Can any Layer-1 blockchain overtake Ethereum?

Since the inception of Ethereum, Layer 1 (“L1) blockchains have been one of the most popular investment verticals in crypto. Among the top 20 cryptocurrencies by market capitalization, over half are native tokens of L1 blockchains. Indeed, the “alt L1” narrative was a key theme for both the 2017 and 2021 adoption cycles. Fueled by overwhelming demand for Ethereum blockspace, many investors and users flocked to the new, shiny L1 with higher capacity and lower fees.

However, a few years after the peak of the 2021 alt L1 narrative, Ethereum still reigns as the de facto L1 blockchain. Many other L1s look like ghost towns, suffering from stagnant or declining user growth.

Nevertheless, new launches persist. Aptos and Sui – two large L1s that launched over the past year – command a combined fully diluted valuation of over $12 billion at the time of this writing. Several upcoming launches are on the horizon too, some with nine or ten-figure private round valuations. In addition, several existing L1s still have strong communities that are confident they can grow to rival Ethereum.

The alt L1 debate still looms large. Therefore, we partnered with KrASIA to answer a commonly asked question by readers: Can any Layer 1 blockchain overtake Ethereum?

Overview of L1s

To unpack that question, we review the history of L1s and areas where Ethereum leads. For the purposes of this report, we limit the scope of L1s to generalized, permissionless smart contract blockchains – so-called “ETH killers.”

The rise of L1s arguably stemmed from Bitcoin’s limitations. Bitcoin’s original purpose was to effectively function as a trustless, peer-to-peer electronic cash system. As the asset itself became progressively recognized as a legitimate currency, developers started to tinker with decentralized applications such as creating alternate digital currencies on top of Bitcoin. But Bitcoin does not adequately support the development of other applications on its platform, mostly due to its limited scripting language and a social layer reluctant to add complex features on top of the network. Multiple prior efforts to create applications on top of Bitcoin have stalled.

Ethereum was launched to fill this gap. It was the first widely recognized blockchain to have a Turing-complete programming language, drastically expanding the design space for decentralized blockchains.

Like Bitcoin, Ethereum’s core culture prioritized decentralization over scalability. So when the adoption of Ethereum grew, such as during the ICO boom in 2017 or DeFi summer in 2020-2021, the network quickly hit throughput limits. The network could get clogged for hours, with gas fees skyrocketing and pricing out a lot of users. At times, a simple token transfer could cost $150 in transaction fees. Developers were reluctant to increase throughput limits lest risk “centralization creep” in the protocol.

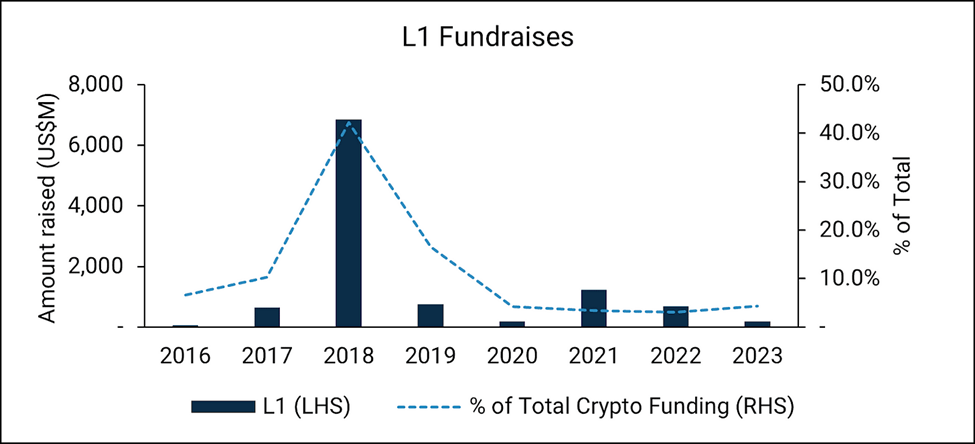

Hence, when Ethereum hit scalability issues, hype for alternative L1s emerged. During the ICO boom, blockchains like EOS, Tezos, and Cardano raised hundreds of millions of dollars, promising faster L1 architecture. Many of the alt L1 whitepapers used in fundraising cited Ethereum’s low TPS (transactions per second) and limitations. The same pattern played out to a lesser extent in 2021. As seen in the below chart, the peak of L1 fundraising coincides with strong crypto adoption.

