Solana Snapshot: A Comprehensive Look at Solana’s Current Market Position

A darling of the prior bull run, Solana has weathered a particularly tumultuous year and a half. We check in on Solana’s ecosystem to see how it has fared in the depths of the bear market and ponder upon its future trajectory.

Solana in a Nutshell

Unlike the multi-layered approach adopted by many of its peers, Solana champions a single, unified state. It rejects the idea of Layer 2s and Roll-Ups, instead the entire network should be run on one single highly scalable blockchain. This monolithic approach has several benefits: no cumbersome bridges, an absence of fragmented liquidity, and a user experience that’s fast, efficient and cost-effective.

A key differentiator enabling Solana’s vision of creating a single state blockchain that rivals the performance of centralized legacy finance systems is its unique virtual machine. Unlike the Ethereum Virtual Machine (EVM), the Solana Virtual Machine (SVM) unifies the execution and consensus layers. This eliminates the insurmountable scaling barrier the EVM faces and empowers Solana to process more transactions per second. However, this methodology has its drawbacks and has led to several shutdowns in Solana’s operations. Any error in the execution layer results in the shutdown of the entire system, a predicament that led to numerous outages in Solana’s early days. Yet, with these issues seemingly resolved, this design is a pivotal component in Solana’s strategy to establish a highly scalable single state blockchain.

Current Adoption

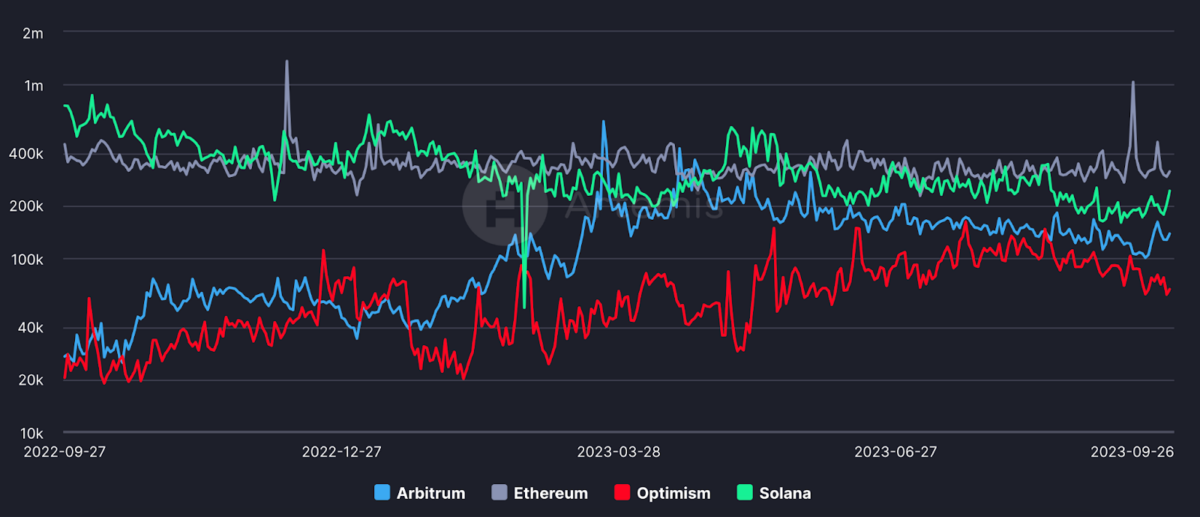

Data shows Solana’s user numbers have reached their lowest in two years, dropping below 200,000 daily active users. This trend, exacerbated by the FTX incident and intensified by Ethereum’s burgeoning Layer-2 solutions, indicates a clear pivot in the market sentiment, favoring Ethereum’s Layer-2 platforms over alternative Layer-1 blockchains.

