The Implications of The Merge: Tax Worry

The late Stephen Covey said there are three constants in life: change, choice, and principles. Well, we are adding a fourth one: Taxes. Almost everyone in the crypto world has been buzzing about the Merge and asking questions about how The Merge affects ETH holders and what it means for the environment. Another key question is, will I have to pay more taxes? We are going to look at the taxability of ETH after The Merge and what it means for you.

How Does The Merge Affect my Income and Taxes?

We will be taking a look at this in different scenarios, what happens to the unstaked pre-Merge ETH in your wallet and what happens when you stake ETH.

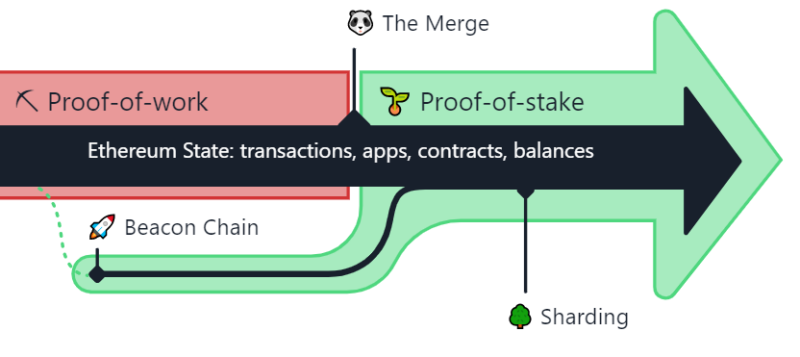

No nation has particular tax regulations or guidelines for how your ETH is handled after the Merge. The Merge will probably be classified as a soft fork for tax purposes, and under U.S. tax law, there are rules for when a soft fork takes place. A soft fork happens when there is a protocol update (like The Merge), but it does not result in the establishment of a new cryptocurrency, according to IRS FAQ 30.

According to IRS guidelines, “a soft fork” happens when a distributed ledger goes through a protocol update that doesn’t lead to a diversion of the ledger or the establishment of a new coin. You won’t get any new cryptocurrency as a result of soft forks; instead, you’ll remain in the same place you were before the fork, which means you won’t get paid anything. The fact that a soft fork will leave you in the same situation as before and produce no more income means it is not a taxable event. This perfectly captures what will take place during The Merge. A new Ethereum chain won’t form as a result of the Merge. It allows ETH to be faster, more scalable, and less harmful to the environment. The old chain will be combined with the Beacon chain; no new revenue is created; all transaction history is kept.

Consider you have 5 ETH available in your wallet. No new revenue is produced; instead, the ETH ecosystem is upgraded after the Merge, converting your PoW ETH into a PoS-enabled ETH.

What happens if I staked ETH before The Merge?

How can I stake ETH before The Merge is something you might be thinking. Isn’t the purpose of The Merge to set stakes? Prior to The Merge, certain exchanges offered staking; however, The Merge completely eliminates the PoW Mechanism and converts all ETH to PoS ETH, requiring you to lock your ETH for rewards in order to stake your PoW ETH (Ethereum prior to The Merge). To lock your ETH, you must convert it to “ETH2” or “ETH2.S”, which represents the staked ETH.

Be aware that different exchanges give the staked ETH different names. Coinbase, Binance, and a number of other exchanges refer to theirs as “ETH2”, whilst Kraken refers to theirs as “ETH2.S”. Because “ETH2” and the others are just used as “labels,” this staking prior to the merge is also a soft fork the coin is essentially the same. Only a new name is used to differentiate; no new cryptocurrency is distributed or produced. For instance, suppose you spend $200 in 2019 to purchase 5 ETH, and then a year later you stake them on Binance by converting them to ETH2. The value of the converted ETH was $5000. No matter the price, this transaction won’t be subject to taxes because it won’t result in new income.

Different Types of Staking and How Tax Laws affect them in various Jurisdictions

As affirmed by Ethereum, stakers won’t be allowed to have access to the original ETH deposited or the staking rewards until the phase where this transaction is supported on the Ethereum 2.0 (the PoS ETH ecosystem) network. It means the ETH2 rewards are illiquid.

Are these Illiquid Reward Taxable?

There are no laid down rules for PoS ETH staking income, so we will use the closest guidance that we can determine how staking taxes should be determined. We would do this for a few jurisdictions, countries have different Tax laws and guidelines.

United States’ closest guidance is the Tax guidance on Mining; Notice 2014-21. Although receiving staking rewards on ETH2 is a taxable event, you are exempt from filing an income tax return until you can utilize, manage, and exchange the rewards. If you staked 5 ETH on Binance in 2022 and received 0.5 a month later as staking incentives, that’s $150 today. You are not expected to report income because it is not spendable yet. But suppose Binance has given you access to your 0.5 ETH staking incentive in 2025. The price of 0.5 ETH is now $350. You now have authority over this $350, so you can declare it as income (you can spend it). Most stakers often won’t be able to receive their rewards until that kind of feature is enabled for PoS ETH (unknown future date). The rewards are currently illiquid and the ETH is locked.

Canada‘s Closest guidance is the Tax Guidance on mining; Guide for Cryptocurrency Users. Generally in Canada, you don’t pay taxes on mining unless you are doing so on a commercial scale. What does this mean for my illiquid staking reward as a Canadian? Like the USA you won’t have to pay taxes until you have full control of the funds as earlier explained you are exempt from filing income Tax returns until you can utilise, manage and exchange the rewards. THE MAJOR DIFFERENCE is that if this staking is done as a “hobby” or for “Pleasure” then you don’t have to report any income tax even though you can spend the staking rewards.

