Exploring the zkSync Era Ecosystem

Over the last year we have witnessed the growth in popularity of Layer-2 (L2) solutions that attempt to scale Ethereum. Solutions like Arbitrum and Optimism managed to push innovation forward in terms of protocol designs, secure important amounts of TVL, onboard millions of users as well as expand the applications (dApps) in their ecosystems. These dynamics were further incentivized with airdrops that rewarded early users of those ecosystems.

In a recent GCR publication, we explored the effectiveness of airdrops for both Optimism and Arbitrum. Given the recent traction of ZkSync Era, we will examine its ecosystem to understand the dynamics of it. Let’s dive in.

zkSync Era

zkSync is a L2 scaling solution trying to resolve scalability issues on the Ethereum network utilizing zero-knowledge proof (ZKP) technology. The protocol is built to enable secure, fast and low-cost transactions while maintaining the security level offered by the Ethereum mainnet.

zkSync is built by Matter Labs, which raised more than $250MM in venture capital investment, including a $200MM round in November 2022 from Dragonfly Capital, a16z and Blockchain Capital, among others.

Traction

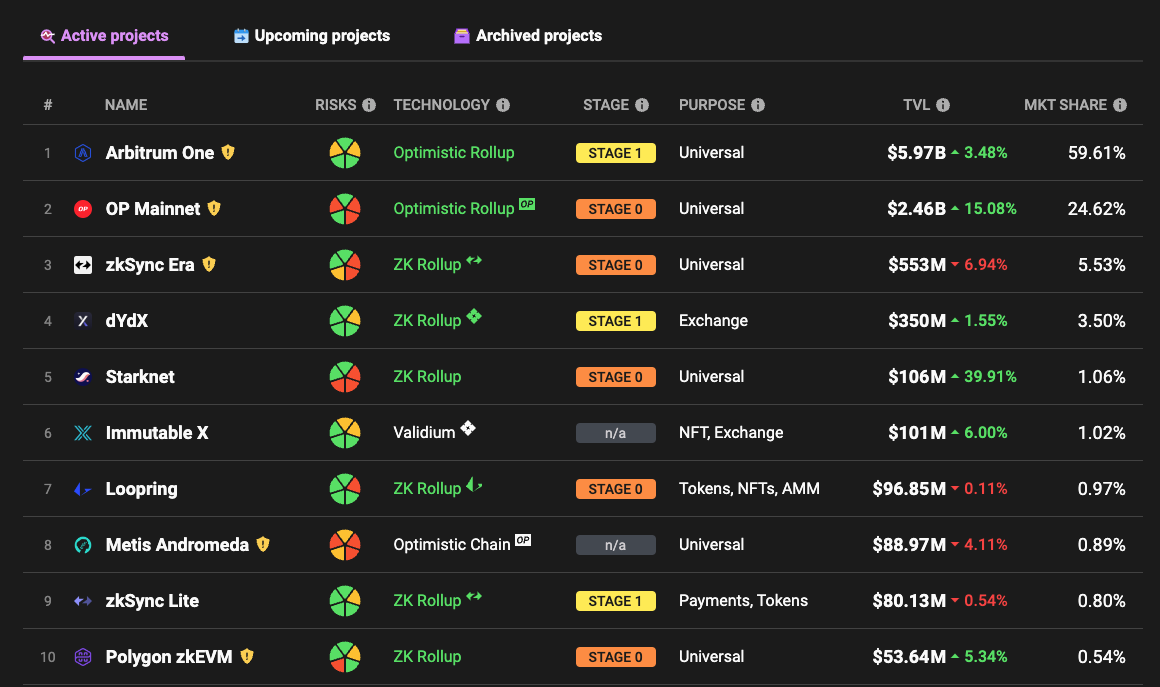

zkSync Era has managed to position itself as one of the top 3 Ethereum rollups by TVL, surpassed only by well known projects Arbitrum and Optimism. zkSync Era is the largest zk-rollup by TVL. At the time of the writing, zkSync Era has a total of $553MM in TVL with more than 50 protocols building on top of it.