State of the Market

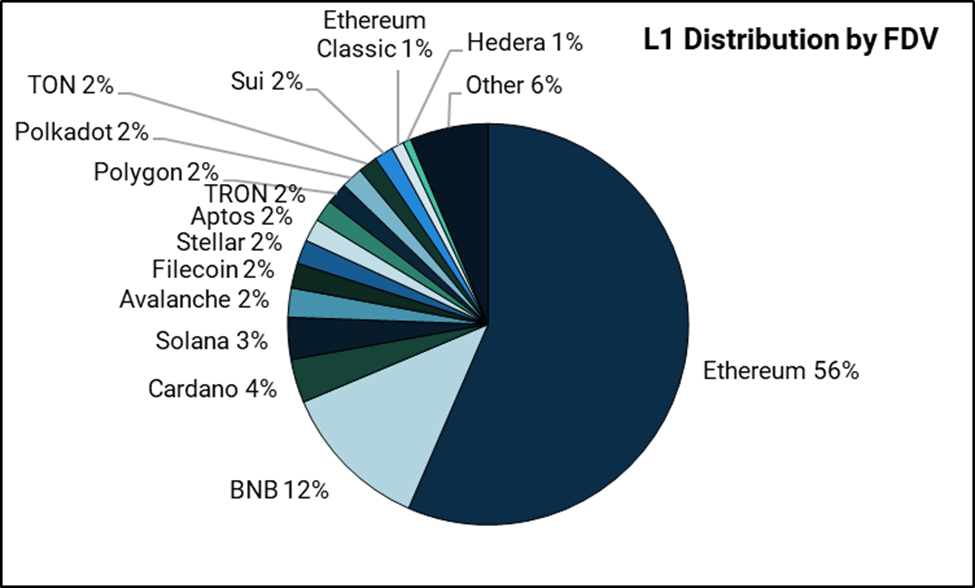

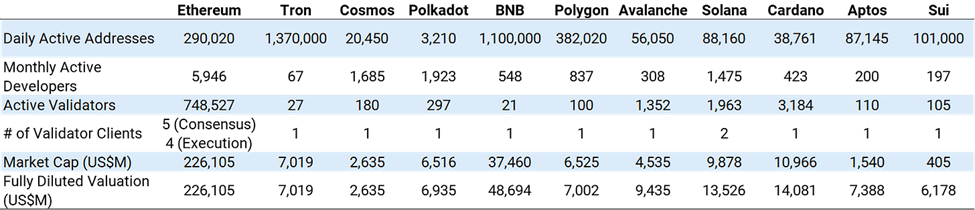

Despite hundreds of L1 competitors that launched since Ethereum, Ethereum is still considered the de facto L1. Clearly, Ethereum is the leader in market capitalization. It has a >55% market share (based on the total market cap as shown below?) among the top 50 L1 blockchains. But where else does Ethereum lead? And what really drives Ethereum’s premium valuation?

Source: CoinGecko. Note: Distribution among top 50 L1s.

Users – Cheaper, Faster L1s Win Out

Users are often cited as the driving force of valuation, as the value of the network is assumed to grow superlinearly to the number of users (Metcalfe’s Law).

