Is Chainlink the Key to the Future of Crypto?

Chainlink is a pivotal piece of the ecosystem in the current web3 space, addressing some important challenges. In this article, we’ll take a look at Chainlink’s core functionalities, its recent developments, and the underlying economics of its token. We’ll also weigh potential risks and conclude with insights on its future prospects. Dive in to understand this key player in the blockchain space.

Chainlink in a Nutshell

Chainlink focuses on resolving the oracle problem, an issue where blockchain systems and smart contracts can’t trust data they receive from third party providers. Chainlink’s solution is a decentralized oracle network, where multiple nodes collect and send data. Once consolidated, this data is seamlessly integrated with crypto protocols via an API connection, enabling smart contracts to access the information they need.

For example, Chainlink’s price node gathers cryptocurrency prices, calculates an average, and relays it to users. To ensure data accuracy, Chainlink employs a reputation system. Providers put up assets as a form of guarantee. If they relay misleading data, they stand to lose some of these assets.

The vision of cryptographically secured systems

In Chainlink’s envisioned future, the majority of digital interactions will be backed by cryptographic integrity. With blockchain and smart contracts a cryptographically secured financial system seems within grasp. However, these systems remain data-dependent. A truly trustless system emerges only when data is sourced from a cryptographically verified origin, a role that Chainlink’s decentralized oracles are primed to fulfill. Chainlink’s aspirations span a multitude of sectors—banking, commodities, real estate, global trade, and more. As more and more real-world and off-chain assets become part of blockchain ecosystems, the need for oracle networks like Chainlink grows ever more crucial.

LINK’s role in the Chainlink Ecosystem

Cryptoeconomic Security

Chainlink uses a stake-based security model where nodes put up their LINK tokens as a form of guarantee. If these nodes don’t deliver up to expected standards, they risk losing (or “slashing”) their staked tokens. This system ensures that the oracle services are both trustworthy and meet performance criteria. In addition, nodes that stake more LINK can take on more tasks and, in turn, earn more user fees, reinforcing their dedication to high-quality service. This staking system is not just about penalties; it’s also a reward mechanism. Those who stake LINK earn a share of the fees paid by users of the oracle services they help secure. Over time, Chainlink plans to emphasize this staking model even more, making it central to how the network functions and compensates its participants.

Chainlink Economics 2.0: Enhancing Sustainability

Chainlink’s Economics 2.0 introduces user staking and expands the economic framework. With the introduction of staking, token holders can now contribute to network security and earn real-yield in return. So far, staking was only possible for node operators themselves. Chainlink Economics 2.0 now allows holders to delegate their LINK to staking nodes.

The BUILD initiative accelerates project growth by offering enhanced access to services in return for a share of the projects’ native token, usually 3-7% of the supply, offering Chainlink to earn a significant stake in the network it accelerates.

Chainlink’s SCALE initiative encourages blockchain networks to shoulder oracle operating costs, accelerating their own growth and fortifying Chainlink’s sustainable future. This arrangement fast-tracks smart contract innovation by alleviating developers from certain expenses while granting them access to specialized oracle services.

Finally, fee-sharing has been introduced as a new revenue generation model. GMX exemplifies this approach, with Chainlink receiving a percentage of the trading fee revenues, a portion of which goes directly to stakers.

Innovative solution to provide new kinds of data

Chainlink’s roots are supplying market data, ensuring DeFi protocols receive dependable price feeds in a decentralized fashion. However, as web3 expands and spawns new trustless applications, the demand for diverse data types emerges. Addressing this, Chainlink is developing a series of computations to introduce novel, cryptographically secure data streams to the web3 ecosystem.

Cross-Chain Interoperability Protocol (CCIP)

Chainlink CCIP provides a universal standard for cross-chain communication between public and private blockchains, enabling the secure transfer of data, tokens, and instructions across chains. CCIP aims to be the TCP/IP of blockchain to facilitate the next wave of real-world asset tokenization. The focus has been on enabling institutions to leverage existing infrastructure to access tokenized assets across chains, as well as providing DeFi projects with secure cross-chain functionality. Swift, Chainlink, and more than a dozen of the world’s largest financial institutions engaged in an industry collaboration to demonstrate how banks and market infrastructure providers could instruct the movement of tokenized assets between any public or private blockchain via a combined solution of Swift messaging standards and CCIP. Similar case studies have been performed in collaboration with other major institutions.