Source: Artemis.xyz

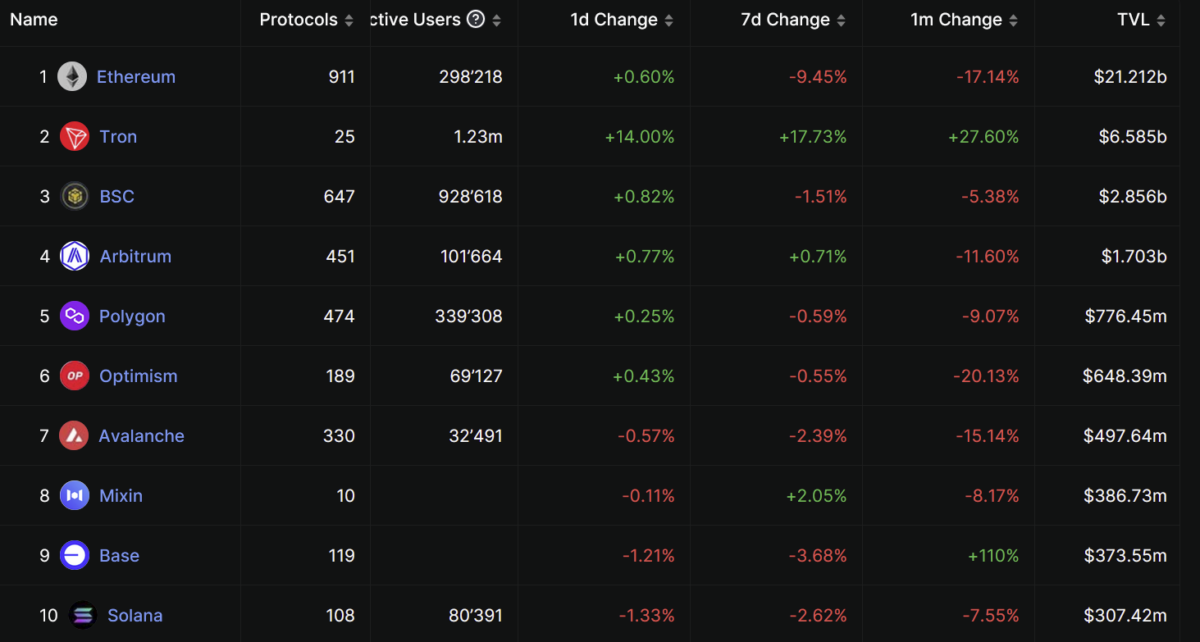

When it comes to Total Value Locked, Solana registers $306.15 million TVL, ranking it tenth on DeFiLlama’s charts. With its high market cap, this TVL is notably modest, reflected in its MCAP/TVL ratio of 25.52. In contrast, Arbitrum leads with an MCAP/TVL of just 0.61, Optimism stands at 1.69, and even the Ethereum mainnet, despite its colossal market cap, is at 9.29. This divergence, combined with the dwindling user numbers, underscores a trend of migration from Solana to the Ethereum ecosystem. Moreover, these TVL/MCAP figures suggest that Solana might be comparatively overvalued in relation to its peers.

Source: Defillama

On the partnership side, Solana’s collaborations with industry leaders like Visa and Shopify infuse a dose of optimism. Visa’s venture into Solana seeks to expedite USDC settlements, leveraging the benefits of stablecoins for brisk and affordable cross-border transactions. However, given Visa’s past collaboration with Stellar Lumen didn’t skyrocket in volume, the true impact of this partnership on Solana remains to be seen. Meanwhile, Solana’s alliance with Shopify offers businesses a swifter payment mechanism, augmented with web3 capabilities and lower interchange fees.

Fostering Innovation in Application Development

Solana’s architectural principles, emphasizing minimal latency, optimal throughput, and economical transaction expenses, have paved the way for developers to craft groundbreaking applications. Drift Protocol stands as a testament to this, emerging as a pioneering decentralized perpetual trading platform. The agility and cost-efficiency inherent to Solana are instrumental for platforms like these. Furthermore, Star Atlas, a prominent entity in the realm of web 3 gaming, underscores the significance of Solana’s swift transaction speeds and economical transaction costs in gaming, a domain where these attributes are indispensable.