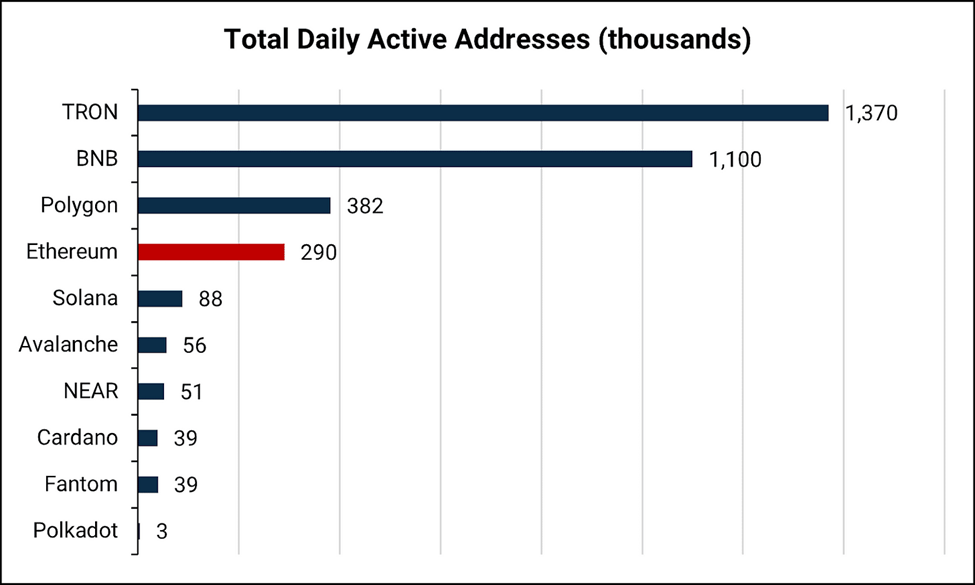

Real active users are difficult to gauge in crypto due to the lack of anti-sybil systems and relative ease in spinning up new addresses. Nonetheless, active addresses can provide a good first approximation in the user adoption of each blockchain.

Source: Token Terminal, Santiment. As of July 31, 2023.

Clearly, Ethereum lags in active users. Its valuation premium is not derived from the quantity of users. Cheaper blockchains like Tron, BNB, and Polygon all have higher user counts. Some networks, such as Polkadot and Cardano, have minimal active users yet see a comparatively high valuation. So with respect to the title question, multiple L1s have already overtaken Ethereum in the number of users.

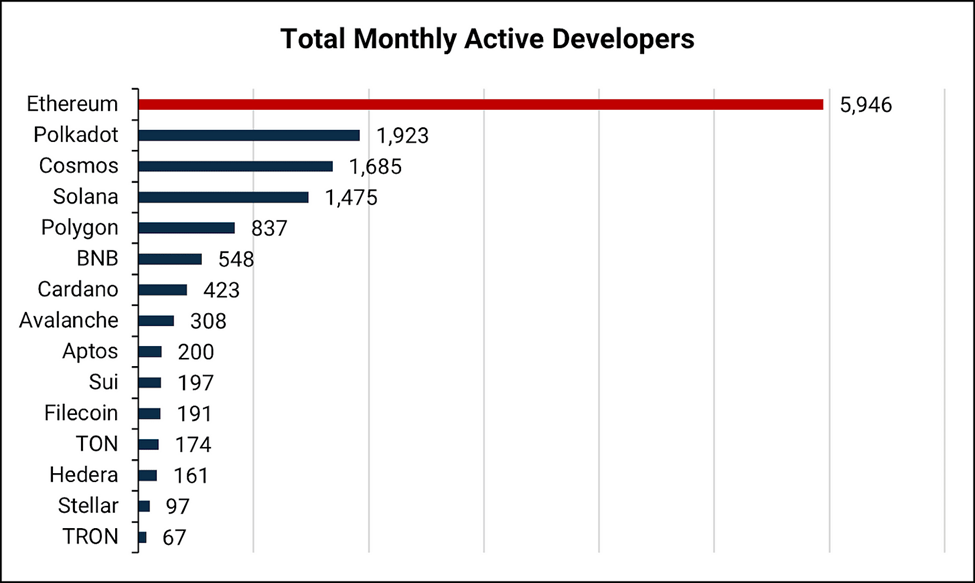

Developers, Developers, Developers

Developers are also helpful as another gauge of network health. Developers not only maintain and improve the protocol layer but also build use cases on top of the L1 itself. They can serve as leading indicators of future value creation.

Ethereum stands out among its peers for having the highest number of total active developers, according to Electric Capital’s developer report.

Source: Electric Capital. As of June 1, 2023.

