Base: The New Player in Ethereum’s Layer 2 Landscape

Base, an Ethereum layer 2 built by Coinbase using Optimism’s OP Stack, launched on August 9th. More than just an addition to the L2 landscape, Base signifies Coinbase’s commitment to addressing Ethereum’s hurdles head-on.

In this article, we’ll dive deeper into Base—exploring its technology, evaluating how it compares to other L2s, understanding its economics, and examining its relationship with Optimism.

Base in a Nutshell

Base is an optimistic roll-up, built using Optimism’s open-sourced tech stack. But before we delve deeper into Base’s unique offerings, it’s paramount to understand the underlying mechanics of optimistic roll-ups.

Optimistic roll-ups are an off-chain aggregation of transactions inside an Ethereum smart contract. Instead of validating every transaction on the mainnet (which can be cumbersome and expensive), ORUs optimistically assume the computations are correct and send a summarized version to the Ethereum main chain. While this approach significantly amplifies throughput, it doesn’t compromise on security. If any discrepancies arise in the off-chain computations, the system facilitates challenges, allowing any observer to highlight the error and rectify it.

By leveraging Optimism’s ORU design, Base is able to offer:

- Low Gas Fees: Base’s architecture ensures that users enjoy more affordable transaction costs, addressing one of Ethereum’s most pressing concerns.

- Fast Transactions: By leveraging the power of Optimistic Roll-Ups, Base expedites transaction processing, offering a smoother user experience.

- EVM Compatibility: Base’s seamless integration with the Ethereum Virtual Machine (EVM) ensures that developers can transition their projects with ease, bridging the old with the new.

- Open-Source Foundation: Base isn’t just a platform; it’s a community. Its open-source nature encourages collective collaboration, ensuring the platform evolves with the needs of its users.

Base in the L2 Landscape: A Deeper Dive

The Layer 2 ecosystem is bustling with innovation and competition. As Base carves its niche, a closer examination of its standing amidst its competitors is crucial.

- Total Value Locked (TVL): The TVL metric offers insights into both trust and adoption. With Base’s TVL sitting at $377.12 million, it’s clear there’s substantial traction, especially given its relatively new entry into the market. Arbitrum is the Ethereum L2 with the highest TVL at $1.64 billion, but Base’s ascendancy, especially its overtaking of zkSync’s $121 million, is noteworthy. For context, while zkSync dangled the carrot of an airdrop, Base has insisted that there will be no native coin and therefore no airdrops.

Source: Defillama

- User Base and Activity: Base’s user engagement paints an interesting picture. Its daily active average stands at approximately 70,000 – 80,000. In comparison, Arbitrum currently hosts around 120,000 daily users, showing a steady decline. Optimism, on the other hand, registers around 80,000 daily active users. Base’s rapid growth could hint at a short-term hype, much like what Arbitrum experienced with its early peaks of over 250,000 daily active users, followed by a steady decline. On the other hand, Base’s current pace might also suggest it’s emulating Optimism’s trajectory of steady growth. Both trajectories are plausible, and only time will tell where Base is truly heading. Currently, the stable user numbers coupled with a slight increase over the last few days hint towards real adoption over short-term hype.