Note: Both “hobby miners” and “commercial miners” pay Capital gains Tax (CGT) but income tax is what varies.

Let’s imagine you staked 5 ETH on Binance in 2022 and received 0.5 ETH the next month, that is $150 today, it isn’t spendable yet, but it is in your wallet. Now it is 2025 Binance has given you access to the 0.5 ETH whose price is now $350 you won’t have to pay income tax on this $350 because you can’t be referred to as a “commercial Staker”.

Now think Almorok ventures staked 300 ETH which has a value of $100,000 and receives a staking reward of 30 ETH which is worth $3500. Now it is 2025 and Binance has given Amorok ventures access to the staking rewards they will have to report tax on the staking reward as they are staking for “commercial purposes”

Note: The “commercial purpose” and “pleasure” terms are usually determined by various factors.

Australia, there are laid down guidelines for staking rewards which the ATO specified how your staking reward should be reported: Staking Rewards and the Roles of Forgers. In Australia, you don’t have to report taxes until you have full access to the staking rewards. Once you have access to the funds you have to report Other Income Tax for the staking rewards and Capital Gain Tax at your disposal (after you sell).

In the United Kingdom, there are also laid down regulations for staking rewards which the HMRC specified in; Crypto Assets Manual. The specific facts will determine whether such staking constitutes a taxable trade (with the crypto assets serving as trade receipts), taking into account a variety of variables including:

- quantity of activity

- organisation

- risk

- commerciality

You don’t have to report taxes until you have full access to the staking rewards. Once you have access to the staking reward, you have to report Income Tax for the staking rewards and CGT or Corporation Tax on Chargeable Gains (CGTC).

Liquid Staking

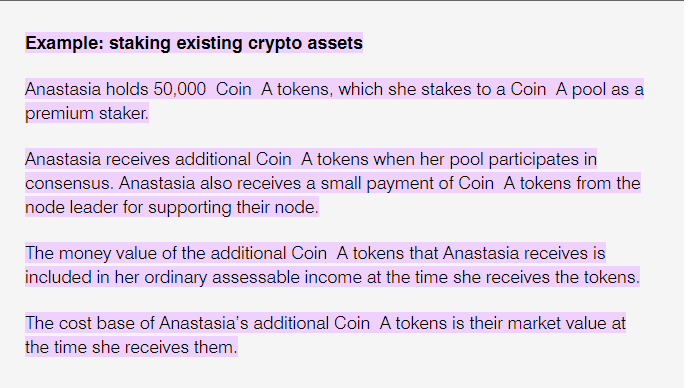

Some stake protocols, like Lido, RPL, Marinade Finance offer liquid staking. Liquid staking offers the ability to not only stake crypto for rewards but also allow stakers to continue to use their locked assets for investment and yield in other activities. So both the staked ETH and the staking rewards received, you have control and can invest them in other activities. The rewards earned in liquid staking are taxable income.

It means you don’t have to wait for a period of time for you to gain full access to your staking rewards. So as soon as you get your staking rewards you can dispose of (sell, swap, etc) it.

Converting ETH to stETH is a taxable event because it is different from the ETH you had. It allows you to earn staking rewards that you can use and control (economic position) and stETH price is not perfectly pegged to ETH, their price varies (different assets). The stETH is taxed at the time of the receipt. Immediately after you receive the rewards income should be reported. Also, when you sell the stETH another taxable event is triggered. Note: ‘stETH’ is a label for liquid-staked ETH.

For example, you swap your 5 ETH (cost basis $5000) with 5 stETH worth $5500. In the next year, you earn 0.5 stETH worth $500. Your tax incursion will be a capital gain of $500 (5500-5000) and an ordinary income of $500 (the subsequent reward for staking stETH).

How does this vary from the Illiquid Staking Taxes in each Jurisdiction mentioned?

In the aforementioned jurisdiction for the illiquid staking rewards, you had to wait for access to be granted before reporting taxes but in liquid stakes, you report Income Tax on the Staking rewards on receipt(immediately you receive the reward) and when you sell the rewards you also trigger another taxable event and is reported on disposal in the United States.

Canada, you have to be a “commercial” staker to report Income taxes on receipt and everyone reports Capital Gains Tax (CGT) on disposal.

Australia, everyone (both commercial and pleasure) stakers report Other Income on receipt and CGT on disposal.

The United Kingdom, it is determined by factors like commerciality, Risk, the quantity of activity and organization. The staking rewards (at the time of receipt) of any crypto assets given for successful mining and staking will typically be taxable as income (miscellaneous income), with any necessary expenses reducing the amount chargeable, if the mining activity does not amount to a trade.

Any earnings must be determined in accordance with the applicable tax laws if the activity qualifies as a trade. If the “staker” keeps the rewards, he pays CGT or CGTC on disposal.

Conclusion

The Proof of Stake mechanism has significantly changed the Ethereum Ecosystem. But, from a tax standpoint, there is no reason to be scared. While there is no debate that post-Merge staking rewards will constitute income for tax purposes, answered questions on how to value them.

Disclaimer: This is not tax advise, always see an attorney/accountant.

This conversational article was written by : Seun Gbri // In collaboration with: Global Coin Research alias GCR