The forthcoming milestones for CCIP include its transition to Mainnet General Availability (GA) and facilitating permissionless use for developers. Additionally, the focus is on extending support to an array of new private and public blockchains. In tandem, Chainlink aims to bolster modularity to accelerate deployments across emerging chains.

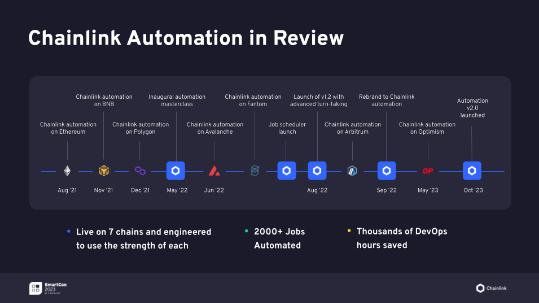

Automation

Chainlink Automation provides a decentralized infrastructure for creating scheduled, automated processes that can trigger smart contracts based on time intervals or on-chain events. It allows developers to build innovative applications by offloading expensive computation off-chain, while still providing security guarantees. Recent launches like Automation 2.0 establish new standards in reliability and expanded cross-chain support. The focus going forward is on enabling more trigger capabilities and expanding availability across chains.

Source: blog.chain.link

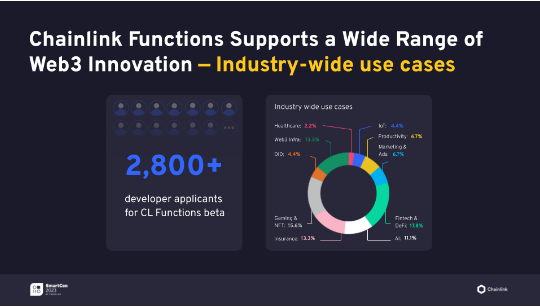

Functions

Chainlink Functions enables developers to easily leverage any external API or computation in their smart contracts. It provides a serverless platform to connect and transform data that can then be consumed onchain. The focus has been on improving the developer experience by simplifying setup, monitoring, and access control. Functions was recently launched on mainnet across multiple chains to make building data-driven dApps faster. Future plans involve increased chain and layer-2 support as well as more developer tooling.

Source: blog.chain.link

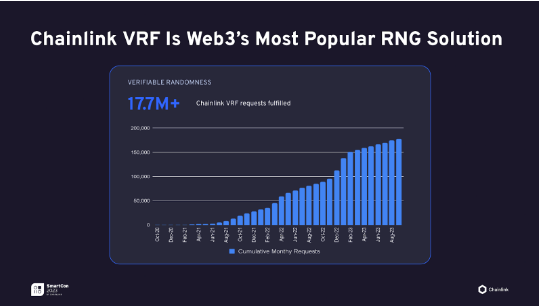

Verifiable Random Function (VRF)

Chainlink VRF is the leading source of verifiable, tamper-proof randomness for smart contracts across multiple blockchains. With the growth of Web3 ecosystems like NFTs and blockchain gaming that require provable fairness, the need for trustworthy random number generation continues to increase. Chainlink VRF has already fulfilled over 17 million requests and is integrated in thousands of smart contracts. The current focus is extending VRF’s success into appchains and enabling easy integration with off-chain systems. Upcoming launches like VRF 2.5 will improve the user experience through enhancements like simplified payments and seamless contract upgrading.

Source: blog.chain.link

Fair Sequencing Services

Fair Sequencing Services (FSS) is a Chainlink protocol that provides fair transaction ordering to help mitigate maximal extractable value (MEV), which is a form of arbitrage that can negatively impact DeFi users. MEV allows miners to arbitrarily reorder transactions to profit from price changes. FSS aims to make transaction ordering provably fair using a decentralized network of nodes that receive transaction bundles from the Protected Order-Flow (PROF) system. PROF shields transactions while still allowing MEV competition. The bundles are then sequenced fairly by FSS before distribution to miners for inclusion onchain. By removing malicious transaction reordering, FSS helps build fundamentally fairer decentralized systems.