Source: Dune

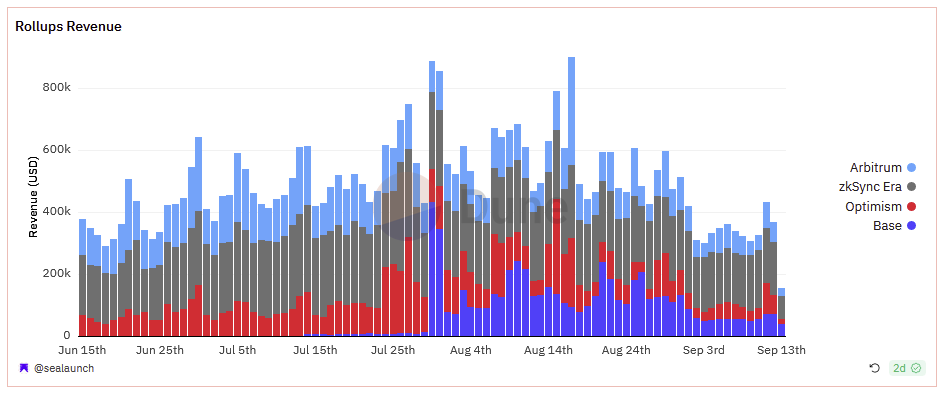

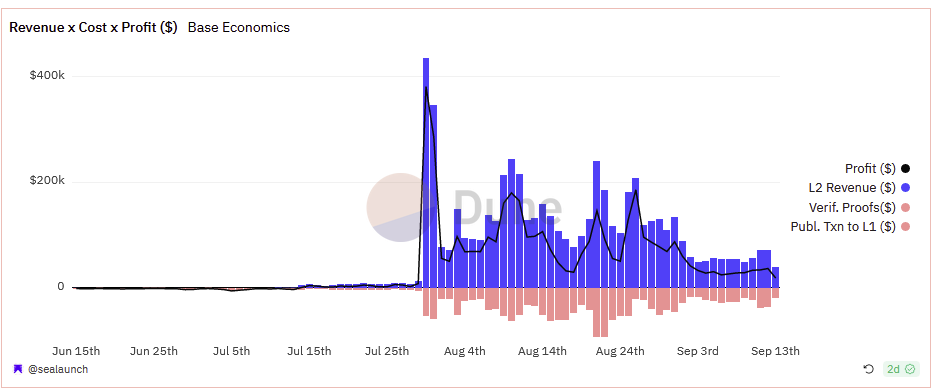

- Revenue Generation and Economics: Base’s economic performance is turning heads. Since its introduction, Base has accrued fees totaling $5.8 million, leading to a revenue of $3.8 million. Base’s daily revenue has declined from an initial figure of around $130,000 to its current range of $60,000 to $70,000. Nevertheless, with an impressive profit margin of 65%, Coinbase still garners substantial daily earnings. In contrast, Optimism generates a daily revenue of approximately $20,000 to $30,000, while Arbitrum’s revenue lies between $60,000 and $80,000. However, as seen with Optimism’s recent update that drastically reduced fees, leading to a significant cut in its revenue, Base’s economic model could see changes in response to network optimizations and user feedback.

Source: Dune

- Capital Flow through Bridges: Bridging assets between chains is a pivotal aspect of Layer 2 solutions. Base’s bridge has facilitated 262,374 users in moving 179,076 ETH onto its platform. While these numbers are commendable, it’s clear that there’s room for growth. Leaders like ZKSync and Arbitrum still have a substantial lead, with their bridges facilitating larger volumes of ETH and more users.

Economic Implications for Coinbase: Diving into the Numbers

As we traverse the dynamic terrain of the crypto world, it’s evident that giants like Coinbase are making calculated moves, and their venture with Base stands out as a prime example.

In the previous year, Coinbase reported a revenue of $662.5 million but ended with a net income in the red, registering a loss of $97.4 million. With Base’s potential contribution for the remainder of the year, an additional $12.42 million could be added to Coinbase’s revenue. With a potentially growing user base, the impact could be even stronger.

Contextualizing this, Base’s projected annual revenue could represent nearly 1.9% of Coinbase’s total revenue from the prior year. That’s right, a fledgling like Base might account for almost 2% of Coinbase’s annual earnings.

Diving into the monthly figures, Coinbase’s monthly revenue from the preceding year averaged out to roughly $55.2 million. Base, if it sustains its pace, could chip in about $4.14 million monthly, increasing Coinbase’s average monthly income by 7.5%.

However, the crypto market is anything but static. An uptick in Base’s user base hints at potential revenue growth, but there’s more to the story. As previously discussed, network upgrades, particularly those that curtail fees, can dent revenue streams. A case in point is Optimism’s recent tweaks, which saw a dip in its earnings. Base might encounter analogous situations down the line, potentially tempering its contributions to Coinbase.

On it’s path to decentralization, multiple sequencers will be introduced on Base.This shift, while bolstering decentralization, will lead to a distribution of revenue between the different sequencers, as opposed to the current scenario where Base, being the sole sequencer, reaps the entirety of it.

That being said, proto-danksharding and danksharding are expected to lower the cost for L2s to post data back to L1 by 10x and 100x, respectively. This could actually help to increase the profitability of roll-ups like Base, if they don’t end up passing the entire savings to users.