Source: L2Beat

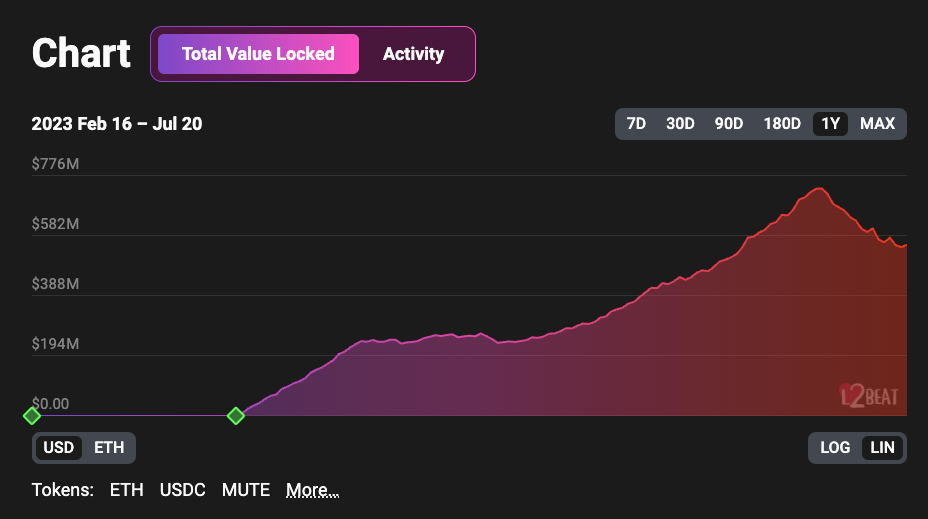

Source: L2Beat

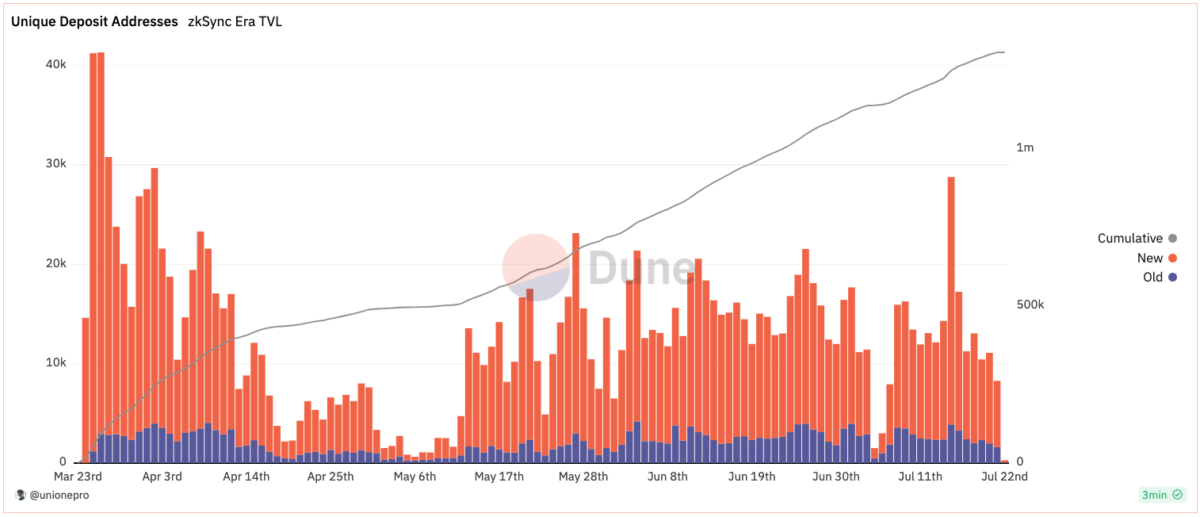

In terms of activity, the network has seen an increased number of users and activity, with wallets surpassing the 1MM users and daily active users (DAUs) exceeding 190K per day, positioning ZkSync as the L2 with highest DAUs, surpassing projects like Arbitrum or Optimism

Source: Dune

Source: Grow the Pie

This increase in the user base, as well as the launch of more projects in ZkSync Era, has fueled the increase in daily transactions, which at the time of the writing are surpassing 700K per day.