Chainlink’s recent technological advancements signal the onset of a virtuous cycle. It commenced with the pioneering delivery of market data. As initial applications leveraging cryptographically secured data thrived, they spurred demand for novel applications. This evolution has given rise to fresh oracle use-cases, notably off-chain computations and the Cross-Chain Interoperability Protocol. As Chainlink ventures into new sectors, it broadens the scope of cryptographically secured applications, heightening awareness and for trust-minimized solutions creating more new use-cases for oracle networks.

The Chainlink bull case

Chainlink stands out with its clear and transparent business model, focused on generating and distributing value to its token. Its product is not just leading but also essential, particularly within the DeFi sector.

Beyond decentralized finance, Chainlink aspires to bridge the gap between the blockchain sector and traditional finance. This could involve enabling communication between banks utilizing permissioned blockchains to handle CBDCs and providing dependable data transfer through its oracles. The scope extends to insurances, climate markets, and global trade, showcasing Chainlink’s versatility.

Believing in the mass adoption of blockchains – whether through the decentralized approach web3 envisions, or by legacy finance adopting the technology for enhanced transactions – implies a belief in the necessity of oracles to secure applications cryptographically. With minimal competition and a technological edge, Chainlink is positioned well to become a foundational element in a future dominated by blockchain technology.

Moreover, Chainlink’s refined business model offers a pathway for token holders to gain benefits and earn real yields from its potential adoption, offering tangible benefits of its potential success to the Chainlink community.

Risk and Reservations

First, there’s a significant probability that enterprises in banking, traditional finance, global trade, and other sectors choose to develop proprietary solutions over adopting Chainlink, potentially constraining its expansion to the web3 market. This choice would significantly shrink Chainlink’s addressable market and peg its prosperity to the broad acceptance of the decentralized finance models.

Further, at present, staking v0.1 is live but limited to 22.5M Link. A threshold that was maxed out within hours of launch. The imminent v0.2 release in Q4 will extend this to 45M Link; however, accessibility remains notably restricted. The timeline for universally available full staking service is still unclear. Given that the LINK token’s utility is intertwined with staking and the generation of real yield, purchasing it now is essentially speculative, hinging on the realization of future features and broad adoption.

Finally, Oracle Networks, being essential but more abstract and complex constructs, may lack immediate widespread appeal. The absence of direct user interaction possibilities and its complexity makes it challenging for Chainlink to ignite a narrative and generate short-term value spikes in a market often driven by hype.

Future Outlook

Chainlink presents a compelling proposition for investors, offering a discernible business model and a path to sustainable yield sourced from protocol revenues. This robust framework is likely to attract discerning investors seeking reliable returns. However, the limited availability of staking options may mean that significant demand could be deferred until the roadmap unfolds further.

Moreover, the pivotal role of Oracles, despite its crucial nature, may not immediately spark widespread enthusiasm due to its less glamorous appeal. This character of Oracles could potentially see Chainlink maintaining a low profile in the short term.

Chainlink demonstrates notable proficiency and leadership in the Oracle sector and maintains a flexible approach to different blockchain ecosystems. This adaptability ensures the project’s resilience and potential for growth, irrespective of the prevailing blockchain platforms in the industry.

In the long term, if blockchain technology continues its trajectory towards mainstream acceptance, Chainlink is poised to reap substantial benefits, becoming an indispensable component in the blockchain ecosystem and potentially delivering sustainable yield to LINK holders.

This article has been written and prepared by Lukasinho, a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information, GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

-

Chainlink is an awesome critical infrastructure crypto project with huge potential. Chainlink is the most popular and utilized decentralized blockchain oracle network built on Ethereum. The network is intended to be used to facilitate the transfer of tamper-proof data from off-chain sources to on-chain smart contracts. Without Chainlink oracle there won’t be fully working integrated smart contacts and this crypto project should be getting more attention and definitely deserves also to be in top 10. There are lots of potential utilization and use cases in future of this innovative technology from finance and banking to medical field, logistics, supply chain and distribution. The future digital economies web3.0 and beyond will run on similar + AI powered projects, the potential is immense!