Interplay between Base and Optimism

Source: base.mirror.xyz

Optimism, with its Superchain plans, paints a picture of a decentralized Ethereum future where multiple rollups serve as bustling hubs for various ecosystems. These rollups, acting as individual powerhouses, are envisioned to interlink and form a collective “mesh” called the Superchain. The guiding principle here is clear: a decentralized, collective effort holds more potential than a single chain acting in isolation.

Base isn’t just a passive participant in this journey. It actively contributes to the Superchain vision. 15% of the Base sequencer fees are funneled back to the Optimism Collective, a significant stakeholder responsible for funding public goods for the Optimism ecosystem. As the second Layer 2 solution after the Optimism Mainnet to be deployed on the OP Stack, Base also aims to bring Coinbase’s vast user base into the Superchain ecosystem. To put this into perspective, according to The Block, Coinbase has 110 million registered users and over 7 million MAUs. Money.com lists Coinbase Wallet as the best crypto wallet for beginners. Base has the potential to introduce many users to their first on-chain experience if Coinbase executes well.

Furthermore, Coinbase isn’t just collaborating; they’re actively contributing to the fabric of the Superchain. Their efforts are directed toward the development of tools and services that promise to elevate the developer experience on both Optimism and Base platforms.

Reservations and Risks

Striking the right balance between efficiency and decentralization is like threading a needle. Base’s current reliance on a single sequencer, managed by Coinbase, invites scrutiny. The sequencer, often unsung in the grander scheme, is pivotal in an optimistic roll-up. Its role is to meticulously order and batch-process transactions, ensuring a seamless harmony with the blockchain’s overarching state.

But with this structure comes a point of contention: the specter of centralization. There’s a looming question in the crypto community: with only one sequencer, are we veering too close to a centralized system? The underlying concern stems from the potential power Coinbase could wield in this setup. Theoretically, they could enforce KYC procedures or curate transactions. While it seems far-fetched for Coinbase to take such unilateral steps, even the remote possibility has spurred debates.

However, this isn’t a challenge unique to Base. Optimism and Arbitrum too embarked on their journeys with a single sequencer. It’s a phased strategy: commence with one, then diversify to foster decentralization as growth ensues. Coinbase seems to echo this sentiment. They’ve dropped hints about integrating more sequencers into Base’s framework. This would invariably dilute the concentration of control, quelling fears of centralization. Yes, bringing in more sequencers might taper off Coinbase’s direct revenue from Base, but it’s a trade-off. As transaction volumes might see an uptick, Coinbase views it as an investment for Base’s expansive growth and maintaining a competitive foothold in the industry.

Future Outlook and Implications

As we peer into the horizon of the decentralized landscape, Base’s trajectory, intertwined with its present positioning, presents a compelling narrative. Supported by Coinbase’s vast infrastructure, Base is poised to be a gateway for a new wave of crypto adopters.

The reality is clear: while the seasoned enthusiasts of the crypto realm have embraced on-chain activities, many casual users still operate on centralized platforms. Coinbase, with its user-friendly interface and massive user base, stands as one of the leading centralized platforms. Through the Coinbase Wallet and its direct bridge, there’s potential to lower the entry barrier, enabling these users to seamlessly transition to the decentralized world of Base. This move is not just about technological integration; it’s an invitation to a broader audience to experience the decentralized wonders of Web3.

Within this context, Base benefits from a dual user base advantage: the seasoned Ethereum community and the vast Coinbase clientele. It’s a unique position that amplifies Base’s potential influence in the ecosystem.

Yet, as Base evolves, its ripple effects on the broader Ethereum ecosystem demand attention. While platforms like Base and Optimism are coalescing towards a shared ambition of an interconnected web of Layer 2 solutions, the “Superchain”, they’re not devoid of competition. Each Layer 2 solution, including Base, is in a race to offer unique features, ensuring user retention and growth. However, they’re also aware of the collective goal: a fortified Ethereum ecosystem. This duality—of competition and collaboration—is what’s driving innovations and alliances, with each platform striving for dominance while also pushing for a unified, interoperable Ethereum frontier.

In essence, Base’s journey is not merely about establishing its own identity. It’s about contributing to a collective, decentralized ambition, one that has the potential to redefine the contours of the Ethereum landscape.

This article has been written and prepared by Lukasinho, a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.