However, it’s Solana’s advancements in the realm of Decentralized Physical Infrastructure Networks (DePIN) that truly distinguish it as a harbinger of innovation. Here, Solana’s attributes of high throughput, scalability, and low transaction fees have rendered it an unrivaled leader. While Layer 2 solutions on Ethereum have indeed reduced transaction costs significantly, Solana’s ability to conduct transactions at a fraction of a cent is pivotal when the transaction value is minimal.

A Closer Look at Innovative Ventures

Hivemapper, a decentralized mapping solution, incentivizes participants to contribute data and imagery of routes, rewarding them with crypto tokens. However, the practical viability of this venture remains a topic of debate, considering the comprehensive and free services offered by established entities like Google Maps.

Render, on the other hand, is a promising venture, creating a marketplace for untapped GPU power, addressing the escalating demand in immersive media and artificial intelligence. The potential impact of this on Solana’s network is immense and unprecedented, especially considering the increasing demand for GPU power in AI.

Helium is revolutionizing internet access by establishing a decentralized wireless network. It’s not just offering enhanced affordability but also shaping up to be a compelling product by leveraging decentralized physical infrastructure networks to reduce operational costs.

Beyond Comparisons and Towards the Future

The uniqueness of these products defies direct comparison with legacy systems, making the potential impact on transaction volume somewhat elusive. However, the essence lies in Solana’s strategic positioning as a frontrunner and market leader in the realm of DePIN. Dominance in this sector can substantially elevate Solana’s brand, propelling it to widespread adoption across diverse sectors and bolstering its quest to be a foundational layer for a new, decentralized, and transparent financial system.

Dissecting Solana’s Technological Prowess

One cannot merely assess Solana’s position by its adoption metrics; its technological advancements are equally pivotal. Let’s unpack the strides made in its tech arena:

Network Stability Enhanced

Once plagued by outages due to transactional spamming, Solana has ushered in a transformative solution: priority fees. These allow users to pay a premium, ensuring their transactions find a place in the block. The outcome? A robust network resistant to spam-induced outages. 2023 stands testament to this fortification, with only a singular outage marring its uptime.

Decentralization

Solana’s decentralization has often found itself under the scanner. Yet, data dispels any myths. Its Nakamoto coefficient—a metric denoting the smallest number of entities controlling over half of resources—stands impressively at 30. In the decentralization derby, Ethereum lags with a coefficient of 2, while others like Polygon and Cosmos trail at 4 and 8, respectively.

Innovations in the NFT Ecosystem

Solana’s NFT space, though overshadowed by competitors, is a hive of innovation.

Compressed NFTs: A new NFT compression solution on Solana dramatically reduces on-chain storage costs for large NFT collections, removing economic barriers to minting millions or billions of tokens. While a collection of 10,000 digital arts may remain unaffected, envision a world where every concert ticket or airline booking is an NFT. The cost implications are staggering, making compression a pivotal step.

Executable NFTs: xNFTs are a new token standard built on the Solana blockchain that allow executable tokenized code representing ownership rights within the asset itself. This enables native web3 applications like decentralized trading platforms, social media, and games to run inside a user’s wallet without needing to connect to external sites. This solves one of web3s major decentralization issues. Currently, smart contracts need a front-end. That website is usually hosted on a centralized platform and the host has to create a legal entity. As xNFTs allow applications to run directly within the wallet, all of this won’t be necessary anymore.