Source: Grow the Pie

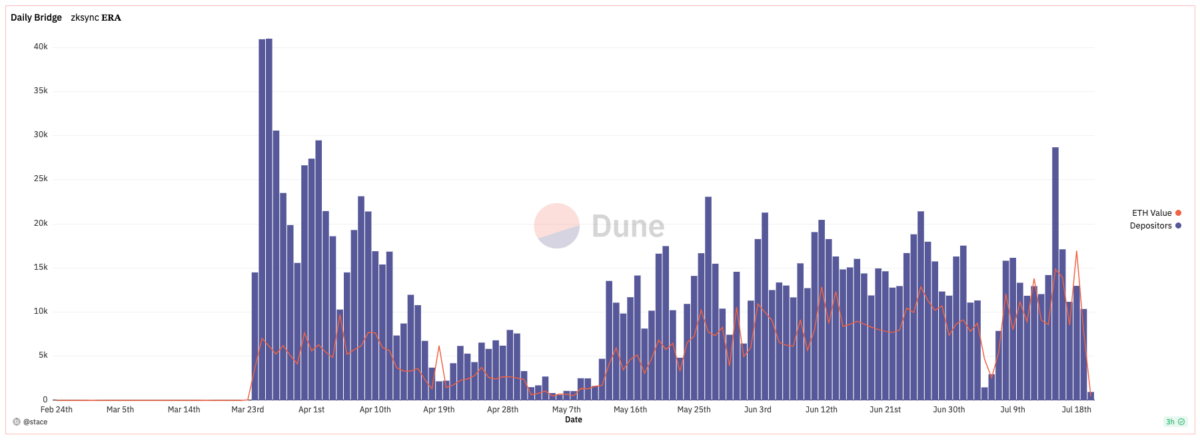

ZkSync Era was launched in March 2023. After an initial surge of activity at launch, bridging of assets have stabilized at around ~12,000 depositors per day.

Source: Dune

Zk Stack

Matter Labs team decided to launch an open source code framework, Zk Stack, which is a modular framework that leverages Zero Knowledge technology and allows the building of highly customizable interconnected blockchains (Hyperchains). With this release, developers have compilers, SDKs for configurations and everything needed to deploy another Layer 2 network or a Layer 3 operating on top of it, all with a high degree of flexibility (including the choice of a centralized or decentralized sequencer)

This open source release is similar and competes with Optimism’s OP Stack, but instead of relying on optimistic rollups, zkSync and Matter Labs leverages zero-knowledge proofs for transactions.

Exploring its ecosystem

Source: zkSync Rater

The DeFi Side:

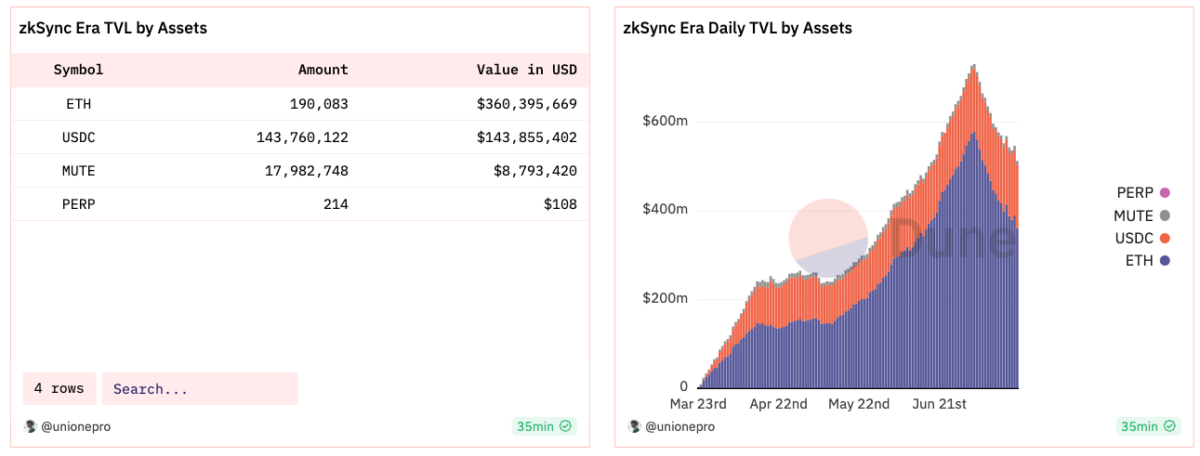

In terms of assets bridged, blue chip assets (ETH & USDC) bridged to the protocol totalled +$460MM of the TVL and account for nearly +95% of total TVL on zkSync. On June 2nd, RocketPool announced the launch of rETH on Era, in a move to increase its market share in the Liquid Staking vertical and to enable a low cost way to obtain rETH. rETH’s deployment on zkSync Era is its fourth L2 deployment, following Optimism, Arbitrum, and Polygon.