Polkadot, Cosmos, and Solana’s developer counts are impressive as they have their own unique programming languages. Aptos and Sui also stand out for their high numbers given that they only recently launched.

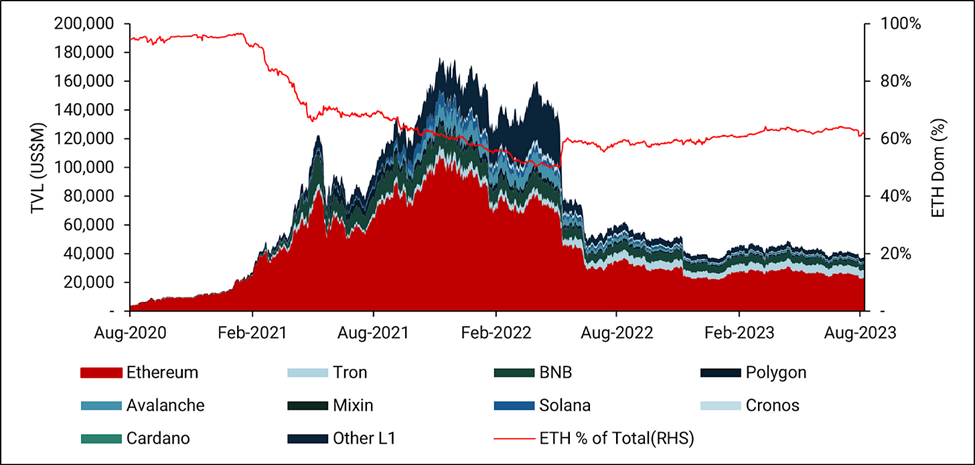

Liquidity

Ethereum clearly leads all other L1s in liquidity on the network, as measured by Total Value Locked (TVL), DEX trading volume, number of trading pairs, and more. Ethereum’s TVL market share amongst other L1s has largely stabilized at around 60% since summer of 2022, coinciding with the collapse of Terra.

Source: DefiLlama. As of August 8, 2023. Note: Removes TVL in Layer 2s.

Ethereum Leads But Not Without Asterisks

To limit the scope of this article, we’ve only focused on some key metrics. There are many more factors to consider. Nonetheless, Ethereum’s valuation lead evidently doesn’t come from user adoption. BNB and Tron win out in those categories by a decisive margin. Instead, Ethereum clearly leads in liquidity and capital flows. It appears the market places a substantial premium on capital above all else.

Factors of Analyzing L1s

What drives the above metrics? Why are there more users on certain chains? What drives capital flows across L1s? And why are some L1s resilient, even after multiple bear cycles, whereas other L1s are relegated to the wayside? Below, we provide some frameworks and models to help answer these questions.

Decentralization

We must first consider the fundamental attribute of blockchains: decentralization. There are multiple benefits of decentralization. For one, greater decentralization improves censorship resistance, helping networks defend against malicious attacks. It also improves resiliency and network security, which gives users confidence to store and transact value across the L1 network. We believe that the greater the decentralization, the higher the premium placed on the L1.

Decentralization itself is an abstract concept that’s difficult to measure. It’s probably one of those things where you know it when you see it. Nevertheless, there are a few factors we can use to look at to gauge the decentralization of a network:

- Number of nodes and node distribution. A node actively participates in the network, maintaining the blockchain state and, depending on its type, validating and relaying transactions in the network. Therefore, a higher number of nodes typically helps improve network resiliency and security. If nodes are more spread out across geographies and organizations, it is less likely that a single actor can exert force on the network. It also matters if nodes run on the same infrastructure (e.g., the same cloud provider) or are run independently with dedicated hardware.

- Token holder distribution. The risks of high token holder concentration should be obvious. With highly concentrated distributions, a few tokenholders can dictate the development of an entire network, deterring users from transacting on the network.

- Client Diversity. Client diversity is the number of software clients that can be used to run nodes. Multiple clients improve the network’s resiliency to attacks and bugs. If a network is only run on one client, a client bug can threaten the entire blockchain.