Programmable NFTs: The new pNFT standard introduced by Metaplex aims to address gaps in NFT royalty enforcement by giving artists more control through frozen token accounts, transferability restrictions, and ruleSets that validate token interactions. With features like allow/deny lists for Programs and Accounts, creators can ensure royalties are paid, exclude royalty evaders, and delegate management permissions. By putting power back in the hands of artists, ProgrammableNFTs are changing digital art ownership and shaking up royalty dynamics in the web3 space.

Firedancer

Firedancer is an innovative new validator client developed by Jump Crypto, aiming to enhance Solana’s capabilities by offering faster transaction processing and greater reliability, addressing some existing limitations of the network. Written in high-performance languages, it brings improved efficiency and introduces support for sharding, allowing the network to handle more transactions and scale effectively. While still under development, Firedancer stands as a beacon of progress, promising a more resilient and user-friendly experience in the evolving landscape of Solana, with the potential to make running nodes more economical and efficient.

Maker DAO’s Tech Nod:

In a move that stunned many, Maker DAO, a stalwart in the Ethereum DeFi space, proposed employing Solana’s tech stack for its sovereign blockchain. While this may not translate into an alliance with Solana, it’s an undeniable validation of Solana’s technological integrity. It speaks volumes when an industry giant deems Solana’s tech more suitable than its native ecosystem.

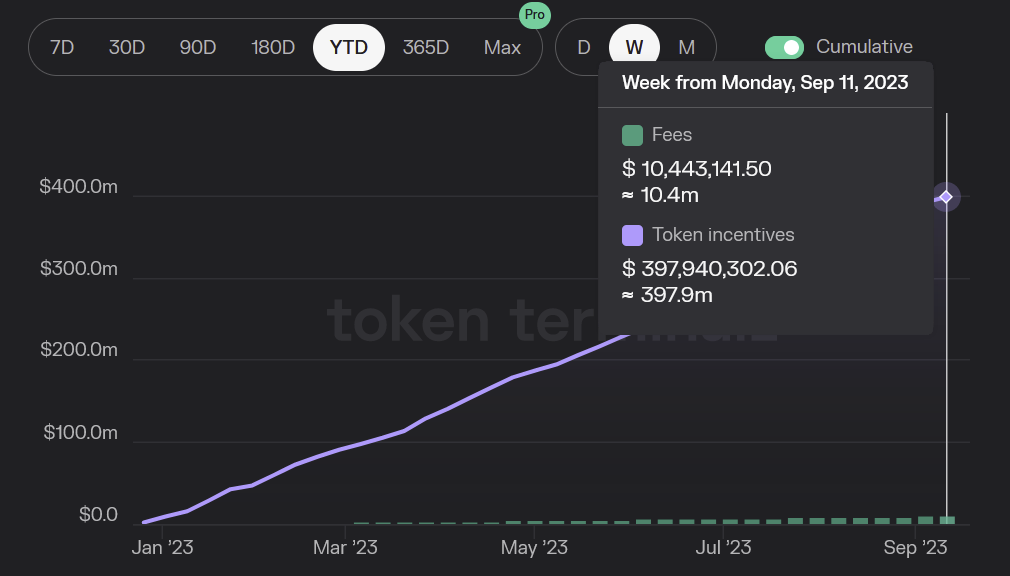

Solana’s Tokenomics & Economic Blueprint

Solana’s tokenomics feature a burn mechanism, which removes 50% of all transaction fees from the total supply. This year, that translated to a burning of roughly $5.15M in SOL from the $10.3M total fees generated. However, the effect of this burn are, for now, overshadowed by a more dominant force: inflation. Solana’s block rewards have inundated the market with tokens amounting to an eye-watering $394.7M, all thanks to the prevailing 6% inflation rate. The juxtaposition is telling: the burn’s effects have only managed to counter a modest 1.3% of this year’s inflation. With its current cadence of 16 million transactions a day, Solana would have to ramp up to a colossal 1.21 billion daily transactions to stave off the inflationary pressure. Even at a reduced 1.5% inflation rate, token burn from present transactional volume would offset only 5% of the inflation. In this scenario, Solana would “only” need 290.56 million transactions a day to curb inflation. To put things in perspective, Visa currently handles 660 million transactions a day. So, while the numbers Solana aims for might seem audacious, they aren’t beyond the realm of possibility, if Solana realizes its vision of becoming a foundational layer for economic activities.