Source: Dune

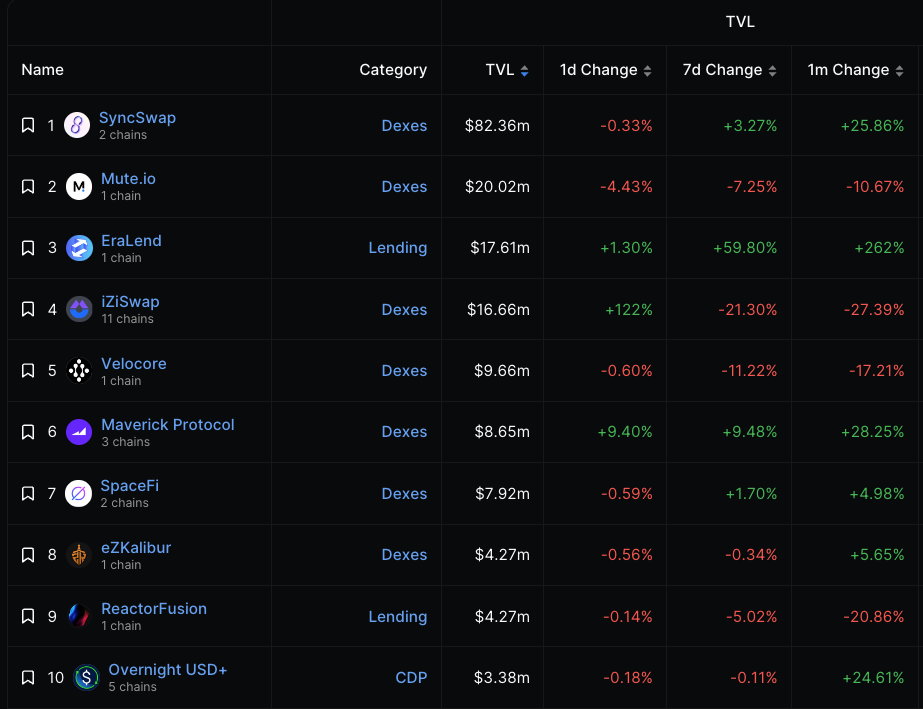

Despite the lack of other bluechip assets, a number of dApps went live as well, and have helped the network to grow its TVL and build its nascent ecosystem. At the time of this writing, there are +20 dApps building on top of zkSync Era and offering different DeFi components: DEXes, Lending & Borrowing and Futures trading.

Source: Defillama

Some of the popular DeFi protocols include:

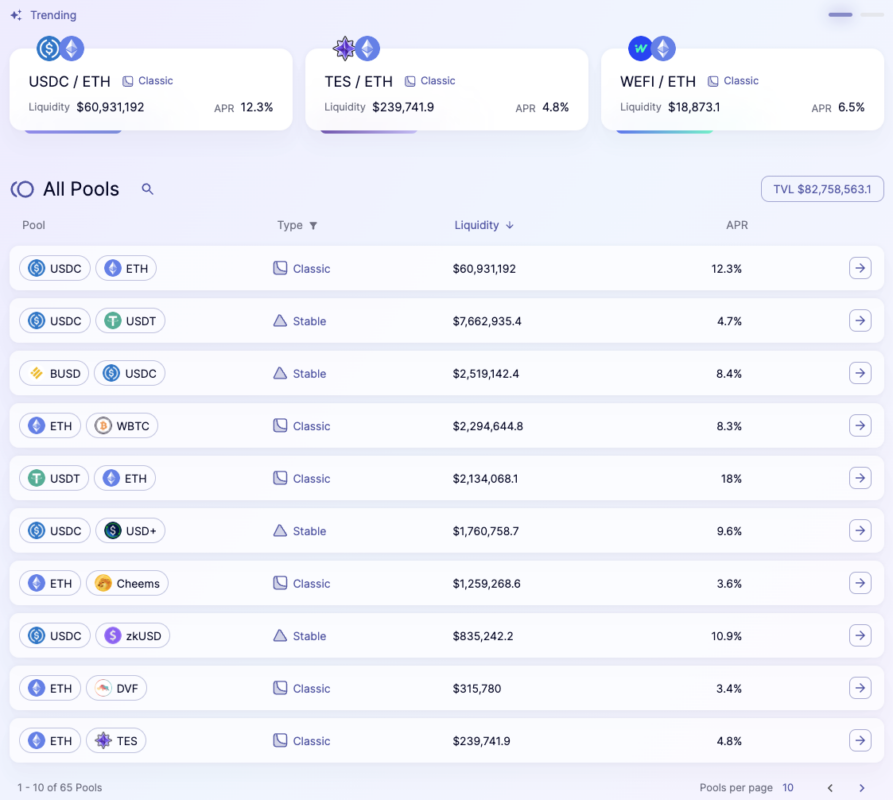

SyncSwap (https://syncswap.xyz/)

Token Live: No | TVL: $ 64.8 MM |

SyncSwap is a Decentralized Exchange built on the ZkSync Era and the one with a first mover advantage. The platform offers one-stop trading of crypto with lower fees given the ZkSync technology. At the time of this writing, it is the leading protocol in ZkSync in terms of TVL ($60 MM).

The platform offers passive yield through SyncSwap liquidity pools for both bluechip assets like (ETH, USDT, wBTC) as well as ZkSync ecosystem assets (Mute, VC, etc). At the time of this writing $Array – $ETH and $SPACE – $ETH are the liquidity pools with highest APRs: 158% and 116% respectively.

Source: SyncSwap

Furthermore, SyncSwap offers a launchpad functionality, in which new projects in the ecosystem can launch and benefit from SyncSwap liquidity and user base.

It’s expected the project will launch a token soon ($SYNC) as it has an incentive program which rewards users with “loyalty tokens”.

Mute (https://mute.io/)

Token Live: Yes ($MUTE) | TVL: $ 20.0 MM |

Mute is building a liquidity hub for ZkSync. The platform offers a DEX that includes limit orders & yield farming products (MUTE Amplifier). The platform is governed as a DAO with the native token $MUTE (already launched). Furthermore, the platform integrated Mute BOND Platform, in which users can acquire $MUTE at a discount, by bonding MUTE LP tokens.

At the time of this writing, Mute is the second largest protocol by TVL, with the highest number of trading pairs.

Velocore (https://velocore.xyz/)

Token Live: Yes ($VC) | TVL: $ 10.7 MM |

Velocore is a (relatively) new contender in the DEX category on ZkSync, and is a fork of Velodrome: Apart from the traditional exchange and LP feature, the platform allow users and protocols to utilize veVC as a governance mechanism to reallocate Velocores’ emission to specific protocol pools, increasing yields as well as liquidity. Furthermore, those protocols can incentivize veVC holders (bribing) to cast its vote to a specific pool. Holders of $VC have to lock their tokens to gain governance vote and be eligible for these bribes.

Apart from this, the platform has built a launchpad in which new projects can take advantage of this liquidity to launch their tokens efficiently.

SpaceFi (https://www.spacefi.io/)

Token Live: Yes ($SPACE) | TVL: $ 6.7 MM |

SpaceFi is another DEX on ZkSync, the platform has built a AMM / DEX, and also allows users to earn extra yield through yield farming opportunities. The platform is governed by a DAO utilizing the $SPACE token, which has to be locked to gain governance power.

NFT Infrastructure

In terms of infrastructure / NFT Marketplaces, the chain has already native marketplaces:

zkNFTex (https://zknftex.io/)

The platform that allows for the collection of NFTs on both ZkSync Lite and zkSync Era (not launched yet), and plans to integrate an NFT launchpad to allow collections launch on the platform.