- Nakamoto Coefficient. The Nakamoto Coefficient measures the number of entities or nodes required to reach a majority (often 51%) in a system. A higher coefficient indicates better decentralization, as it means more entities are needed to compromise or control the system. However, it is a singular metric that can miss a lot of nuances. For instance, Lido has 32% share of all staked Ethereum. But Lido spreads the stake between 30 node operators and cannot command what the operators do with their stake (i.e. cannot enforce malicious collusion).

- Governance Model. Off-chain governance involves decision-making outside the blockchain through community coordination, while on-chain governance embeds governance directly into the protocol, allowing automated, token-based voting on changes. The impact on decentralization varies. Off-chain governance is less impacted by the concentration of token holders but prone to political centralization and potentially high barriers to participation.

- Culture. Culture is an arguably underrated aspect of blockchain decentralization. A culture with strong values can help defend a blockchain against centralization risks/threats – such as Bitcoin’s cultural defense against application development (The OP_Return Wars of 2014) or Ethereum’s united push to improve client diversity

Network Effects

Network effects in blockchains span across many dimensions.

One of the clearest network effects is the interaction between users and developers with many analogies to Web2 platforms. User growth attracts developers to the network, which typically leads to new applications, creating further use cases spurring more users to the network, and so on.

Network effects are also present in other aspects. Programming languages like Solidity, for instance, can create meaningful network effects. As more developers learn Solidity, the community of Solidity programmers expands, making it easier to find collaborators, hire developers, and get community support for a problem. There are more developer resources, such as software libraries, tools, and best practices, making it easier to create robust smart contracts. It is easier to find competent security auditors. All of this improves innovation loops within an ecosystem by attracting more developers and accelerating an application’s time to market.

As financial applications are a key use case of crypto, capital network effects are also vital. Liquidity begets liquidity. New financial primitives are most likely to launch on the network with the largest market size and most liquidity. These network effects are also strengthened by support from key stakeholders. For instance, Coinbase enabling deposits/withdrawals, Circle supporting native USDC issuance, and Fireblocks supporting custody all help to improve capital flows.

Lindy Effect

Given the nascency of digital assets and lack of historical data, many often call on the Lindy Effect as a suitable mental model for gauging L1 success. The longer the blockchain has been around and relevant, the longer it is likely to continue to be relevant. This model is likely applicable. L1s that survive a myriad of challenges – such as technical issues, hacking attempts, market volatility, regulatory scrutiny, competition, etc. – and still have strong user traction are better positioned to thrive in future cycles.

This model suggests that more mature L1s that are still relevant have better odds of eventually overtaking Ethereum.

Hysteresis

Hysteresis is a concept that describes a system where the state depends on its history. Once a system is set on a path, it tends to persist on that path, and deviations become harder the longer the system remains in its trajectory. History matters.

Hysteresis plays a significant role in understanding several L1s. For example, Ethereum’s initial use of PoW before transitioning to PoS arguably helped widespread participation and token distribution during its earlier years. This type of distribution is incredibly difficult for new networks to replicate. As another example, despite FTX’s negative impacts on the Solana ecosystem over the past few years, FTX’s earlier affiliation arguably helped propel Solana into the mainstream and become a top alternative L1 ecosystem.

Viewed in this context, Ethereum’s leadership isn’t the result of technical superiority, but of its unique historic path, the momentum it’s gained over the last decade, and the compounded effects of its choice. Like many other analogies in tech history (such as the oft-cited QWERTY example), Ethereum could retain dominance primarily from being a first mover and its unique history.

Differentiation

L1 blockchains often differentiate against Ethereum and other L1s by offering superior architecture or catering to specific niches. This could involve superior scalability, reduced transaction costs, unique consensus mechanisms, enhanced privacy features, or specialized tooling for specific industries. For instance, Solana’s differentiation is committing to a monolithic blockchain architecture to maximize the benefits of composability and liquidity effects. Aptos and Sui offer Move as a more secure and intuitive programming language that reduces the odds of unintended code bugs.

