000 ARB, with its total supply and maximum supply capped at 10,000,000,000 ARB. The maximum airdrop allocation for users is 10,250 ARB, with only 0.7% of users receiving this amount. On average, recipients were awarded 1,249 ARB, which, if sold at the ATH of $1.79, would yield approximately $2,200. Unlike OP, the ARB token is relatively new to the market and is still in the process of establishing its price dynamics.

Source: Dune Analytics for Arbitrum, blockworks

Although the price impact seems to be more lenient on the ARB side, we believe this is because Arbitrum launched in the market recovery period where OP launched in the beginning of the bear market. Additionally, In the case of OP, the airdrop appeared to have a more prolonged influence on the token’s value, with the ATH occurring nearly a year after the airdrop. In contrast, ARB is still in the early stages of price discovery, and the full impact of the airdrop on its value remains to be seen.

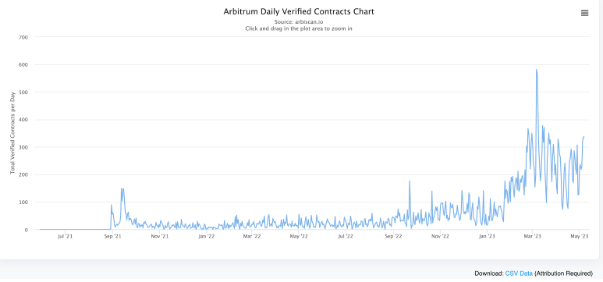

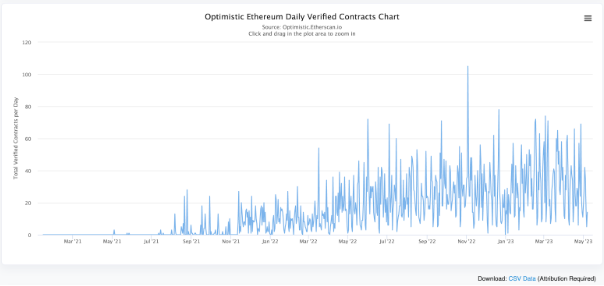

Number of Verified Contract Before VS After the Airdrop

Source: arbiscan and optimistic.etherscan

Verified daily contracts offer valuable insights into the overall activity and development taking place on the Ethereum network. A high number of verified daily contracts signifies a thriving ecosystem characterized by ongoing innovation and growth.

There is a notable disparity between the number of verified daily contracts for Optimism and Arbitrum. Even after the airdrop and implementation of public goods funding on Optimism, the number of deployed contracts appears to have plateaued. In contrast, Arbitrum sees almost five times more activity, with around 300 contracts deployed daily compared to Optimism’s 60 contracts per day.

While there is no definitive explanation for this difference, one possible factor is the contrasting approaches to contract deployment taken by the two platforms. In September 2021, Arbitrum began allowing projects to deploy their contracts freely. Optimism, although had been live for a longer period but maintained a more restrictive approach, with only a limited number of dApps permitted to go live. This closed network was eventually opened up in December 2021, three months after Arbitrum’s decision to allow free deployment.

This timeline suggests that developers prefer platforms where they can experiment and reach their target audience as early as possible. As a result, Arbitrum may have benefitted from an initial network effect, attracting a greater number of developers and projects due to its more open approach to contract deployment. This could be one reason why Arbitrum’s daily verified contract numbers are higher than those of Optimism.

Is the airdrop effective?

The airdrops for both Optimism and Arbitrum have demonstrated varying degrees of effectiveness in promoting user engagement, driving token prices, and encouraging overall project success. The data suggests that while airdrops can indeed contribute to short-term growth and heightened interest in a platform, their long-term impact may depend on a variety of factors, such as the network’s approach to governance and the implementation of additional incentives or improvements to maintain user engagement.

In the case of Optimism and Arbitrum, the airdrops not only increased the number of unique addresses and total value locked on the platforms, but they also had a tangible impact on the price of their respective tokens. However, the long-term effects on user behavior and the broader Layer-2 ecosystem require further investigation.

As the crypto landscape continues to evolve, it will be interesting to observe how airdrops and similar strategies are utilized and refined to foster user engagement and project success. As these case studies demonstrate, the effective use of airdrops involves a delicate balance of incentivizing users in the short term, while also planning for sustainable growth and development in the long term. Understanding this balance will be crucial for future projects seeking to leverage the power of airdrops in their growth strategies.

[This article has been written and prepared by zkCyborg and GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.]

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

*****