Source: tokenterminal.com

The math lays bare Solana’s grand vision: a future where blockchains are the linchpin of our entire financial matrix with Solana at its centre. For this blueprint to manifest, not only does the blockchain adoption landscape need to expand to uncharted territories but Solana must stand as a titan in this new financial world.

The Risks Shadowing Solana’s Horizon

For every promising frontier, there’s always a flip side, and Solana’s voyage is no exception. Let’s peel back the curtain on the potential pitfalls that could derail this ambitious project.

The Ethereum Juggernaut and the Scalability Misconception

Solana, among other Layer 1 solutions, rode the wave of a prevalent sentiment: Ethereum, the blockchain behemoth, was believed to be hitting a scalability ceiling. This perspective painted a picture where alternative Layer-1s, like Solana, would step in to fill the gap. However, this viewpoint is starting to fade as Ethereum’s Layer 2 ecosystem manifests its seemingly limitless scalability potential.

While it’s a given that no single platform will monopolize human interactions, history has shown that dominant platforms emerge, casting vast shadows over their competitors. Ethereum is shaping up to be that colossus in the blockchain arena. For Solana to achieve its grand vision, it doesn’t merely need to coexist; it needs massive adoption. With capital and users gravitating towards Ethereum and its extensions, Solana’s challenge is becoming steeper by the day.

The Alameda & FTX Overhang

Solana faces a unique challenge as a significant chunk of its tokens are held by the fallen heavyweights, FTX and Alameda Research. Recent movements in cold wallets associated with FTX have reignited concerns about potential market dumps. Alameda Research had acquired around 48 million SOL and FTX 58 million. A substantial part of their holding was locked up for 10 years, mitigating the risk of a massive, immediate sell-off, but Solana could still face significant sell pressure for years. This is particularly true in the short-term, during the bankruptcy process, where a significant amount of SOL could be sold. While these sell-offs won’t annihilate Solana’s prospects they could exert downward pressure on its valuation, especially as long as the broader market sentiment remains bearish.

Future Outlook and implications

Solana boasts technology that’s undoubtedly impressive and arguably ahead of many competitors, including the market leader, Ethereum. Its audacious vision to create one highly scalable global state blockchain, offering a decentralized alternative to legacy finance systems, is backed up by some of the most advanced tech stack in the space. The smooth and seamless user experience provided by a single state blockchain over a layered approach positions Solana to potentially become a massive pillar in a new decentralized financial system. The strides Solana has made, be it partnerships with global giants like Visa or innovations like Solana Pay and compressed NFTs, further reflect its commitment to a future dominated by blockchain-centric transactions and business operations.

Yet, for its economic model to achieve long-term viability, it’s imperative for Solana to rise beyond just co-existing in the shadows of the giant, Ethereum, with its vast Layer-2 landscape. Solana must become a behemoth in its own right, carving a significant chunk of the market share. The broader crypto landscape, however, poses challenging questions. Despite Solana’s highly advanced tech stack, current trends, characterized by users and capital migrating towards Ethereum’s Layer-2 solutions, coupled with narratives championing Ethereum’s limitless scalability, paint a daunting picture for Solana. To truly manifest its vision, Solana doesn’t merely need innovation — it requires a shift in market momentum. This shift must not only bring users and capital back to its shores but also transform the prevailing narrative back to positioning alternate Layer 1 chains as indispensable players. In this reshaped narrative, propelled by its highly advanced technology, Solana would be in a prime position to emerge as the colossal pillar supporting a modern, transparent financial system.

This article has been written and prepared by Lukasinho, a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.