Furthermore, the platform has managed to establish partnerships with relevant players like 1KX, Ivy Market and Onto.

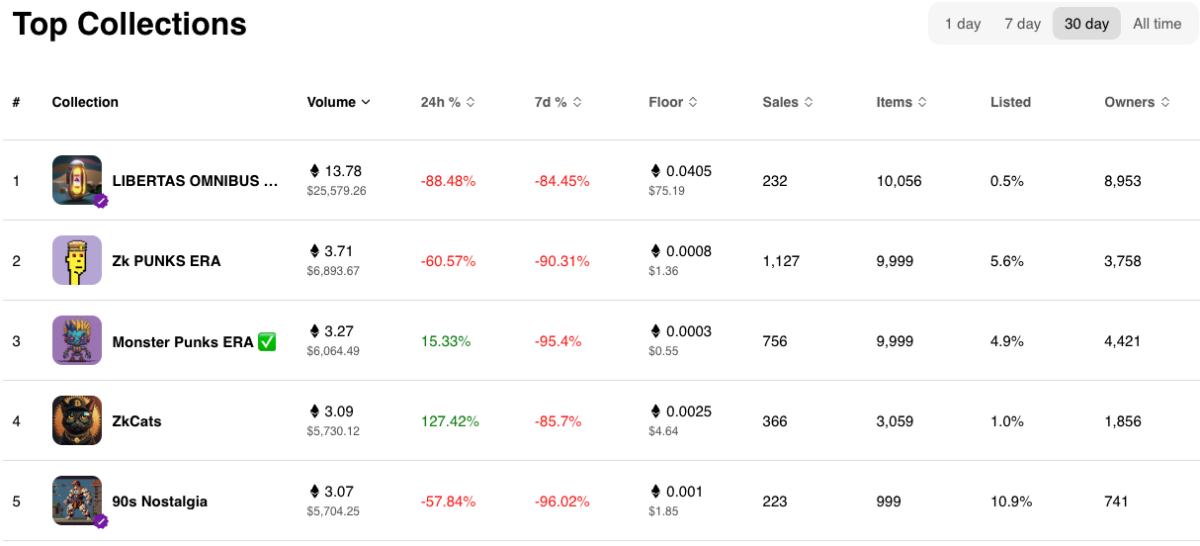

In terms of NFT collections, the ecosystem does not seem to be very developed yet. 2 of the 3 top collections in terms of volume are: ERA Naming Service (similar to ENS on mainnet) which has nearly 300 ETH in volume as well as Mint Square (a generic collection for NFTs created / minted on MintSquare)

Worth nothing, the floor price of those collections are extremely low and the activity might be inorganic. Users may be trying to increase their activity on the chain for a potential airdrop, minting, buying and then selling them for that sole purpose.

The top 5 NFT collections by volume include zkApe, zkRock and zkAnimals, collections that managed to generate +100 ETH in traded volume as well as consistent floor prices (on the 2 digit dollars)

Some of the NFT collections borrow heavily from “blue chips” collections on Ethereum mainnet – such as zkApes Bored Apes), zkAmurai (Azukis) and zkPunks (CryptoPunks).

Source: KreatorLand

Conclusion

The ecosystem in ZkSync Era is evolving, with more protocols and projects entering the ecosystem or growing their chain footprint. Although some of the activity might be inorganic due to airdrop farmers, we expect more protocols and builders to jump to zkSync Era given the scalability advantages that rollups have. Furthermore, as the potential airdrop goes live, we should expect more strategies and techniques to prevent and avoid sybil attacks that can hurt the rollup’s long term sustainability

This article has been written and prepared by Renato Martinez a member of the GCR Research Team, a group of dedicated professionals with extensive knowledge and expertise in their field. Committed to staying current with industry developments and providing accurate and valuable information GlobalCoinResearch.com is a trusted source for insightful news, research, and analysis.

Disclaimer: Investing carries with it inherent risks, including but not limited to technical, operational, and human errors, as well as platform failures. The content provided is purely for educational purposes and should not be considered as financial advice. The authors of this content are not professional or licensed financial advisors and the views expressed are their own and do not represent the opinions of any organization they may be affiliated with.

*****