Monetary Policy

A blockchain’s monetary policy is a cornerstone for its success, especially for Layer 1 (L1) protocols. This policy dictates how the native cryptocurrency of the blockchain is issued, distributed, and potentially burned, influencing both its scarcity and value proposition. A clear, consistent, and transparent monetary policy can foster trust among participants, attract long-term investors, and stabilize the network’s economic environment. Moreover, it directly affects the incentives for validators or miners, ensuring the security and functionality of the blockchain. If well-balanced, the monetary policy can promote sustained growth, adoption, and stability, differentiating the L1 blockchain in a competitive market and ensuring its long-term viability.

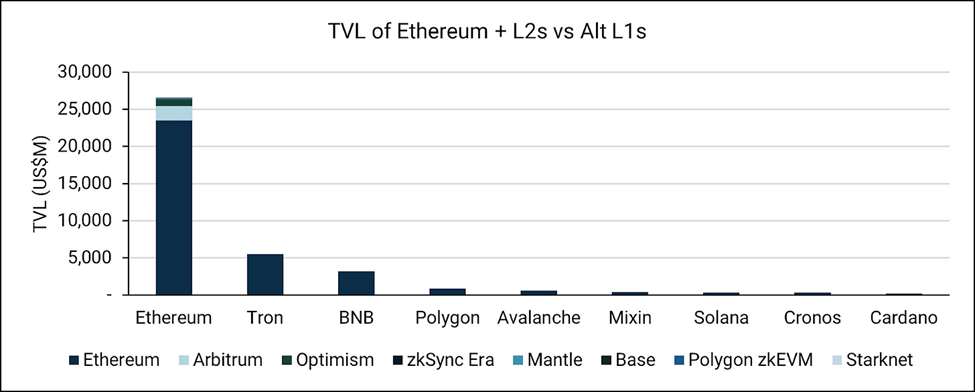

L2s

Alt L1s are not the only viable scaling solution anymore. Roll-ups became Ethereum’s unofficial official scaling roadmap in October 2020. Since then, they have gradually taken share from other alt L1s. In fact, Arbitrum and Optimism – both optimistic roll-ups – have more active users and TVL than most of the top L1s. Recently, Coinbase’s optimistic roll-up, Base, has also quickly gained mindshare. Over the next few years, ZK roll-ups will also most likely follow as well.

Viewed in a broader context, optimistic rollups, ZK rollups, and application-specific roll-ups are all part of the Ethereum ecosystem. When these networks are factored into Ethereum itself, the barrier to “overtake Ethereum” becomes much higher.

Source: DefiLlama

Conclusion

Answering the question “Will any L1 overtake Ethereum?” is an exercise fraught with potential folly. The landscape of technology, especially in as nascent a field as crypto, is ever-evolving and filled with uncertainties. The question also implies zero-sum thinking, where one L1’s win is another’s loss. As Warren Buffett aptly stated, “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

If pressed for an answer, it seems most likely Ethereum will retain its leadership in the L1 space for the foreseeable future. It leads across metrics that matter the most, particularly in decentralization. As active participants in crypto, we also see the most innovation around frontier technologies – such as scaling solutions, ZK technology and applications, privacy solutions, MEV mitigation/democratization, and more – in the Ethereum ecosystem.

Among the current alternative L1s, we see Solana as the most promising candidate to overtake Ethereum. Its monolithic, fast throughput architecture poses a meaningful architectural difference to Ethereum. It is the only other L1 with multiple validator clients. The Solana community, hardened by severe left tail events over the past few years, is one of the most vibrant and ardent. It’s an ecosystem where we see unique innovation not witnessed on other chains, such as xNFTs, state compression, compressed NFTs, Solana Mobile Stack, and more.

But the crypto landscape is nascent and ever-evolving, with potential for new and disruptive technologies to emerge. Given this dynamic, narrow predictions are pointless. It is more productive to continuously observe, remain adaptable, and be open to changing one’s mind.

Author

Steven Shi is an Investment Partner for Amber Group’s Eco Fund, the company’s early-stage crypto venture fund. He has over five years of experience in hedge funds, private equity, and investment banking firms.

[This article has been written and prepared by Amber Group and the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.]

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.